The Walt Disney Company (DIS)

A not-so long time ago, in a galaxy not at all far away (cue dramatic music), we may be set to witness Stream Wars! Yes folks this is no joke, our beloved Walt Disney Company will start its own streaming service called Disney +. It was just a matter of time for Disney to expand its empire to the newest and hottest media platform and include a streaming service.

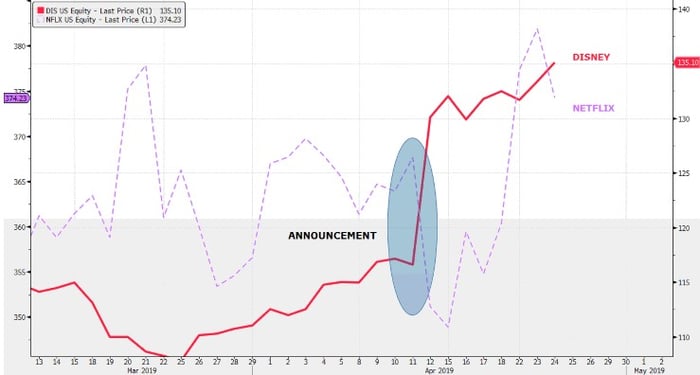

The Netflix share price fell (purple dotted), while Disney (pink line) increased in value when the announcement was made on the 11th of April. The new service is set to undercut current market leader Netflix (NFLX) by some margin.

Source - Bloomberg

On the flip side, Disney’s Keven Mayer said that Disney is not looking to be bigger than Netflix but to coexist as Disney would offer entirely different content.

One thing that is for sure is that Disney is no “Micky Mouse” business anymore and by looking at the latest Q1 earnings release the company will be a household name for generations to come. Revenue beat analysts’ expectations by $96.50m and its Earnings Per Share (EPS) up by $0.30.

The next earnings date is scheduled for the 8th of May 2019.

Chart life

By looking at the chart of Disney we can see that the price action broke out of the base formation around $116 per share and moved higher. The increased momentum was due to the announcement of the new streaming service. As greed sets in, it is possible that investors might push the price action to a target price of $140 per share in the medium term.

Source - Bloomberg

Portfolio particulars:

- Portfolio Hold (Current).

- #WhatsTheBeef Long term Target price: $140.00 (Future)

Know your company: The Walt Disney Company (DIS)

- Founded in 1923, The Walt Disney Company is by far one of the largest and most popular diversified entertainment companies in the world.

- In 2012 Walt Disney Co. shelled out $4bn for LucasFilm, which included the Star Wars and Indiana Jones franchises from George Lucas.

- Florida’s Walt Disney World Resort is the Largest Resort in the World and covers 25 000 acres of land which include 4 theme parks and 18 hotels.

Invest in The Walt Disney Co.

New to investing in US stocks? Learn how to transfer your Rands to Dollars using EasyFX here.

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.