The last few weeks have been nothing short of eventful for DCX10 token holders. It started with volatility picking up -off the back of record low volatility - Bitcoin breaking $10 000 along with record trading volumes. Then we saw Bitcoin shooting to $12,000 early on a Sunday morning only to plummet 12% to $10,500 within the hour before bouncing back to over $11,300 almost immediately. The increase in prices was across the board, DCX10 clocking in a YTD move of +100% in ZAR.

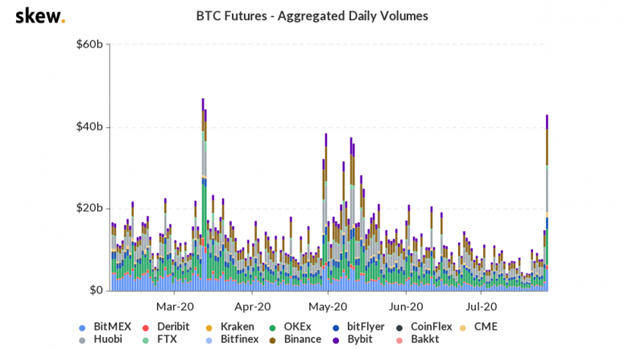

Bakkt & CME Bitcoin futures open interest hits all-time-high

Regulated exchanges Bakkt and CME, Both institutional exchanges, are small in size compared to the BTC futures volumes on crypto exchanges, but an interesting bullish metric, as it shows institutional money in getting ever more involved in the crypto space. The numbers can also be verified and trusted. Crypto exchanges also saw a significant increase in volume.

US banks can now custody cryptocurrency

The Office of the Comptroller of the Currency, now run by former Coinbase executive Brian Brooks, issued a letter allowing US national banks to provide fiat bank accounts and cryptocurrency custodial services to cryptocurrency businesses. For an industry that often struggles to find access to traditional banking services, the stamp of approval from the federal government is a significant milestone.

"This opinion clarifies that banks can continue satisfying their customers' needs for safeguarding their most valuable assets,” Brooks said, “which today for tens of millions of Americans includes cryptocurrency."

Twitch is giving subscribers a 10% discount if they pay using cryptocurrencies.

The Amazon-owned company will let users pay in bitcoin, ether, bitcoin cash, XRP, USDC, GUSD, PAX or BUSD.

A live-streaming platform popular with video gamers, Twitch had around 3.8 million broadcasters in Q1 2020 and around 1.44 million concurrent users as of March 2020.

Twitch introduced a cryptocurrency payment option in 2014 but quietly removed it in Q1 2019; it was brought back in June. Offering a discount suggests the platform is encouraging its subscribers to use cryptocurrencies for goods and services rather than just as a speculative investment.

Buy DCX10

on EasyEquities

Gold climbing, and digital gold?

According to the World Gold Council, investors have poured a net $7.4 billion into gold-backed ETFs in the month of July on the back of coronavirus concerns. As such, gold, used as a store of value by investors in times of stress, surged to all-time highs— surpassing its latest record in the aftermath of the Great Financial Crisis in 2011. While gold has returned around 25% YTD in USD, Bitcoin has performed 60% YTD.

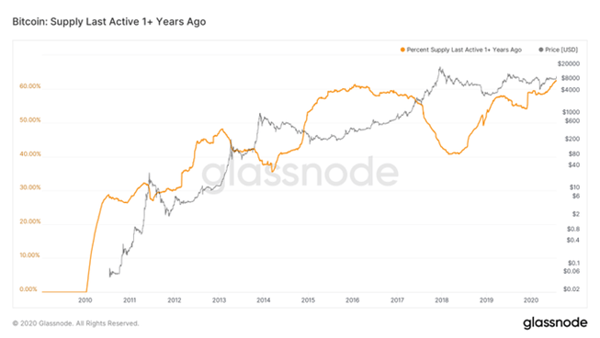

Bitcoin not moved in more than a year

According to Glassnode 62% of Bitcoin supply (11,400,000 BTC) has not moved in at least a year. This could be interpreted as short term speculators are waning and long term HODLers are at an all time high. Real question is: How many of those 11.4 million BTC are lost forever and will never move because nobody has the private keys to them?

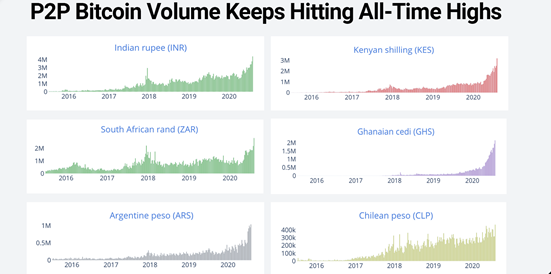

Peer 2 Peer Bitcoin volume hits all-time highs

Data from usefultulips.org put the below at new highs

- India ($4.4M)

- Kenya ($3.2M)

- South Africa ($2.8M)

- Ghana ($2.1M)

- Argentina ($1M)

- Chile ($500K)

- Nigeria ($10.3M)

Africa is having a particularly good resurgence.

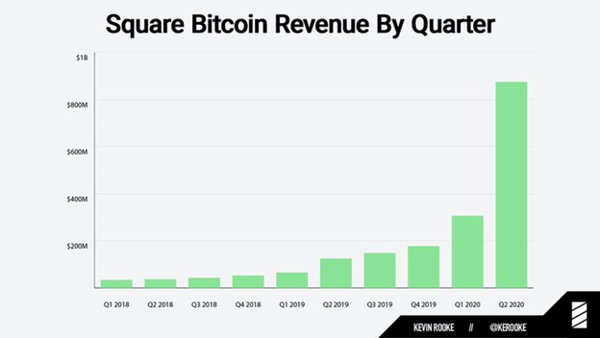

Retail and institutional continues its monstrous growth

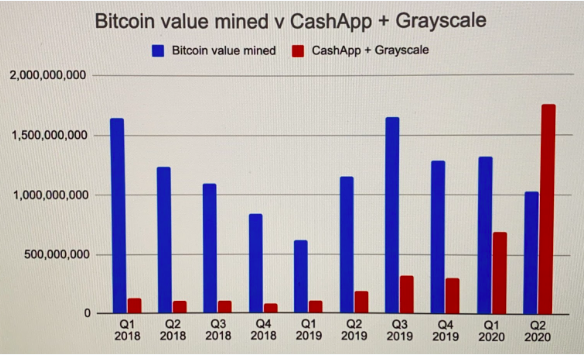

Square did $875 million of Bitcoin revenue during Q2 2020, 3x the volume of Q1 2020. This is Americans using the popular CashApp app to buy Bitcoin.

ListedReserve below graphs how Grayscale and CashApp consumed 170% of newly mined BTC supply in Q2.

Ethereum is booming

According to IntotheBlock roughly 75% of Ethereum addresses are in the money. “If the most important aspect of creating a strong community is to make the members wealthy then Ethereum is by far leading in this category. You’ll never have 100%, so 80:20 is pretty impressive.”

Ethereum's Aggregate Security Spend ("Thermocap") just reached $7 billion USD.

Thermocap is the total revenue generated by the network (block rewards paid to miners), and can be used as a measure of the true capital flow into Ethereum.

Ethereum usage is roaring as the number of contract calls – a metric for network activity – hits an all-time high. Coin Metrics said record activity on Ethereum – now five years old – came primarily from the decentralized finance (DeFi), which has more than quadrupled in size to $4 billion total value locked, year-to-date.

Buy DCX10

on EasyEquities

New to the crypto markets

and want to know more about the DCX 10 index?

Read: What's happening in Crypto?

Digital Token FAQs can be found here for even more information

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Earle Loxton, CEO of DCX Capital (Pty) Ltd as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.