ETF ANALYSIS

Stanlib 40 ETF

Suitability

This week we review the Stanlib Top 40 ETF, which gives exposure to the 40 biggest companies listed on the JSE. They represent at least 80% of the JSE’s total market capitalisation, and provide broad exposure to SA’s general economic performance, while many constituents also earn a substantial portion of their revenue internationally. The Stanlib Top 40 ETF is good for investors with a medium- to long-term investment horizon. It can be used as part of a core investment portfolio. Equity investments tend to exhibit higher short-term volatility than other asset classes, so a longer investment horizon gives a portfolio time for returns to accumulate ahead of volatility.

What it does

The fund tracks the value of the FTSE/JSE Top 40 index. The Stanlib Top 40 fund exposes investors to the price performance of the FTSE/JSE Top 40 index and pays out, on a quarterly basis, all dividends received, net of costs. Constituent companies are weighted according to market value, which means the price movement of a larger constituent company will have a larger effect on the price of the index than that of a smaller company. The market value of constituent companies is free-float adjusted: it excludes locked-in shares (such as those held by holding companies, founders and governments) and cross-holdings (where a listed company, such as Remgro, Reinet or PSG, owns a chunk of another listed company).

Advantages

The fund invests in the most liquid blue chip companies on the JSE, some with international operations, which enhances risk diversification.

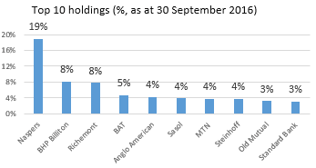

Top holdings: The top 10 assets constitute 62% of the fund.

Risk: In addition to being a 100% investment in equities –which is a riskier asset class than bonds or cash – its weighting methodology introduces idiosyncratic risk due to big exposures in heavyweights such as Naspers. However, the returns over time should compensate for volatility.

Also, constituent companies have diversification benefits because they operate in several jurisdictions and in varied sectors, diminishing the risk to a degree.

Fees

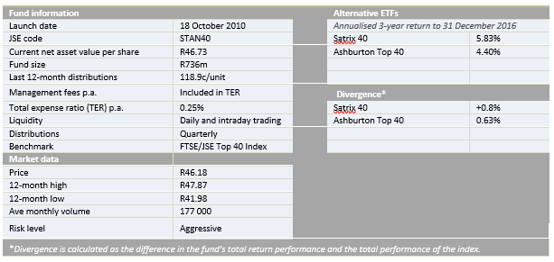

The Stanlib Top 40 ETF has a total expense ratio (TER) of 0.25%

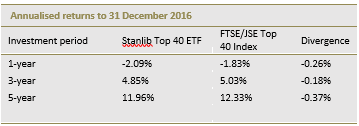

Historical performance

The table below show lump sum investment returns for different maturities.

Fundamental view

Equities are driven by general economic activity. SA’s economy has performed poorly recently and the equities market has remained largely flat for the past two years. However, the significant foreign exposures in the fund benefit from rand weakness, and often involve regions where economic growth is faster than SA’s.

Alternatives

The fund’s closest peers are the Satrix 40 and Ashburton Top 40 ETFs. The main difference is the Stanlib Top 40 is adjusted for free-float whereas its peers are simple market-weighted funds. Other close peers are the Swix-weighted funds – Satrix Swix ETF and Stanlib SWIX ETF – which consider the market capitalisation of companies that are held on the JSE register. This means companies that are listed on the JSE but mostly traded on other markets such as London are held in a lower proportion.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

|

|