With the economy trotting along to avoid the dust bin, our retailers saw their worst year in over two decades gauging from the general retail index which lost close to 20% in value over 2019.

Taking excerpts from one of my favorite publication the Financial Mail, which had an excellent article titled “Time for a retail rebound?” where Katharine Child from BusinessLIVE gives readers some valuable insights.

Here are some of the noteworthy excerpts from the article:

Within the overall carnage, Massmart and Truworths stand out — the former losing 48% in value during the latter, once the most highly regarded name in local apparel retail, shed 40%.

Cosmetics and toiletries chain Clicks, on the other hand, defied the trend by gaining 32% between January 2019 and 2020.

In this context, investors were anxious for a better festive season, but recent trading updates from Mr Price, Truworths and TFG aren’t likely to kindle much excitement — not least because of a week’s worth of power cuts last month.

In the 13 weeks to December 28, Mr Price’s sales rose 3.5%. In its 26-week trading update to December 29, Truworths’ local sales gained just 2.7%, while Foschini owner TFG managed a 5.9% lift in revenue for the nine months ended December 28.

Investec’s John Biccard believes no local company should trade at more than a 7-8 P/E, given SA’S weak economy.

Cannon Asset Managers chief investment officer Samantha Steyn says given the recent sales figures “there is still a risk of downgrades to earnings expectations. We believe investors need to be selective, given the local economic risks.”

Our clients

Our clients are diversified across the different retail sectors with activity in the clothing retailers pretty much flat since the second half of 2019. This might indicate that they are waiting for more certainty in the market before allocating their hard-earned Rands.

What does EasyResearch say

The financial mail article gives the reader a great perspective of both sides of the argument, so the question remains, is retail set to rebound?

Looking at how well some of the stocks bounced back over the festive season one would be hard-pressed to think otherwise. But most clothing retailers and the retail sector, in general, are still moving one way, and that’s lower.

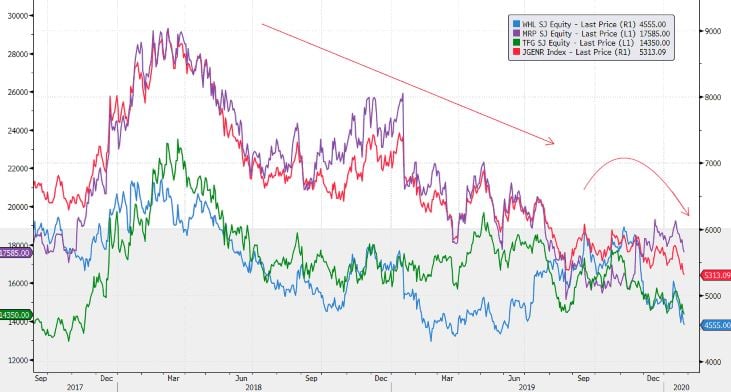

Looking at the chart one can see the downturn in the clothing retailers which did see a short-term recovery but has rolled over and turned bearish once again. The clothing retailers in the chart include Mr Price (purple), Woolworths (blue), The Foschini Group (green) and the general retail index (red).

Conclusion

Taking a step back one would see that the outlook on the retail sector, in general, is grim. There's a high possibility that personal and value-added taxes will rise in the coming budget, placing more strain on the already overburdened consumer.

Not to mention, the possible downgrade to junk status would see the retail and financial sector under immense pressure. Luckily, it’s not all doom and gloom. If this comes to pass, we might find some bargain hunting on the market and retail sector.

Source – EasyResearch, Financialmail, Katharine Child, BusinessLIVE, Bloomberg

Take note all pricing and performance was taken pre-market on January 28th 2020.

*Chart sources - Bloomberg

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.The value of a financial product can go down, as well as up, due to changes in the value of the underlying investments. An investor may not recoup the full amount invested. Past performance is not necessarily an indication of future performance. These products are not guaranteed. Examples and/or graphs are for illustrative purposes only.