Catch this roundup courtesy of DCX's Earle Loxton on the trends in Crypto markets. From the listing of a cryptocurrency on the US exchange to Crypto facilities debuting in the retail space, you do not want to miss out on the insights.

Coinbase listing

Reuters broke the news that Coinbase was preparing a US listing. Reportedly Coinbase, valued at $8 billion during the latest funding round, could see the listing scheduled for as early as this year. That would be the first major cryptocurrency exchange to go public - why does it matter? Well it would be an enormous vote of confidence in the crypto industry and another step forward in terms of the industry growing up and being taken seriously, not to mention a different method for institutional capital to enter the space.

Buy DCX10

on EasyEquities

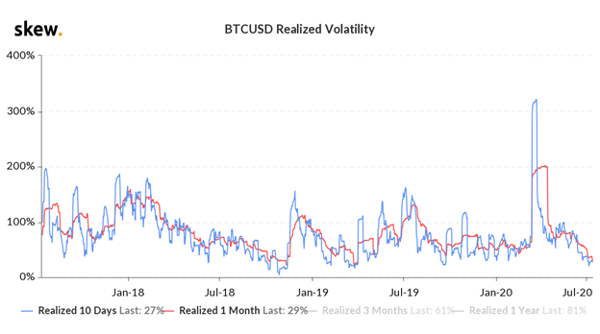

Bitcoin volatility or lack thereof

Bitcoin is currently going through its least volatile period in recent history. Is that likely to continue? It would not be surprising if Bitcoin were to return to much higher levels of volatility in the coming months. This comes at a time when traditional markets (US stock market) have been roaring. Some of the mega cap tech stocks have even given DCX10 (returns 30% in USD YTD) some competition. Apple, Amazon and Microsoft are over 30% return YTD. Is reduced volatility for Bitcoin a new normal? Doubt it.

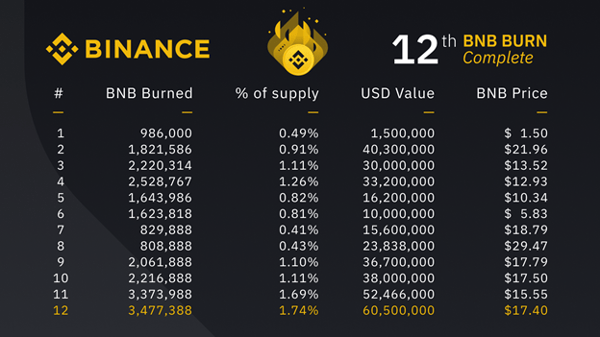

Binance coin burn

One of the more interesting tokens held by DCX10 is Binance coin (BNB). Every quarter they burn coins (remove them from supply), Binance's 12th BNB burn just happened and burnt 3477388 BNB, equivalent to $60.5 million. Binance claims (due to legal reasons) it burns BNB based on the trading volume and no longer based on profit.

Bitcoin difficulty makes an ATH

Hash rate and difficulty continue their upward trend. This shows the network is healthy and growing. Miners are continuing to invest in the future of the chain.

TikTok posts make Dogecoin Soar 40% in 24 Hours

Arguably the most interesting story recently has been the Dogecoin Challenge. Dogecoin is a cryptocurrency established in December 2013 as somewhat of a joke, it features the Doge meme as its logo. The latest in an endless series of TikTok trends, users were encouraged to buy the crypto and pump it, “turn $25 in $10 000” thereby making serious money if the coin’s price hits $1. It currently sits at $0.003.

83 Tons of Fake Gold Bars - Nikkei Asian Review

It's been reported that the biggest gold-counterfeiting scandal in modern history with 83 tons of fake gold bars was discovered in China — equivalent to 22% of China’s annual gold production and more than 4% of China’s gold reserve as of 2019.

Dozens of financial institutions loaned $2.8 billion over the past five years with pure gold as the collateral to Wuhan Kingold Jewelry Inc.— the largest privately-owned gold processor in China’s Hubei province. It was later found out that the gold was in fact gold-plated copper.

This would just not fly with Bitcoin. “Bitcoin fixes this” is a term used a lot lately and when it comes to counterfeiting a store of value Bitcoin steps up. Bitcoin’s most important characteristic is its scarcity due to its limited supply of 21 million. Its monetary policy follows a predictable schedule wherein the new bitcoin created halves every four years. Currently, 6.25 bitcoins are created every 10 minutes. Additionally, Bitcoin relies on private keys to sign, seal, and prove ownership thereby preventing counterfeits.

Amazon CEO Jeff Bezos Has More Money than Bitcoin’s Market Cap

Jeff Bezos is worth more than all Bitcoin in circulation. With Amazon stock trading at record highs Jeff Bezos fortune, even after his divorce, was well over $171 Billion. Bitcoin’s current market cap is roughly $170 Billion. Why is this important? This is just one person, and while it portrays the immense wealth individuals have in our society another perspective is how small Bitcoin still is, and how much room it therefore still has to grow. Gold’s total market cap is about $8 trillion currently - Bitcoin has a lot of potential catching up to do.

Buy DCX10

on EasyEquities

Revolut (popular digital bank) customers in U.S. can now trade Crypto

Revolut now gives US customers the ability to convert BTC and ETH among 28 global currencies, with plans to branch out into other cryptos in the future.

In Europe, where Revolut also supports litecoin (LTC), bitcoin cash (BCH) and XRP the digital bank has over a million customers transacting in crypto, the Revolut crypto arm is regarded as a “profit center” for the bank.

Binance’s Swipe-Powered Crypto Debit Card Debuts in Europe

Binance’s highly-anticipated cryptocurrency debit card, Binance Card, is officially debuting in countries of the European Economic Area, or EEA. Swipe is currently available in 31 countries within the EEA, according to the announcement, the Binance Card rollout will allow users to instantly convert the cryptos to fiat and spend them at over 60 million merchants across 200 regions and territories.

“By providing a tangible way to transact, convert and spend crypto for everyday use, we are furthering our mission of making crypto more accessible to the masses. Giving users the ability to convert and spend their crypto directly with merchants around the world, will make the crypt experience more seamless and applicable.” CEO Binance.

Buy DCX10

on EasyEquities

New to the crypto markets

and want to know more about the DCX 10 index?

Read: What's moving DCX10?

Digital Token FAQs can be found here for even more information

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Earle Loxton, CEO of DCX Capital (Pty) Ltd as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.