Intellidex top ETF picks for April 2017

We review the list of Intellidex’s favourite exchange traded funds (ETFs), taking into account market developments during the month of March.

We begin by providing a quick overview of local and international developments that influenced returns of ETFs:

Local

South Africa’s seemingly bright start to the year has been dealt a major blow by President Jacob Zuma’s cabinet reshuffle which saw the sacking of Finance Minister Pravin Gordhan and his deputy, Mcebisi Jonas, causing a weakening of the rand and a rise in the cost of government borrowing. Political uncertainty has been cited as one of the major reasons why credit rating agencies are wary of SA’s outlook. Now that it has manifested on the negative, and already S&P Global has downgraded SA to junk(having been a notch above the sub-investment credit grade) while further downgrades from Moody’s and Fitch appear imminent.

Researchers at Barclays say that SA slipping to junk will see the forced sale of at least $500m by institutions whose mandates do not permit them to hold sub-investment grade bonds in foreign debt. That would worsen rand losses and exert inflationary pressures.

However, the economy has been showing positive signs since the beginning of the year. The inflation rate has been falling and is expected to be augmented by what is anticipated to be the second-biggest maize harvest in almost four decades, of 14.6-million tons. It is forecast to be 84% larger than the 2016 crop, which was the smallest since 2007. Also, overall SA’s trade balance in the first two months of the year has drastically improved, with a deficit of only R6bn compared with R23.6bn in the same period last year. Exports have also benefited from an uptick in commodity prices.

International

The first quarter of 2017 has seen the best performance of European stocks since 2015 – they’re up 5.5%, with inflows to European equities benefiting from strong economic data and corporate earnings and activity, despite the uncertain political outlook. In addition, the outcome of the Dutch elections, in which the far right wing party of Geert Wilders was defeated, show there might yet be hope for the European project. However, the French elections remain a key political risk for investors in the next quarter.

Across the Atlantic, US President Donald Trump is finding it tough to navigate the Washington “swamp” after he suffered his first big political setback when he failed to repeal and replace the Obamacare health plan. That indicates that it might be tough to push through his other policies, especially on tax reform, coincided with the weakest performance of US equities since he took over as president. On a brighter note, the US Federal Reserve has softened its interest rate hike trajectory. Although this has been a relief for most currencies including the rand, recent ructions by Zuma’s cabinet reshuffle have reversed the trend.

Our favourites

Below are Intellidex’s picks in each of the five broad categories of investment strategies. These are funds we like in each broad category – certainly not all categories will be suitable for all investors, but generally diversification makes for a stronger portfolio. The funds we pick are the ones we think are best in each category.

Local equities

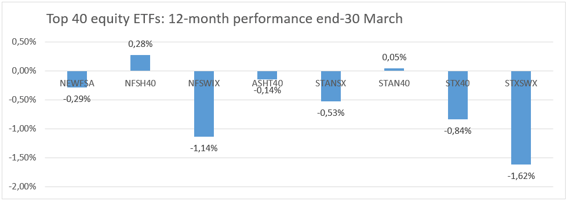

Locally, we like funds that track the JSE top 40 index to form part of an investors’ core portfolio. These funds provide diversification and stable returns over the long term, which is desirable in uncertain times.

Within the top 40 ETF family, we prefer ETFs that use the Swix weighting method rather than the traditional JSE top 40 index, which is determined by unadjusted market capitalisation. The Swix weights constituents based on the share capital held in electronic records and registered on the SA share register. It therefore excludes shares held outside SA, which results in reduced exposure to cyclical commodities, which improves diversification and stability of returns.

We like any of the three Swix-weighted top 40 funds (Satrix Swix, NewFunds Swix 40 or Stanlib Swix) but we maintain our choice of Stanlib Swix 40 (STANSX) because of its lower expense ratio. However, you will notice from the graph above that over the past year the Newfunds Shariah 40 (NFSH40) performed better, albeit marginally, than its peers because it is overweight in commodity-heavy counters.

Foreign equities

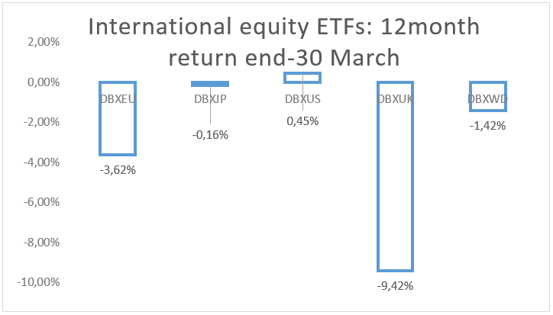

Coincidentally, international ETFs became popular at the beginning of 2016 when the rand hit its lowest historical level against the dollar, after Zuma fired the then finance minister, Nhlanhla Nene, at the end of 2015. Since then, the rand has recovered to stronger levels -- until last week’s events. Foreign funds are substantially driven by exchange rate movements, which is why the rand’s performance is topical when considering investing in international ETFs. The strong performance of the rand, particularly since the beginning of 2017, saw returns on international ETFs turning negative with the exception of US equities, whose strength partly made up for the effect of the stronger rand. This recent trend is now set to reverse: the rand is likely to weaken further while US equities are softening as the Trump honeymoon effect fades.

Although European stocks performed well in the first quarter of 2017, it was off a low base and we still prefer the US funds over its peers because political uncertainty is still, high particularly in Europe. Our choice in this category is a fairly new fund, the CoreShares S&P 500. Because it is a new fund with no track record, it is not in the graph alongside. But we like its total expense ratio, which is expected to be between 0.55% and 0.65%. That will be cheaper than its closest peer, the db x-USA, which has an average TER of 0.86%. Given that the two track indices with a similar return profile – the S&P 500 and MSCI US – we think CoreShares’ lower cost structure will likely help it outperform its peer.

Property ETFs

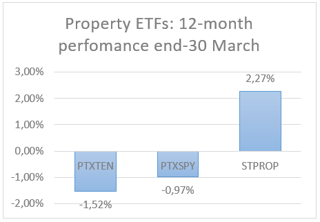

There are a few property-focused ETFs to choose from but our choice is the CoreShares PropTrax 10, which uses an equally-weighted index that reduces the idiosyncratic risk of individual companies. However, now that Brexit process is firmly under way, the exposure of some of the constituents to the UK is likely to undermine performance for the sector.

There are a few property-focused ETFs to choose from but our choice is the CoreShares PropTrax 10, which uses an equally-weighted index that reduces the idiosyncratic risk of individual companies. However, now that Brexit process is firmly under way, the exposure of some of the constituents to the UK is likely to undermine performance for the sector.

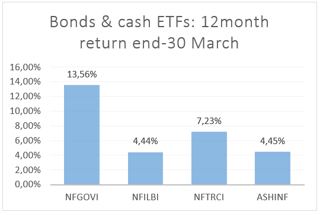

Bond and cash funds

Bonds and cash are good additions to an equities portfolio because they enhance risk-adjusted returns. There are now five (including the recently listed Satrix ILBI) listed funds in this category:

(i) NewFunds GOVI ETF;

(ii) NewFunds ILBI ETF;

(iii) NewFunds TRACI 3 Month ETF;

(iv) Ashburton Government Inflation ETF; (v) Satrix ILBI ETF.

They each track different things: (i) tracks government bonds; (ii), (iv) & (v) track inflation-linked government bonds; and (iii) tracks short-term money market instruments.

If you are investing for a very short period, usually less than a year, then NewFunds TRACI 3 Month (NFTRCI) is a natural choice, because it is least sensitive to sudden adverse interest rate movements. It is similar to just earning interest on your cash with minimal possibility of capital loss.

However, for a longer investment horizon, the motivation is to protect against inflation – particularly in emerging markets where various external and internal variables can substantially drive up prices. At this juncture, SA faces an imminent credit downgrade from global rating agencies, an occurrence likely to drive inflation. So we would choose an inflation-linked bond to cushion investors from surprise inflation pressures. Because the Satrix ILBI ETF promises to have the lowest expense ratio of 0.25%, it is our choice here. It does not have a performance history as it was launched last month, so we don’t have its performance figures in the graph above, but should mimic the performance of other inflation-linked bond funds.

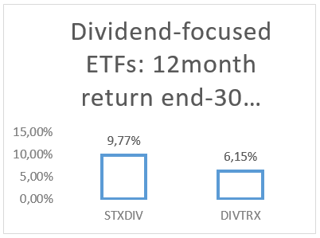

Dividend-focused funds

We believe returns should be considered on a total return basis which combines both capital growth and dividends. Certain funds focus on dividends which can be particularly important for investors who require an income.

We believe returns should be considered on a total return basis which combines both capital growth and dividends. Certain funds focus on dividends which can be particularly important for investors who require an income.

Whereas the Satrix Divi pools its assets from the top 40 index, the Coreshares Dividend Aristocrat ETF extends its pool to mid-caps. We prefer the Satrix Divi because it is forward-looking, based on projected dividends. Also Starix Divi has consistently performed ahead of its peer in the last couple of months. The CoreShares fund is based on historical performance that may not be repeated in future.

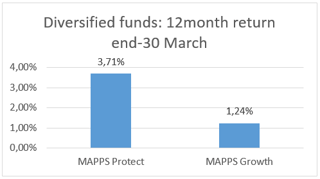

Diversified funds

Equities are regarded as the financial asset class that carries the most risk. They generally provide the best returns over time, which compensates for the high short-term risk, so they are more suited to longer-term investors.

One way to reduce that risk is to invest in funds that include other asset classes such as bonds and cash. Two good funds for this are the NewFunds MAPPS Protect ETF and the NewFunds MAPPS Growth ETF.

One way to reduce that risk is to invest in funds that include other asset classes such as bonds and cash. Two good funds for this are the NewFunds MAPPS Protect ETF and the NewFunds MAPPS Growth ETF.

They are designed to meet two different risk appetites: Protect is suitable for older savers nearing retirement and Growth is for younger savers with a longer time horizon.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.