Mobile payment service adoption

Crypto got a bounce when it was announced that PayPal and Venmo were to roll out crypto purchases through their apps. They plan to roll out direct sales of cryptocurrency to their 325 million users. This move will increase the number of users who are able to easily buy and sell crypto by effectively turning the apps into wallets, creating in the process, a very effective fiat on-ramp.

Currently PayPal can be used as an alternative means for withdrawing funds from exchanges such as Coinbase but this would be a first in terms of offering direct sales of crypto. This offer makes total sense as fintech apps that offer crypto are gaining significant traction. Square, the company behind payments app CashApp launched by Twitter CEO Jack Dorsey, rolled out bitcoin purchases in 2018 and reported $306 million in bitcoin revenue in its most recent earnings report. Then there is London-based Revolut and retail giant Robinhood, both offering crypto. The importance of these huge fintech apps’ exposure to the crypto market cannot be overstated. This is real world adoption indeed.

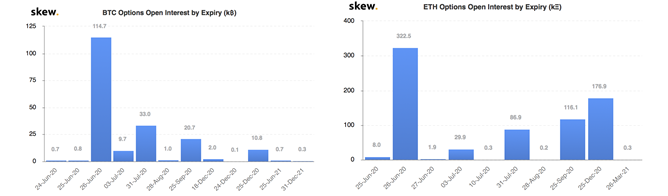

Record options open interest

On Friday June 26, roughly $1B+ worth of Bitcoin and Ethereum options contracts on Deribit, the leading crypto options exchange, expired. This is important as the rapid growth of options has created a sector that is now large enough to tangibly effect the market of spot Bitcoin and Ethereum trading. This record expiration gave good reason to think that Friday would be an extremely volatile day for crypto...and it was. Record options open interest also shows how the crypto industry is maturing and arguably attracting more sophisticated investors.

The Federal Reserve of New York

Last week the editorial section of the Federal Reserve of New York, Liberty Street Economics, argued that “Bitcoin is not a new type of money”, rather, the authors pointed out that Bitcoin’s innovation lies in a “new type of exchange mechanism”, unseen in history, chiefly an electronic exchange mechanism that does not rely on a trusted third party. Additionally, the authors speculated that, along the way, this new type of exchange mechanism could unleash new ways to facilitate the transfer for various assets in the future. Seems they are catching on.

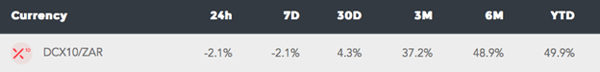

Buy DCX10

on EasyEquities

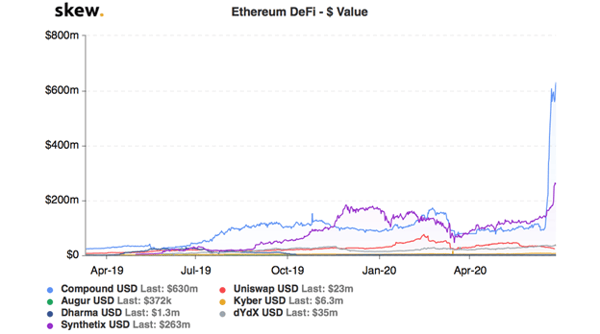

DeFi

DeFi is short for “Decentralized Finance” and includes digital assets, protocols, smart contracts, and dApps built on a blockchain. Over the last few weeks we have seen enormous excitement around DeFi, reminiscent of the ICO hype before the 2017 rally. Check out other jargon here.

Why is DeFi exciting for DCX10?

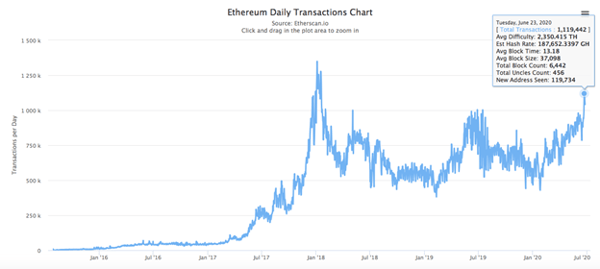

While DeFi tokens are not held in DCX10 yet, most of these tokens are on the Ethereum mainnet. A good example is $COMP token which saw an overnight price increase last week. The expected introduction of Ethereum 2.0 later this year will undoubtedly fuel bullish sentiment for ETH as it will enable DeFi projects to scale up properly. ETH has been one of the best-performing assets this year, +76%, partially due to the market beginning to price these developments in.

What is good for the ecosystem is good for ETH, and that's good for DCX10. ETH is 11.6% of DCX10.

Buy DCX10

on EasyEquities

New to the crypto markets

and want to know more about the DCX 10 index?

Read: After halving, why be bullish on DCX10?

Digital Token FAQs can be found here for even more information

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Earle Loxton, CEO of DCX Capital (Pty) Ltd as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.