Diversify your portfolio against inflation

High Inflation fears are slowly making headlines again and the importance to diversify and position one’s portfolio becomes relevant in this week’s Intellidex ETF Analysis.

Intellidex insight: Inflation-linked bonds have unique risk characteristics which enhance risk-adjusted returns in a portfolio of equities and nominal bonds. The principal value of an inflation bond is regularly adjusted by the latest inflation rate measured by the consumer price index. So the principal value rises over time or can decrease in a deflationary environment, although this is rare. Simultaneously, the investor receives a regular coupon payment (or interest). While the coupon interest rate stays fixed, the interest paid on the rising inflation-adjusted principal value means that the rand value of the interest paid also rises over time. In practice, the value of an inflation bond is set by the market and is based on market participants’ inflation expectations. If inflation is expected to increase, prices will be bid upwards, and vice versa. Therefore, if expectations are for lower inflation, it might be more beneficial to hold the nominal bond.

Click logo to view ETF

on EasyEquities

However, this doesn’t mean that returns from inflation-linked bonds for investors who do not hold the bonds to maturity is a linear function of inflation. While inflation is a major driver of value there are other market forces such as investors’ expectations of interest rates and credit ratings. Thus, prices for ILBs fluctuate, reflecting investors’ perceptions of various drivers of value.

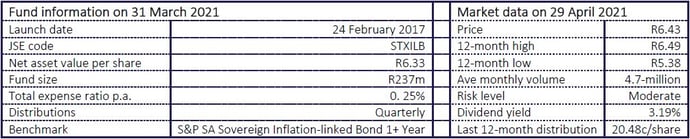

The Satrix ILBI ETF is the cheapest among its peers with a TER of 0.25%, making it the ideal vehicle to gain exposure to investments that protect against the invisible hand of inflation.

Fund description: The fund gives investors exposure to the value of the S&P South Africa Sovereign Inflation-Linked Bond 1+ Year Index. All income received from instruments comprising the index and net of cost is re-invested on behalf of investors into the portfolio. The fund is also involved in script lending.

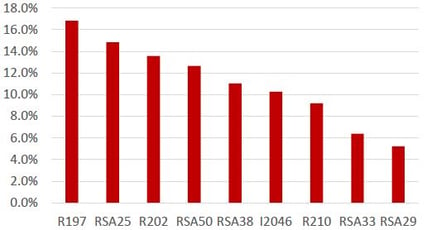

Top holdings: 73% of the money market securities in the fund are issued by SA’s highly rated banks which minimises credit risk.

Suitability: The fund is suitable for a long-term investor seeking to protect capital and income from the invisible hand of inflation. Also, it can be a building block for portfolio diversification. Investing in inflation-indexed bonds is ideal for income-focused investors who worry about the potential detrimental effects of inflation on their buying power.

Fundamentals: Our macroeconomics guru at Intellidex, Peter Attard Montalto, says “consumer price index (CPI) is in the mud”, at least for the time being, and he did not adjust his inflation forecast for this and the next two years after the latest March CPI reading undershot market expectations at 3.2%, although, thankfully, we were on the mark. We see inflation (headline) averaging 4.2% this year and rising marginally to 4.5% and 4.6% in the next two years.

This is lower than the 5% inflation average since 2010. The main reason is that the price of core elements which excludes food and energy prices is expected to remain weak. This will be anchored by low demand and no forex-related pass-through costs.

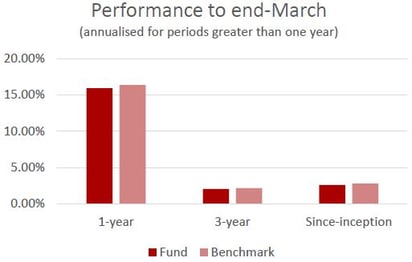

It means inflation-linked bonds will continue to underperform their nominal counterparts, except for the past year where their returns were quite similar due to Covid-specific circumstances. Inflation bonds have significantly underperformed nominal bonds, returning less than half the nominal bonds returned in the past three years.

Click logo to view ETF

Why invest in this ETF?

So why would you invest in inflation bonds, one might ask? The simple long and short answer is “diversification”. Plus, should inflation creep up unexpectedly you are covered – a real concern as you might learn in the next paragraph.

The story of low inflation is not unique to SA, globally inflation has underwhelmed much to the surprise of all, and sundry given the unprecedented liquidity in the system. But fears of the return of high inflation have dominated headlines since the beginning of the year with strong commodity prices further cementing the fears. However, major central banks think we should not worry much about near term above-average inflationary pressures which they view as fleeting with expectations anchored to the downside in the longer term. This has birthed a dislocation between monetary authorities’ expectations and the market. So, there is a real risk that we might import inflation should it surprise to the upside globally.

Fund statistics

Click logos to view ETFs

on EasyEquities

Alternatives: Absa NewFunds ILBI (TER: 0.35%) and Ashburton Inflation (TER: 0.41%)

EasyResearch Informed Decisions

Portfolio positioning and diversification becomes the focus again as the global economic landscape changes again. Talks of “Hyper Inflation” are making the rounds in the U.S which if come to pass will most certainly influence the local economy.

Inflation-linked bond ETFs like the Satrix ILBI ETF, Absa NewFunds ILBI ETF and Ashburton Inflation ETF to name a few could be a cost-effective way to safeguard your portfolio.

New to investing

and want to learn more about other Intellidex ETF picks?

Read: ETF Picks for the Investment Environment by Intellidex

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.