Intellidex Reviews May 2020: ETF Picks

The easing of lockdown restrictions globally plus economic stimulus packages provides some rationality to the exuberance observed in markets, and as such we identify funds that investors can use to take advantage of this momentum in a core-satellite strategy.

Global equities maintained positive momentum in May as the unwinding of Covid-induced lockdowns gathers pace. Two traditional barometers of global growth, crude oil and iron, had a fantastic month, benefiting from global optimism and climbing 42.9% and 15.7% respectively. However, oil remains down 42.8% year-to-date (YTD).

The MSCI world index, a barometer for the dollar performance of developed market equities, rose 4.6%, while the MSCI emerging & frontier (dollar) index edged up 0.7%. The havens, global bonds and gold, performed poorly while the rand recovered against the greenback. With the rand strengthening, the predominantly rand-hedge JSE top 40 index edged up 0.4% and is now at -8.4% YTD to end-May. SA government bond prices rose 7.1% while yields subsided.

Against the backdrop of the strengthening rand, average returns for JSE-listed local asset ETFs were marginally up while foreign asset ETFs were negative. A basket of all local ETFs inched up 0.48% while the basket of all JSE-listed international ETFs shed 1.71% in May. And the basket of commodity ETFs increased 2.43%, as gains by rhodium and platinum funds more than offset loses endured by gold and palladium funds. Consequently, Intellidex’s equally weighted ETF portfolio – which is built from these three broad JSE ETF categories – was marginally weaker, returning -0.97%, compared with its benchmark of all JSE-listed ETFs, at -0.08%.

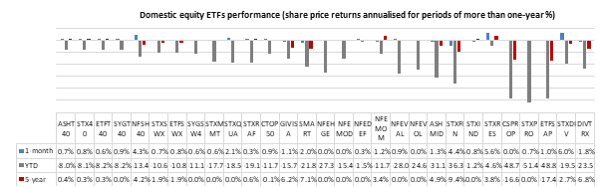

Local ETFs

Local equities were primarily driven by resources (+22.6%) with minor gains from industrials (+2.0%), while financials (-3.3%) faltered. Consequently, top-performing ETFs came from the resource-heavy funds: Satrix Divi (+6.0%); Satrix Resi (+5.6%); and NewFunds Shari’ah 40 (+4.3%). Logically, the worst performer came from financials: Satrix Fini (-4.0%). In bonds, the NewFunds Govi ETF impressed with a 6.8% jump.

In commodities, last month’s loser, 1nvestRhodium ETF, bounced back strongly, climbing 33.1%. In contrast, 1nvestPalladium tanked by 7.0%.

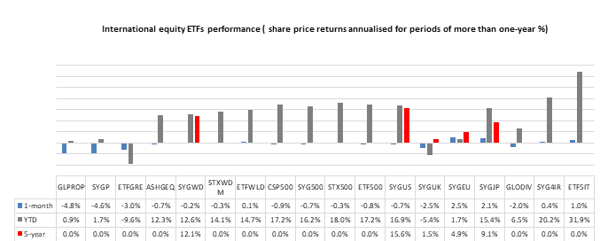

International ETFs

The German and Japanese equity indices came out tops. As such Sygnia funds, Eurostoxx 50 and MSCI Japan, topped the international fund charts, increasing 2.5% and 2.1% respectively. The big losers where property and bond funds: Cloud Atlas Africa Real Estate (-13.8%); Coreshares S&P Global Property (-4.8%);

and FirstRand US Dollar Custodian Certificate (-4.7%).

Intellidex ETF portfolio

We have a difficult time ahead of us and volatility in the markets should remain. In such times, diversification across asset classes and economies remains an investor’s best bet.

The uncertainty of Covid-19 will keep volatility in equity markets elevated. While we favour low-volatility and defensive strategies, investors can sniff for opportunities as excess liquidity plus the reopening of economies can mean the upward momentum in equity markets remains in place for longer – even if just for technical reasons.

A Bloomberg report by Cormac Mullen suggests a possible short squeeze is brewing in US equity markets, which can spur US equities higher, in the process pulling the rest of the globe upwards. Mullen notes that speculative net short positions in S&P 500 e-mini futures have jumped to their highest in five years, plus short positions in the largest US equity ETF, the SPDR S&P 500, are at historically extended levels and are about to eclipse this year’s high. If equity prices continue rising, the unwinding of short positions can drive the market even higher.

Locally, the NewFunds Equity Momentum ETF can be added as a satellite fund to core equities holdings. The fund can ride this optimism as it uses a momentum strategy while keeping risk at manageable levels. Internationally, the Sygnia Itrix Eurostoxx50 fund could benefit from a combination of reopening of economies and the finalisation of a €750bn EU fiscal bailout.

Locally, the NewFunds Equity Momentum ETF can be added as a satellite fund to core equities holdings. The fund can ride this optimism as it uses a momentum strategy while keeping risk at manageable levels. Internationally, the Sygnia Itrix Eurostoxx50 fund could benefit from a combination of reopening of economies and the finalisation of a €750bn EU fiscal bailout.

Offshore exposure hedges investors against the ailing South African economy and rand weakness. There is, however, a rand paradox when investing offshore that investors ought to keep in mind. While the rand has recovered from the worst levels, historically it remains at weak levels and this creates a bit of dilemma.

Traditionally, most JSE index funds holding offshore equities have derived a significant portion of their returns from exchange rate gains, that is, the rand weakening against major currencies. Mean reversion is likely to play out in future and offshore returns can be suppressed or wiped out should the rand strengthen substantially.

However, with the South African economy likely to perform relatively worse than the global economy, the rand could remain depressed for longer or weaken even further. Notwithstanding the recent rally, we forecast that it will struggle at around R18/dollar in the short to medium term.

Now for their pick of ETFs

Domestic:

We expect financial markets to remain volatile in the coming months, so using anti-volatility strategies is a sensible approach. The JSE offers a number of such funds and investors can choose among three, depending on risk profile: NewFunds Volatility Managed Defensive Equity ETF (+0.3% in May), NewFunds Volatility Managed Moderate Equity ETF (flat in May); and NewFunds Volatility Managed High Growth Equity ETF (flat in May). These funds manage volatility and drawdowns simultaneously.

Because volatility of equities is not uniform under all market conditions, the objective is to maintain the same amount of volatility within the fund by reducing equity exposure in times of high volatility and increasing the fund’s cash component. And conversely, when volatility is low, the fund will increase its equity exposure and reduce its cash holding.

The objective of these funds is to maintain a target level of volatility in the fund. We like this agility. Unlike most ETFs which have fixed rebalancing/reconstitution periods, these funds apply a target volatility (TV) process daily, so that volatility is always around the target level, ensuring the risk profile is not excessive for extended periods. The most conservative of the three funds is the NewFunds Volatility Managed Defensive Equity ETF with a TV of 8%; followed by NewFunds Volatility Managed Moderate Equity ETF with TV of 15%; then the Volatility Managed High Growth Equity ETF with a TV of 20%.

Finally, to take advantage of the optimism in the market, investors can take a punt on NewFunds Equity Momentum ETF (-1.2%), which follows a momentum strategy but weights constituents by their contribution to volatility to limit exposure to highly volatile stocks. This fund can be added as a satellite fund to any of the core funds mentioned above.

International (Developed Markets):

We maintain our foreign exposure to the broad-based Satrix MSCI World Equity Feeder ETF (-0.3%). A good alternative, though, is the Ashburton Global 1200 Equity ETF (-0.7%) but it has a higher TER. Furthermore, you can add the Sygnia Itrix Eurostoxx50 ETF (+2.5%) as a satellite fund, speculating on possible approval of the proposed €750bn EU fiscal stimulus plan. Europe seems to have handled the virus outbreak better than the US. Other more focused international equity themes that can be used tactically include property, dividend and technology funds.

.

International (Developing Markets):

We don’t have many options for developing markets and stick with the Satrix MSCI Emerging Markets ETF (-3.2%). It invests in a wide range of emerging economies including some of the fastest-growing markets such as China and India. The Cloud Atlas AMI Big50 (+1.5%), which focuses on African equities, can be used as a satellite fund to the core Satrix MSCI Emerging Markets fund. However, the Cloud Atlas AMI Big50 ETF has been extremely volatile since its listing on the JSE, which is somewhat expected given its frontier markets exposure.

.

Dividend & Income-themed:

If you rely on your investment income for day-to-day expenses, you may want to allocate a portion of your portfolio to ETFs that have a high distribution ratio. We maintain our choice of dividend-focused strategies like the CoreShares S&P Global Dividend Aristocrats (-2.0%) and the CoreShares South Africa Dividend Aristocrats ETF (-1.8%).

A key advantage with the dividend aristocrat strategy applied by these funds is that it selects constituents based on the actual dividend payouts rather than a dividend yield. This is particularly important now when financially challenged companies may deceptively exhibit high yields because of low market prices. The strategy also tends to select companies that can endure difficult market and economic environments and whose earnings are not cyclical.

Such funds are usually overweight in highly cash-generative and resilient sectors. The only gripe we have with these funds is that they are pricey. The CoreShares S&P Global Dividend Aristocrats has a TER of 0.64% and the CoreShares South Africa Dividend Aristocrats ETF costs 0.54%, which we find exorbitant. An alternative for the local choice is the CoreShares PrefTrax ETF with yield twice as large, though it is pricier with a TER of 0.63% and its yield is twice as large.

Bonds and Cash:

SA’s fiscus is set to deteriorate substantially as revenue collections take a hit due to Covid-19, while the country’s expenditure is expected to remain sticky. The poor state of SOEs increases the downside risks while SA’s sovereign credit rating junk status by all three credit rating agencies bodes ill for government borrowing costs.

Given this backdrop, we gravitate towards the FirstRand US Dollar Custodian Certificate (-4.7%), which invests in US treasury bonds and offers rand hedge qualities. Our thesis, however, is weakened by the fact that international bonds are expensive due to central banks’ actions and further upside potential is limited. However, investors with access to broad emerging market bond ETFs should also consider those in a tactical strategy. When markets calm down, such bonds are likely to come back in style as money that is currently parked in safe havens starts looking for yields. For this reason, and given limited bond ETF choices, NewFunds Govi (+6.8%) can be adopted as a satellite fund. For short-term investors, usually less than a year, we maintain the NewFunds TRACI (+0.5%) as our choice.

Diversified funds:

If you find the process of diversifying your portfolio daunting, two ETFs can do it for you. They combine equities and bonds to produce a diversified portfolio for two investor archetypes with differing risk appetites: Mapps Protect ETF (+1.2%) is more conservative, usually suitable for older savers. Mapps Growth ETF (+0.1%) suits investors with a longer-term horizon. Notably, both funds invest in SA-listed assets, thus lack an offshore flavor.

Commodity funds:

Adding a commodity ETF to your portfolio improves diversification because commodities march to the beat of their own drum – they are not in synch with broader markets. Rhodium has been our metal of choice ever since the start of last year and it did wonders to our portfolio. However, we think it has run its course.

We speculatively replace it with platinum. In the short term, the platinum market is expected to remain tight. Demand will be dented by the temporary closure of automotive factories across the world and ongoing erosion of platinum jewellery consumption. However, medium- to long-term prospects for platinum are enticing. With the palladium price now significantly higher than platinum, automakers are increasingly trying to substitute some of the palladium used in diesel and petrol catalytic convertors with platinum. Should that happen, platinum will regain its shine.

Intellidex Reviews

April 2020: in the news

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.