Spotify Technology SA (SPOT)

“Listening is everything” so turn up your audio dial as Spotify is set to release its Q3 earnings this Thursday before the U.S market open.

This Swedish audio and media streaming provider, Spotify Technology SA (SPOT) has become the world’s largest subscription platform which caters to the majority of the globe’s population.

Click to view Spotify Technology SA (SPOT) shares

on EasyEquities

Fundamentals leading up to earnings

Spotify is continuously innovating its offering across Podcasts, Music and now taking on Radio with its “The Get Up” morning show. But ultimately what investors will be looking for in the Q3 earnings is growth and in particular revenue from advertisements and subscriptions.

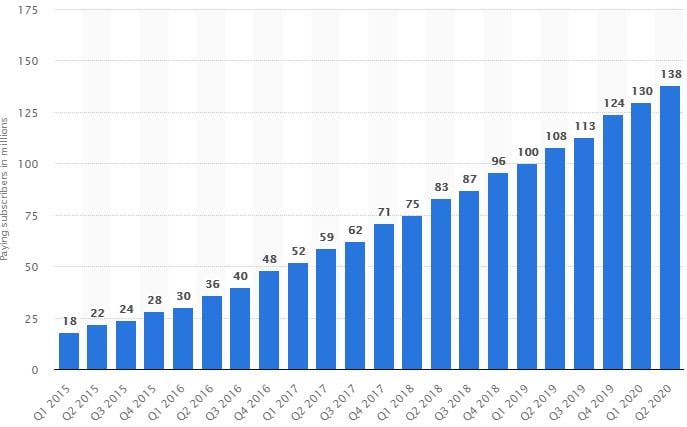

Premium or paid subscriber growth numbers will be scrutinized over the last quarter as the rate of growth has been slowing down on a year-over-year basis despite all the innovation. Spotify has over 138 million premium subscribers worldwide which have more than doubled since 2017.

Spotify Technology SA (SPOT) share overview:

- Sector: Communication Services

- Market Cap of $53.11 billion.

- Price/Earnings (LTM): 62.6x

- Price/Book: 22.2x

- Next Earnings: 29th of October 2020 (before the U.S market open)

- 52 Week Range low of $117.67 and $291.75 per share high.

Revenue growth has also seen a decline as more participants to the audio streaming market like Pandora, Apple, Amazon, Alphabet’s YouTube are taking market share away from Spotify. Pandora, one of Spotify's main rivals has the highest-grossing music app in the Apple App Store offers similar services than Spotify, placing the Swedish streaming service under pressure.

Earnings expectations

Zacks Investment Research consensus estimates are that the “music-streaming service operator is expected to post quarterly loss of $0.59 per share in its upcoming report, which represents a year-over-year change of -243.9%. Revenues are expected to be $2.34 billion, up 18.8% from the year-ago quarter.”

Chart Life

The price action in Spotify broke out of a rather large base formation in May 2020 and gained over 80% to the streaming stocks all-time high at $291.75 per share. I expect the stock to react after earnings which might drive prices lower. Levels of interest are the $293 resistance and $194.74 support level for new buying opportunities.

Short interest on outstanding shares on Spotify Technology SA (SPOT) is 1.5%, while the median analyst expectations are $222.96 per share (red line).

Portfolio particulars

- Portfolio Hold (Current)*

- Portfolio Buy opportunity: Neutral, will revise after earnings**

- WhatsTheBeef long term target price: $302.00 per share.

Click to view Spotify Technology SA (SPOT) shares

on EasyEquities

Informed decisions

Spotify Technology SA (SPOT) is still the largest role player in the audio streaming market which is enjoyed and used across cultures and geographies. If the global dominator in audio streaming can continue to innovate and take even more market share from radio it could lead to more revenue.

For the new EasyVestor considering the stock as part of their portfolio, I would suggest waiting until after the earnings release to make an informed decision.

New to investing

and want to know more about about Communication Services stocks?

Read: When Goliaths meet and This is no “Micky Mouse” company (DIS) and Facebook

Sources – EasyResearch, Spotify Technology, Amy Watson, Statista, Koyfin, SeekingAlpha, Zacks Research, The Motley Fool, Wikipedia.

Take note: stock data was taken on 26/10/2020 during the U.S market open.

*Portfolio Hold (Current) refers to investors who already hold the stock within their portfolio before the U.S. market open.

**Portfolio Buy opportunity refers to Technical level crossed which might imply that the markets behavior would support the outlook and Close above refers to a share price close above a Technical Resistance level.

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.The value of a financial product can go down, as well as up, due to changes in the value of the underlying investments. An investor may not recoup the full amount invested. Past performance is not necessarily an indication of future performance. These products are not guaranteed. Examples and/or graphs are for illustrative purposes only.