Renergen Limited (REN)

Is Renergen Limited’s (REN) Stefano Marani (CEO) and Nick Mitchell (COO) the next South African success story? Compared to the likes of Elon Musk, Mark Shuttleworth, and Adrian Gore? They might just well be (“I know all us EasyVestors will have Charles Savage on that list too”).

These two guys have the only product for which there is no substitute. O, and did we mention, they have the richest resource of it in the world, by a factor of 10. It is helium (He), and yes, the party balloon type. When cooled to -260 degrees Celsius however, it becomes one of the most critical elements on this planet, without any substitute. Not exactly what you had in mind right?

Log in to view Renergen Limited (REN) shares

on EasyEquities

Fundamentals

- Duel listed: JSE & ASX

- Sector: Oil & Gas

- Market Cap: R1.4 billion

- Price/ Revenue: 6.6x

- 52 Week Range Low of R9.25 and per R17.72 per share high

- Phase 1 production: 79,200 kg of He and 633,600 gigajoules (GJ) of liquid natural gas (LNG) per annum.

- Phase 1 revenue: estimated at R212 million per annum

- Valuation: based on the 1P Methane reserve of 40.76 BCF at a price per GJ = R9.9 billion

The great

- Helium intersections of 12% He with an estimated grade of 3%, whereas the average for the rest of the world sits way below 1%.

- Pilot plant has been producing Compressed Natural Gas (CNG) as fuel for the Megabus fleet since

- Phase 1 plant in progress and the estimated for completion is July 2021.

- Offtake for 90% of the helium already in place.

- Partnerships for 600 trucks being lined up as we speak. Using LNG as fuel. These include Megabus, Logico Logistics, BHIT, and Total.

- LNG is a by-product in Renergen’s helium production process. In other words, the LNG pays the bills while the helium is the cream on top.

The opportunity (or as some might say the “bad”)

- The global helium supply is dropping at an alarming rate and over the last 10 years have seen a couple of supply crunches. Between 2011 and 2013 and the most recent in 2019 with helium shortfalls up to 20%. Renergen will save the day, but production only starts mid-2021.

- South Africa has more than 377,000 heavy duty trucks registered on its roads, producing a lot of carbon dioxide. Switching from diesel to LNG has the benefit of reducing a trucks CO2 by 22%, in addition to reducing the combined running cost per truck by R1.37 per km.

Supply & Demand

Helium:

Supply: There are only about 6 other helium producers in the world and Renergen resource is by far the richest.

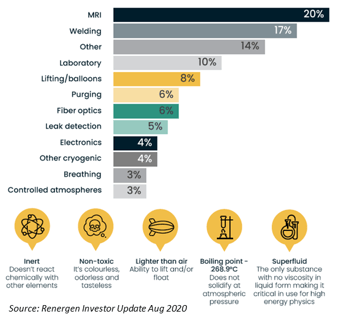

Demand: It is an exceedingly rare commodity and irreplaceable in many modern industries (Fig. 1).

Figure 1: Helium’s unique properties and uses

Figure 1: Helium’s unique properties and uses

LNG:

Supply: Renergen is the only company with an onshore production right. Giving them a head-start to other producers of 5 to 10-years.

Demand: Renergen will target the massive South African trucking fleet to supply it with LNG and there is already a demand.

Log in to view Renergen Limited (REN) shares

on EasyEquities

Outlook

Am I a shareholder – Yes. Will I buy again – Yes. The only real question is at what price do I buy? The geologist in me wants to say that the story just does not get any better than this, but the investor side will always be cautious. The companies first kg of He is just around the corner and now might just be the time to start adding a few shares or at least to keep a closer eye on the company.

New to investing

and want to learn more about Small Cap Stock?

Read: Russell’s small caps, and When 2 Small-Cap Titans Meet

Sources:

1 REN:Johannesburg Stock Quote - Renergen Ltd - Bloomberg Markets 2 Revenue based on plant running at 90% capacity, estimated $/ZAR of R15.45, helium price of US $ 45/kg and LNG price of US $ 15/GJ. 3 1P Methane reserve of 40.76 BCF MHA Final Report (March 2019) (renergen.co.za) converted to 43 million GJ, multiplied by US $ 15/GJ and $/ZAR of R15.45. 4 Yes, there is a helium shortage, and it will affect more than just balloons (zmescience.com) 5 Investor Update August 2020 (renergen.co.za) 6 Renergen announces new LNG truck solution, adds another LNG supply route (engineeringnews.co.za)

Take note that all stock data was taken on 30 November 2020.

Innes Buurman

EasyVestor, Project Geologist

The contents of this blog post are for information purposes only. This is the genuine opinion and actual experience of the user sharing their story and is not financial advice. The user doesn’t have any financial interest or relationship to us other than being a client. Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Innes Buurman a Project Geologist with experience in hard rock geology, over a range of commodities including Ni-Cu-PGE, Au, Zn-Pb, Coal, and CBM as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.

.