Fastly Inc. (FSLY)

Sectors that moved “Fastly” (no pun intended) into new highs during the COVID-19 pandemic were e-commerce and cloud computing services like Fastly Inc. (FSLY)

One cloud computing company that made headlines and a new stock addition to EasyEquities is Fastly Inc. (FSLY) which operates an edge cloud platform that packs a punch. The stock has gained over 331% over the last year with the potential of more upside to come if fundamental factors playout.

Log in to your account to view Fastly Inc. (FSLY) shares

on EasyEquities

Fundamentals

Fastly Inc released Q2 earnings in August beating expectations and might move into profitability if coronavirus tailwinds continue to pull through to the end of the year. Revenue on a year-over-year basis increased 62%, a beat of $3.21 million. The companies also saw an increase in customers from Q1, the largest since its IPO.

The cloud computing company also raised their third-quarter outlook higher, which has the market all excited, but concerns over the single most prominent client, TikTok did pull through.

Fastly Inc. (FSLY) share overview:

- Sector: Information Technology

- Market Cap of $9.81 billion.

- Enterprise Value: $9.45 billion.

- Dividend Yield: N/A

- Price/Book: 18x

- Next Earnings: 7th of November 2020.

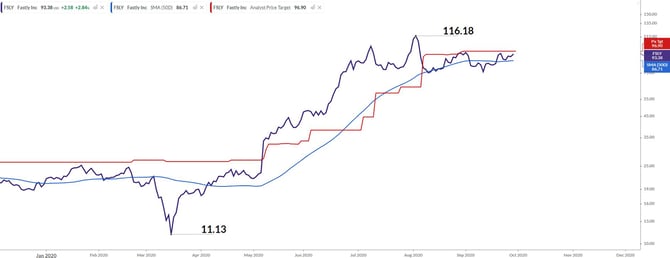

- 52 Week Range low of $11.13 and $116.18 per share high.

Fastly Inc (FSLY) share price has been under pressure of late but saw buyers return as the cloud computing service provider’s largest single customer, TikTok made headlines over the weekend.

Options traders are also anticipating big moves in the stock over the coming weeks that should be taken note of while the number of bullish outlooks in Hedge Funds is on the increase.

Outlook – Fastly along with Zoom and others are set to catch more strong pandemic tailwinds from the latest wave of outbreaks in the U.S and E.U as the work from home movement is set to increase.

Chart Life

The price action increase over 900% from the COVID-19 downturn in March to the highs we saw at the start of August before the earnings release. The price action has formed a head and shoulders reversal pattern, which might be negated if the price action can move higher than $97 per share.

Short interest on outstanding shares on Fastly Inc. (FSLY) is only around 8.6%, while the median analyst expectations are $96.90 per share (red line).

Portfolio particulars

- Portfolio Hold (Current)*

- Portfolio Buy opportunity: above $75.00 per share**

- WhatsTheBeef long term target price: $118.00 per share.

Log in to your account to view Fastly Inc. (FSLY) shares

on EasyEquities

Informed decisions

The stock is undoubtedly one to watch during the COVID-19 pandemic, but its reliance on TikTok, its largest customer, raises some concerns. If the deal between TikTok, Walmart and Oracle to form the new entity TikTok Global can't be finalized, then we can expect more downside for Fastly Inc. But the opposite is also true if the deal gets done and the Trump administration is satisfied then we might expect Fastly Inc. to move higher.

New to investing

and want to know more about latest stock additions?

Read: New Vaccine Stocks Land on Easy

Sources – EasyResearch, Fastly Inc, SeekingAlpha, Koyfin, Yahoo finance, Wikipedia.

Take note: stock data was taken on 30 September 2020 before the U.S market open.

*Portfolio Hold (Current) refers to investors who already hold the stock within their portfolio before the U.S. market open.

**Portfolio Buy opportunity refers to Technical level crossed which might imply that the markets behavior would support the outlook and Close above refers to a share price close above a Technical Resistance level.

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.The value of a financial product can go down, as well as up, due to changes in the value of the underlying investments. An investor may not recoup the full amount invested. Past performance is not necessarily an indication of future performance. These products are not guaranteed. Examples and/or graphs are for illustrative purposes only.