NewFunds MAPPS Protect ETF

Suitability: This ETF is a multi-asset fund designed to troubleshoot asset allocation challenges. We discussed some of the issues relevant to asset allocation in our note of a fortnight ago. This fund is designed for more risk-averse investors with a shorter time horizon, such as those nearing retirement. It has 40% invested in equities, 50% in bonds and the balance in cash, so it is designed to limit the risk of capital loss and provide income, while still capturing some growth through the equities exposure. Its cousin, MAPPS Growth ETF, is suited for investors who can tolerate more risk and have a longer investment horizon.

This fund eliminates the effort, time and cost of building a diversified portfolio – it does it all for you in one transaction. You can click here to find out more general information and benefits of ETFs.

What it does: The NewFunds MAPPS™ Protect fund mimics the total return performance of:

- Equities through the Swix 40 index;

- Nominal bonds through the Govi index; and

- Inflation-linked bonds through the Ilbi index;

The asset class proportions are about 40% equity, 15% nominal bonds, 35% inflation-linked bonds and 10% cash.

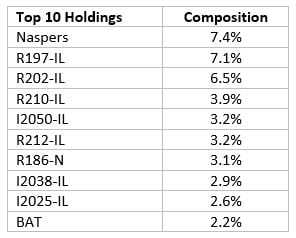

Top holdings: The top 10 holdings make up 42% of the portfolio. There are only two equity holdings in the top 10, Naspers and British America Tobacco. However, the fund consists of 43 counters, nine inflation-linked (IL) bonds and 11 nominal (N) bonds.

Risk: The equity portion of the fund is likely to exhibit more volatile returns, while the bonds and cash holdings will be more sensitive to interest rate changes. Overall it should have lower volatility than a pure equity fund would.

Fees: For the year to end-March, 0.33% of the average net asset value of the portfolio was incurred as charges, levies and fees related to the management of the portfolio.

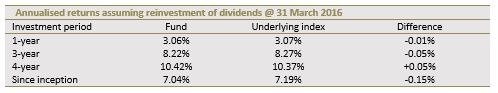

Historical performance: The fund’s performance depends on how you invest – through a single lump-sum payment or regular payments. The table below reflects the fund’s historical annualised returns for a lump-sum investment.

Fundamental view

The fund has four integral parts: equities, nominal bonds, inflation-linked (real) bonds and cash. Equities give the fund exposure to general economic performance, while inflation-linked bonds provide a hedge against inflation which preserves your buying power. The equities component can also be used to hedge against inflation. Nominal bonds and cash provide certainty of current income.

Generally, bonds act as insurance against capital loss but equities exposes the fund to the risk of capital loss – although the constituents are blue chip stocks which limit that risk. Given that the role of bonds and cash in a portfolio is to provide income and capital protection, the fund’s huge exposure to these asset classes make it suited to someone nearing retirement who does not want to take on much risk of loss of capital.

The main factors driving the value of this ETF include: interest rates, sovereign credit ratings, inflation, the exchange rate, economic activity and various global trends. Generally speaking, low and stable inflation/interest rates, decent economic growth and an investment grade credit rating are positive for the fund’s value. However, SA’s economic outlook is poor, with GDP growth this year expected to be around 0.6%. The picture is further dampened by a volatile exchange rate and the Brexit development has added uncertainty to the economy and financial markets.

Alternatives: Its peer, the NewFunds MAPPS Growth fund, has a different asset class composition. The MAPPS Growth has 75% in equities, 20% in bonds (equally split between nominal and real) and 5% in cash. We have already reviewed this fund and the note can be found on the EasyEquities website.

BACKGROUND: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies – or in this case numerous bonds – in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.