Intellidex reviews: db x-trackers (now Sygnia) Euro Stoxx 50 Index ETF

ETF ANALYSIS

db x-trackers Euro Stoxx 50 Index ETF

Performance review

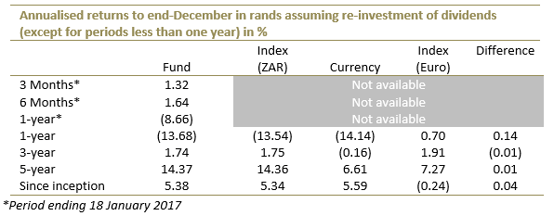

This ETF is popular for its rand hedge properties which were magnified at the end of 2015 when the rand hit its worst level in history against major currencies. However, the rand has since shown some resilience in the face of increasing uncertainty in Europe and a recovery in commodity prices. The fund normally derives a significant part of its return from the rand’s performance against the euro. But for the year to end-December 2016, the fund in rand terms made a loss of 13.7% – while the underlying Euro Stoxx index in euro terms made a positive return of 0.7%. The bulk of the loss therefore emanated from rand’s strengthening against the euro (or euro weakening against the rand): the euro lost more than 14% against the rand (shown on table below).

Outlook

Although equities are fundamentally driven by financial performance, this family of funds has an additional return component attributed to foreign exchange movements. Since its inception, rand weakness has accounted for all of the fund’s total return on an annualised basis. However, the rand’s rally during 2016 negatively affected its overall return.

This year promises to be a pivotal one for the European Union mainly due to geopolitical risks. There is Brexit to contend with while a number of influential countries of the union have elections looming where polls suggest nationalist, anti-EU parties will do well.

The struggling banking sector in EU countries coupled with unsustainably high government debts has kept the EU economy on a rocky path since the 2008 financial crisis, marked by slow growth. Another concern is that the institutions making economic decisions affecting citizens are not mandated through elections, which further threatens the political acceptability of the euro project. These issues increase uncertainty and point to a weak economy and currency.

Besides Europe’s challenges, SA faces its own factors that are bearish to the rand: political uncertainty, slow growth and the threat of a credit rating downgrade. However, good rainfalls and a recovery in some commodity prices could see the economy recover somewhat, further strengthening the rand.

Additionally, the policies of the new Trump administration in the US as well as the Federal Reserve’s interest rate policy will play important roles in determining global exchange rates, particularly of emerging economies.

Overall, we remain confident that diversifying your portfolio with foreign assets is wise, not just to hedge against rand weakness but to gain exposure to industries that are underrepresented locally. However, given the risks facing Europe, we have doubts as to whether it is best to try achieve this through the db x-EU ETF. There are other six alternatives that can be used to gain foreign exposure (see below under “alternatives”).

.jpg?width=554&height=369&name=370H%20(1).jpg)

Suitability

This fund is suited for long-term investors who want to hedge rand weakness and are concerned about the performance of the South African economy. However, it will underperform should the rand strengthen against the euro. The portfolio offers exposure to blue-chip multinational European companies which have multi-currency income streams. Investing in this ETF does not flout any exchange control limits as it is rand-settled.

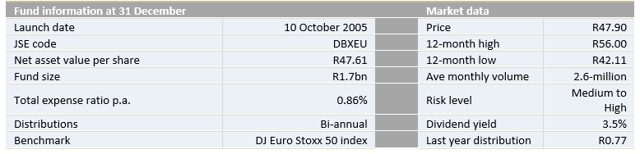

What it does: The ETF tracks the price and yield performance of the Euro Stoxx 50 index by holding a portfolio of securities in the same proportion as the basket of securities that make up the index. The Euro Stoxx 50 index is a market capitalisation weighted index representing the performance of the 50 largest and most liquid blue-chip stocks from countries within the eurozone.

What it does: The ETF tracks the price and yield performance of the Euro Stoxx 50 index by holding a portfolio of securities in the same proportion as the basket of securities that make up the index. The Euro Stoxx 50 index is a market capitalisation weighted index representing the performance of the 50 largest and most liquid blue-chip stocks from countries within the eurozone.

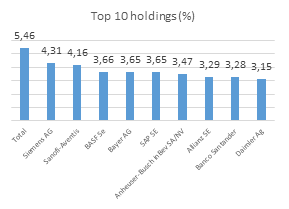

Top holdings: The top-10 holdings constitute 38% of the overall portfolio. All these companies are global leaders in their respective industries with long track records.

They have significant market power and are highly profitable cash generators.

Risk

This is a 100% investment in equities, which is a riskier asset class than bonds or cash. It is likely to be volatile, but the returns over time should compensate for volatility.

Alternatives

There are no other ETFs listed on the JSE that track the DJ Euro Stoxx 50 index. But there are other ETFs which track various developed market indices: db x-USA (tracks the US MSCI index); db x-Japan (tracks MSCI Japan index); db x-UK (tracks FTSE 100 index); db x-World (tracks MSCI world index); CoreShares S&P Global Property (tracks S&P Global Property 40 index); and CoreShares S&P 500 (tracks the S&P 500 index)

About Exchange traded funds (ETFs)

Exchange Traded Funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, US-listed companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the EasyEquities platform. In addition, it qualifies for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.