INFLATION? What do ETFs have to say?

NewFunds ILBI (inflation-linked bond index) ETF

Suitability: Bond ETFs are a good way of introducing bonds to your portfolio. Asset allocation strategies involve allocating a portion of a portfolio to different asset categories such as equities, bonds and cash. The allocations depend on your investment time horizon and risk tolerance, but as a rule of thumb young investors should allocate more to equities while investors at a later stage of their careers should have portfolios weighted more to less risky assets such as bonds and cash. Some investors also use bonds in order to ensure they have a long run income, as many pay out a regular coupon. The NewFunds ILBI ETF, however is a total return index so it doesn’t pay any cash dividends. On a monthly basis coupons received are reinvested into the fund, increasing the net asset value of the portfolio and consequently increasing the value of each unit. RMB Inflation-X ETF is the only bond ETF which pays cash dividends.

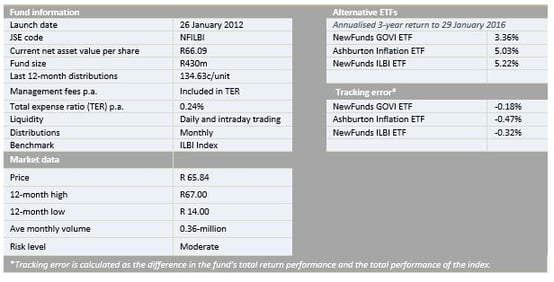

What it does: NewFunds ILBI ETF aims to track the performance of the Barclays\Absa South African government inflation-linked bond index (ILBI). ILBI is a weighted basket of South African government inflation-linked bonds. The ETF tracks the component bonds of the index in proportion to the index weightings.

Advantages: The main attraction of bonds as an asset class within an investment portfolio is their low correlation with shares (for those interested in the technicalities, over the past decade, the JSE’s all bond index has had a lowly correlation factor of 0.13 with the all share index). And because the ETF is inflation protected, the initial amount invested will increase in line with inflation while real also benefitting from returns in excess of inflation.

Disadvantages: The fund is designed to replicate the performance of the ILBI and does not make active bets relative to sectors, yield curve or credit quality. It is also restricted to certain government bonds, thus excluding corporate bonds and other issues by state-owned enterprises such as Eskom and Sanral.

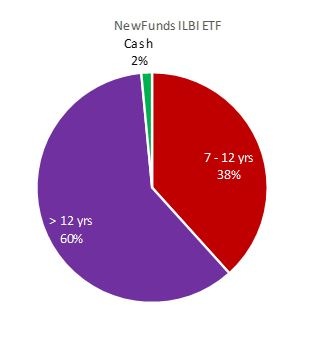

Top holdings: The fund is invested in bonds issued by the SA government with the majority being long-term bonds with maturities of seven years or more.

Risk: The most common risks associated with fixed-income securities are inflation risk, credit risk and interest rate risk. However, because all of this ETF’s constituents are inflation-linked sovereign bonds issued by the SA government, they do not have inflation risk and credit risk is minimal. Interest rate risk arises from fluctuating interest rates. As interest rates rise, bond prices fall and vice versa.

Fees

NewFunds ILBI ETF has a total expense ratio (TER) of 0.24% which is one of the cheapest on the market.

Historical performance

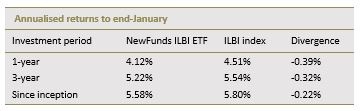

Since its establishment in 2012, the fund has recorded annualised return of 5.58%.

Fundamental view

Government bonds are traditionally seen as safe havens in turbulent times. This is largely because they are less volatile than stocks and often their prices trend in the opposite direction to equities, so they offer good diversification.

The past decade has been a superb one to own bonds. The IGOV, made up of government inflation-linked bonds, returned an average of 10% a year. While that is lower than the 14% a year returned by the JSE top 40 total return index, there is less risk. (The technical measure of risk, volatility, was 6% for bonds and 19% for the top 40 index).

Two key factors supported the performance of bonds during the period: declining interest rates and inflation rates. The South African Reserve Bank cut the repo rate from 12% in 2008 to a low of 5%. And inflation retreated from around 12% to below 3% before climbing to about 6% Now, with interest rates still near historic lows, bond prices are still relatively high. As interest rates continue rising, bond prices will almost certainly decline. Expectations of a higher inflation rate might, however, make inflation-linked bonds more valuable.

Alternatives

Retail investors seeking exposure to bonds have two other options: Ashburton Inflation ETF and NewFunds Govi.

Ashburton Inflation ETF tracks the South African government inflation-linked bond total return index of eight RSA inflation-linked bonds. The product has an expected TER of 0.45% a year.

NewFunds Govi ETF is also a total return product but tracks the performance of the SA government bond total return index (Govi). This index consists of bonds issued by the South African government, including only those issues in which National Treasury obliges the primary dealers to make a market. The TER is 0,25% a year.

BACKGROUND: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies – or in this case numerous bonds – in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.