Apple Inc (AAPL)

William Tell has nothing on “Tim Apple” when it comes to shooting the lights out, and Apple Inc did just that, blew the competition out of the water after its latest earnings release.

Great news for new budding investors who love the brand, but affordability has been hindering your investment opportunity is that Apple will have a 4-for-1 stock split at the end of August.

“Not that that was a problem for EasyVestors which have fraction investing available to them on the Easy platform!”

Click to view Apple Inc. (AAPL) shares

on EasyEquities

Why/ What is a Stock Split?

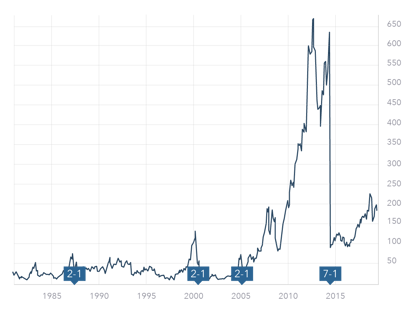

So, for all the newbie EasyVestors out there, a stock split is not an uncommon practice in the stock market, and Apple has had four stock splits before the upcoming corporate action.

A stock split is when a company like Apple deem their share price to be out of reach for most investors and want to make it accessible. Apple will have a 4-for-1 stock split scheduled for the 24th of August, which should make it more affordable for most and increase the liquidity of the shares.

Simply put for every Apple share you own on the record date you will receive three additional Apple shares, and simultaneously the share price will be quartered. So, if your 1 Apple share is trading at $400 now, it will trade at $100 after the split is enacted. The investor will now have four shares to the value of $400 as a stock split does not dilute the value or have any fundamental impact on a company.

EasyVestors should take note that when looking at the Apple chart the day after every stock split, the graph will adjust to the new share price and should not be confused with an adverse event.

Source - Macrotrends

Fundamentals

Apple's Q3 results ending the 27th of June 2020 posted a record quarter for the company and to everyone's surprise shrugged off any signs that a global pandemic is in full swing. The company posted a beat in earnings per share (EPS) by $0.51. Quarterly revenue also sored, beating expectations by $7.13 billion, which is a 10.92% increase from the year-ago quarter.

“Apple’s record June quarter was driven by double-digit growth in both Products and Services and growth in each of our geographic segments,” and “In uncertain times, this performance is a testament to the important role our products play in our customers’ lives and to Apple’s relentless innovation. This is a challenging moment for our communities, and, from Apple’s new $100 million Racial Equity and Justice Initiative to a new commitment to be carbon neutral by 2030, we’re living the principle that what we make and do should create opportunity and leave the world better than we found it.” - Tim Cook (CEO)

Apple Inc (AAPL) share overview:

- Sector: Information Technology

- Market Cap of $1932.76 Billion

- Dividend Yield: 0.70%

- Forward P/E: 30.8x

- Price/Book: 26.8x

- Next Earnings: the 1st of November 2020.

- 52 Week Range low of $200.48 and $455.61 per share high.

Apple’s quarterly $0.82 dividend went ex-dividend on the 7th of August already, but EasyVestors should also note that the dividend will also be quartered to reflect that share change once the split goes through.

Chart Life

Apple's share price has increased over 95% since the March lows and might continue to do so after the stock split at the end of the month, and the technical outlook will be revised.

The solid red line on the chart is the current price target expectations by analysts before the stock split on Apple Inc (AAPL) at $426.74 per share.

Portfolio particulars

- Portfolio Hold (Current)*

- Portfolio Buy opportunity: Neutral until the Apple stock split**

- WhatsTheBeef long term target price: Neutral.

Click to view Apple Inc. (AAPL) shares

on EasyEquities

Other noteworthy research on other FAANG stocks - The mighty Amazon.com and Facebook

Source – EasyResearch, Apple Inc, SeekingAlpha, The Motley Fool, Business Insider, Macrotrends, Wikipedia.

*Portfolio Hold (Current) refers to investors who already hold the stock within their portfolio.

**Portfolio Buy opportunity refers to Technical level crossed, which might imply that the markets behavior would support the outlook and Close above refers to a share price close above a Technical Resistance level.

Take note that all Apple Inc (AAPL) share data was taken on the 11th of August 2020 during the U.S stock market open.

Subscribe for free EasyResearch and get it first

READ:

How to use EasyFX to invest in US stocks

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.The value of a financial product can go down, as well as up, due to changes in the value of the underlying investments. An investor may not recoup the full amount invested. Past performance is not necessarily an indication of future performance. These products are not guaranteed. Examples and/or graphs are for illustrative purposes only.