Top 4 picks after explosive week for U.S Retailers

U.S Retail Earnings

What coronavirus pandemic? The U.S retail sector reported earnings this week, and they are on fire beating expectations as if the pandemic never happened.

Why is the retail sector relevant for new #EasyVestors? – Retail sales and consumer spending drives much of the U.S economy and is also a high gauge of whether an economy is healthy or not. Think about it, if consumers are able and willing to spend hard-earned cash an economy hums along. If the consumer is under pressure and holds off buying the economy tends to slow down.

Click to view Retail shares

on EasyEquities

Here are some insights into some of the most relevant retail stocks this week:

First, one out of the earnings gate and the home improvement giant did not disappoint. Home Depot posted double-digit gains as surging demand in DIY projects were high on the priority list. The company’s spending to improve on its supply chain and distribution saw online sales steal the show and significantly increased Home Depot’s ability to adapt to the changing landscape.

Earnings – Home Depot's second-quarter earnings per share came in at $4.02, which is $0.33 better than expected while the company raked in revenue of $38.05 billion over the quarter. Revenue increases by $3.38 billion, which is a 23.39% Y/Y increase. Home Depot has also declared a $1.50 per share quarterly dividend.

Outlook - Consumers spent on average 10% more per visit to their favorite Home Depot, which could be attributed to stimulus payments over the period which ads up. The cautious tone from the company’s earnings call could suggest that these consumer trends might not continue into Q3.

Home improvement just got a whole lot better for Lowe’s Companies which surpassed analysts’ earnings expectations for the second quarter. The company’s stellar quarter can be attributed to its updated retail strategy which saw resources allocated to e-commerce platforms.

Earnings – Lowe's Companies Inc, reported second-quarter earnings per share of $3.75, which is a $0.80 per share beat on expectations. The company’s revenue for Q2 came in at $27.3 billion a 30.1% increase Y/Y. Gross margin rates and the operating margin improved 34% and 14.49% respectively, while sales at Lowes.com increased by 135%. "Sales were driven by a consumer focus on the home, core repair and maintenance activities, and wallet share shift away from other discretionary spending” – M Ellison (CEO)

Outlook – Lowe’s Companies momentum might continue into the next quarter, but the company has, for the time being not given any forward guidance on revenue or earnings. This might indicate that the home improvement retailer is also concerned about economic growth over the short term due to the COVID-19 pandemic.

Click to view Retail shares

on EasyEquities

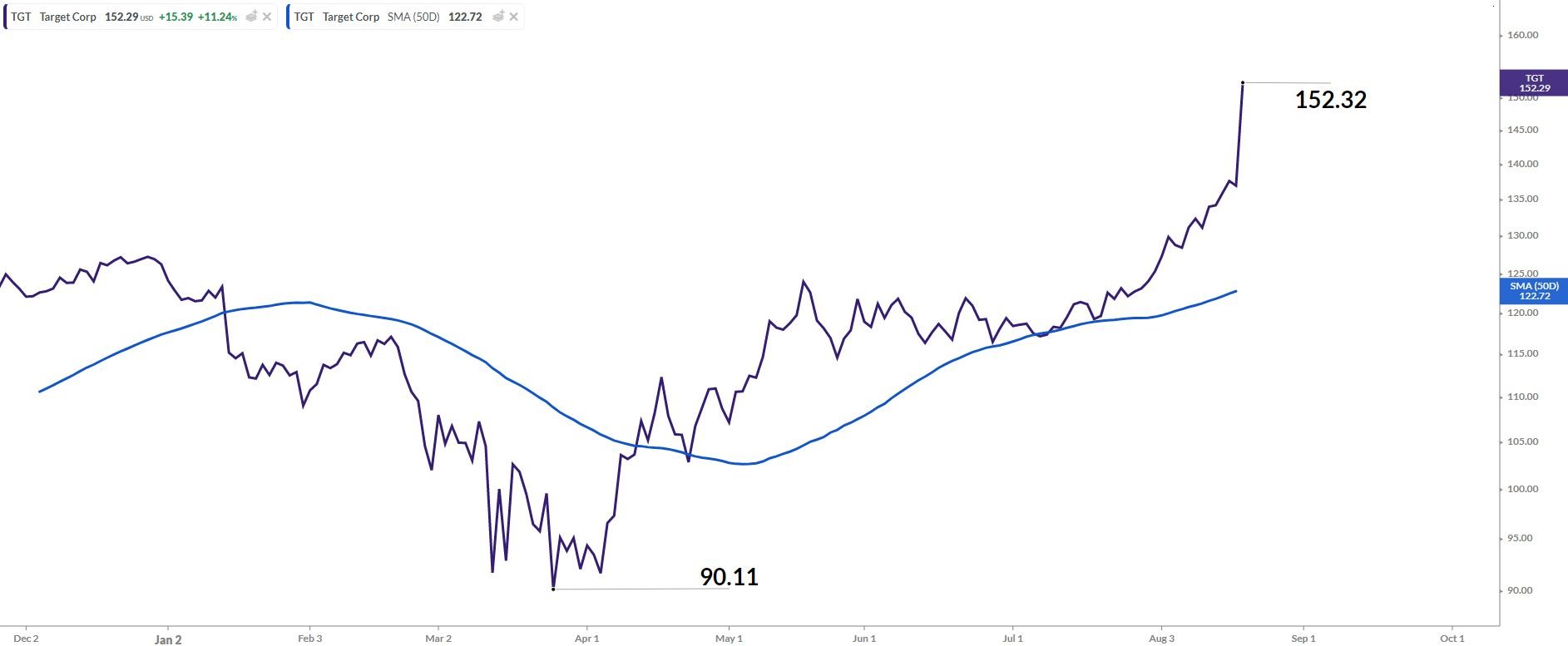

Earnings came in right on “Target” for investors in the eight largest retailers in the U.S, which is also a component of the S&P 500 Index. The stellar earnings saw the share price rocket to new all-time highs with online sales growth being the standout winner at 195% Y/Y.

Earnings – Target's second-quarter earnings saw earnings per share of $3.38, which beat estimates by $1.74 per share. Revenue for Q2 came in at $22.98 billion, a 24.8% increase Y/Y despite the COVID-19 lockdown measures.

Outlook – The company’s earnings conference call put investor fears at rest that the momentum could not carry into the third quarter. During the call, executives stated that the August comparable sales were already up at low double digits. Although online sales stole the show in Q2, Target stores did also impress with impressive sales growth numbers of 24% vs the expected 7.6%.

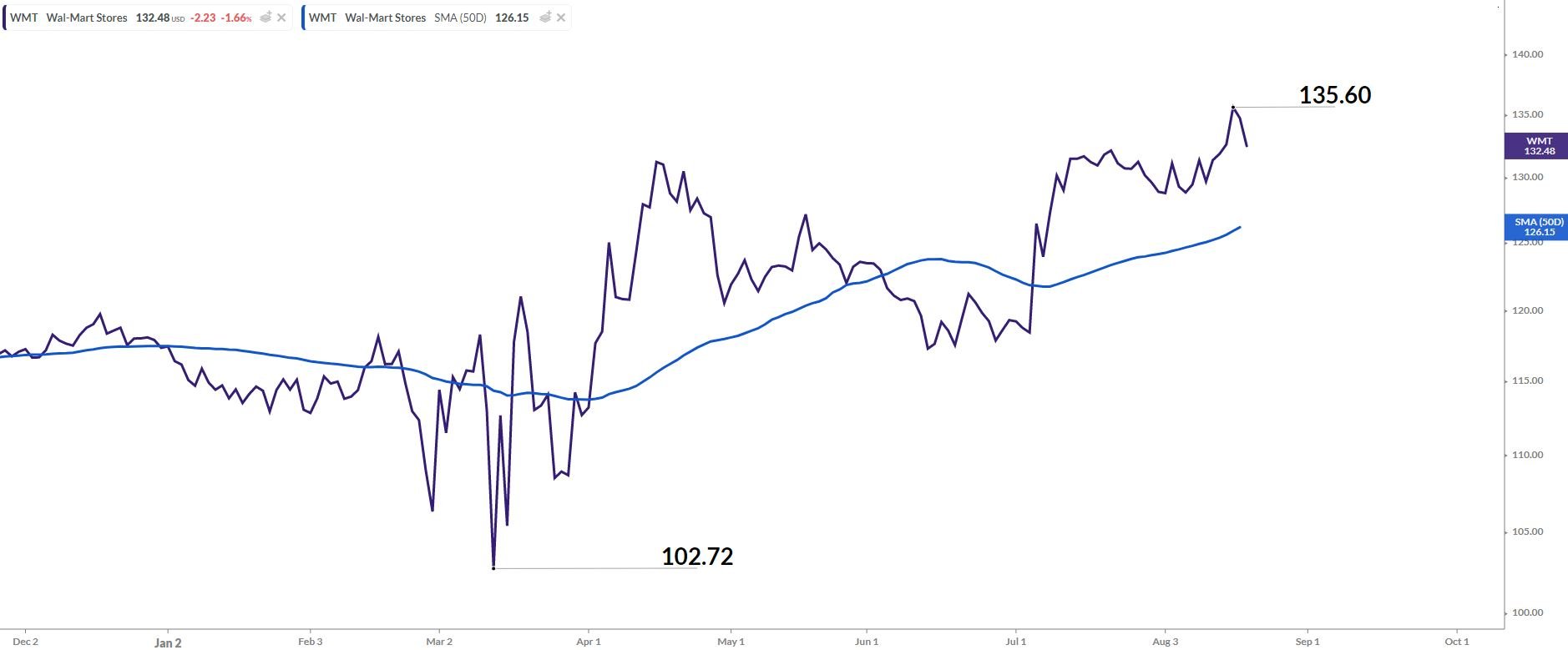

The people of Walmart are always stealing the show, but not this time, this time, the shareholders in the world's largest retailer are smiling from ear to ear after better than expected earnings. Another e-commerce success story as Walmart's online sales growth nearly topped 100% during Q2.

Earnings – Walmart reported better than expected second-quarter earnings. Earnings per share came in at $1.56, which is $0.31 better than the $1.25 consensus. Revenue came in slightly higher than estimates, with a 5.6% beat Y/Y while international sales fell 6.8%.

Outlook – Walmart is the world’s largest retailer and employer, which new EasyVestors can use as a barometer to see how healthy the U.S economy is. Consumer spending is what keeps the economy ticking, and a slowdown in these buying trends could mean trouble.

What should be noted is throughout the earnings call presentation, the positive impact of the Government stimulus packages was mentioned. Government stimulus added significant tailwinds for the company over the reporting period, but as of July sales started to slow down as stimulus payments began to taper off.

Informed decisions

E-commerce stole the show this last quarter as companies which positioned themselves and reacted to the pandemic capitalized. One bright aspect coming through from all retailer's success over the previous quarter was the Government stimulus packages.

If the U.S Government continues to introduce stimulus into the market, we might expect it to have a positive effect on retail. On the flip side, if these stimulus payments start to wain, it might lead to headwinds for our favorite retailers.

Other noteworthy research on Retail Stocks - Here comes the Alibaba (BABA) and The new “retail” normal is on fire!

Sources –EasyResearch, the balance, Street Insider, Home Depot, Lowe's Companies, Target Corp, Wal-Mart Stores, SeekingAlpha, Koyfin, Yahoo Finance, The Motley Fool Wikipedia.

Take note that all share data was taken on the 19th of August 2020 during the U.S stock market open.

Subscribe for free EasyResearch and get it first

READ:

How to use EasyFX to invest in US stocks

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.