Intellidex Reviews April 2020: ETF Picks

Local equities were primarily driven by resources (+22.6%) plus decent gains from financials (+8.6%) and industrials (5.2%). Logically, top-performing ETFs came from the resources sector, with the Satrix Resi up 20.6% followed by NewFunds Equity Momentum (+17%) and NewFunds Top 50 (16.6%). The worst performers came from the property and managed volatility funds – volatility funds hold cash if volatility is high, hence missed out on the recovery.

Property funds have been under persistent pressure for the past two years as the South African economy faltered – and with Covid-19 the situation is dire. At the bottom is the Satrix Property fund (-2.2%) and NewFunds Volatility Managed Defensive Equity which remained flat, though the latter remains one of the few resilient funds YTD.

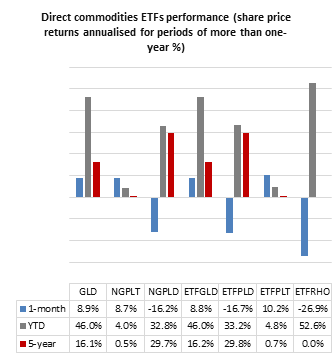

In reversal of fortunes, rhodium and palladium funds fell on hard times. The 1nvest Rhodium ETF tanked 26.9%, but remains the best-performing fund YTD, up 52.6 %. However, its cousin, 1nvestPlatinum, rose 10.2% but is the worst performer among commodity funds YTD.

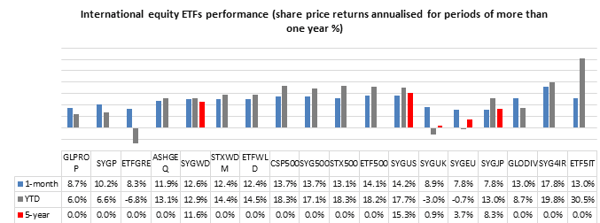

International ETFs

Internationally, the US and tech stocks dominated the recovery as the Nasdaq index climbed 15.4%. The Sygnia/Itrix 4th Industrial Revolution ETF rose 17.8%, while the Satrix Nasdaq 100 ETF increased 15%. While bonds managed positive returns, they were at the bottom of the pack, with the worst performer the 1nvest Global Govt Bond Index Feeder ETF, which is up 2.5%.

Intellidex ETF portfolio

We made wholesale changes to our ETF holdings to reflect the new reality. We feel those changes are still relevant. Overall, diversification across asset classes and economies remains an investor’s best companion.

In equities, which have been extremely volatile, we favour low-volatility and defensive strategies. The uncertainty of Covid-19 will keep volatility in equity markets high for the foreseeable future. It is unfortunate that we do not have JSE-listed funds that track volatility indices – it is the only asset class to have truly exhibited high negative correlation with equities.

Offshore exposure will hedge against the ailing South African economy and rand weakness. There is, however, a rand paradox when investing offshore that South African investors ought to keep in mind. The rand is hovering around its historical lows and for South African investors this creates a bit of dilemma.

Traditionally, most JSE index funds holding offshore equities have derived a significant portion of their returns from exchange rate gains, that is, the rand weakening against major currencies. Mean reversion is likely to play out in future and offshore returns can be suppressed or wiped out should the rand strengthen. However, with the SA economy likely to perform relatively worse, the rand could remain depressed for longer or weaken even further.

Now for their pick of ETFs

Domestic:

As we expect financial markets to remain volatile in the coming months, using anti-volatility strategies is a sensible approach. The JSE offers a number of such funds but we prefer the NewFunds Volatility Managed Defensive Equity ETF (+0.4% in April), which has a mandate of managing fund volatility and drawdowns simultaneously. Because volatility of equities is not uniform under all market conditions, the objective is to maintain the same amount of volatility within the fund by reducing equity exposure in times of high volatility and increasing the fund’s cash component. And conversely, when volatility is low the fund will increase its equity exposure and reduce its cash holding.

The objective of this fund is to maintain a target level of volatility in the fund at 8%. We like the fund’s agility. Unlike most ETFs which have fixed rebalancing/reconstitution periods, this fund applies the target volatility process daily, so that volatility is always around the 8% level, ensuring the fund’s risk profile is not excessive. If you have higher risk tolerance you can opt for its cousins with higher TV: Volatility Managed Moderate Equity ETF with TV of 15%; and Volatility Managed High Growth Equity ETF with TV of 20%.

Our main concern with the ETF is that it is still small with assets under management of only R10m. Generally, ETFs have to reach a certain threshold to be viable and this fund is still far off that level. Having a small asset base exposes investor to liquidation risk if the fund does not attract more assets. It may also result in a higher total expense ratio than larger funds that have the advantage of economies of scale. It is also pricey with a total expense ratio (TER) of 0.55%.

International (Developed Markets):

Here we do not have many options since all the international funds on the JSE are largely vanilla-type. We maintain our exposure to the broad-based Satrix MSCI World Equity Feeder ETF. The ETF gained 12.4% in April. A good alternative, though, is the Ashburton Global 1200 Equity ETF (+11.9%) but it has a higher TER. Other more focused international equity themes include property, dividend and technology funds. These are worth considering for tactical or other investor-specific reasons.

International (Developing Markets):

For developing market exposure, we choose the Satrix MSCI Emerging Markets ETF (+11.6%). It invests in a wide range of emerging economies including some of the fastest-growing markets such as China and India. The Cloud Atlas AMI Big50 (+7.6%), which focuses on African equities, can be used as a satellite fund to the core Satrix MSCI Emerging Markets fund. However, the Cloud Atlas AMI Big50 ETF has been extremely volatile since its listing on the JSE, which is somewhat expected given its frontier status.

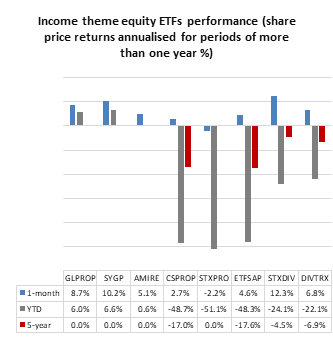

Dividend & Income-themed:

If you rely on your investment income for day-to-day expenses, you may want to allocate a portion of your portfolio to ETFs that have a high distribution ratio. Property have been our choice for a long time but we find them too vulnerable now. We think diversified dividend-focused strategies like the CoreShares S&P Global Dividend Aristocrats (+13%) and the CoreShares South Africa Dividend Aristocrats ETF (6.8%) will do a better job.

A key advantage with the dividend aristocrat strategy applied by these funds is that it selects constituents based on the actual dividend payouts rather than a dividend yield. This is particularly important now when financially challenged companies may deceptively exhibit high yields because of low market prices. The strategy also tends to select companies that can endure difficult market and economic environments and whose earnings are not cyclical. Such funds are usually overweight in highly cash-generative and resilient sectors.

The only gripe we have with these funds is that they are pricey. The CoreShares S&P Global Dividend Aristocrats has a TER of 0.64% and the CoreShares South Africa Dividend Aristocrats ETF costs 0.54%, which we find exorbitant. A good alternative for the local choice is the CoreShares PrefTrax ETF with yield twice as large, though it is pricier with a TER of 0.63%.

Bonds and Cash:

SA’s fiscus is expected to weaken in the short term as revenue collections take a hit from the ongoing lockdown, potential business failures, retrenchments and economic slowdown, while its expenditure, on the other hand, is expected to remain sticky. Moody’s also exacerbated the situation by downgrading SA’s credit rating to junk status.

Given this backdrop we change our pick for this segment to the FirstRand US Dollar Custodian Certificate (+2.9%), which invests in US treasury bonds and offers rand hedge qualities. We steer clear of SA bonds for now. However, investors with access to broad emerging market bond ETFs should also consider those as a long-term strategy.

When markets calm down such bonds are likely to come back in style as money which is currently parked in safe havens starts looking for yields. For short-term investors, usually less than a year, we maintain the NewFunds TRACI (+0.6%) as our choice.

Diversified funds:

If you find the process of diversifying your portfolio daunting, two ETFs can do it for you. They combine equities and bonds to produce a diversified portfolio for two investor archetypes with differing risk appetites:

Mapps Protect is more conservative, usually suitable for older savers.

Mapps Growth suits investors with a long-term horizon.

They were up 7.9% and 12% respectively. Notably, both funds invest in SA-listed assets, thus lack an offshore flavor.

Commodity funds:

Adding a commodity ETF to your portfolio improves diversification because commodities march to the beat of their own drum – they are not in synch with broader markets. Rhodium has been our metal of choice ever since the start of last year and it did wonders to our portfolio. However, we think it has run its course.

We speculatively replace it with platinum. In the short term, the platinum market is expected to remain tight. Demand will be dented by the temporary closure of automotive factories across the world and ongoing erosion of platinum jewellery consumption. However, medium-to long-term prospects for platinum are enticing. With the palladium price now almost three times that of platinum, automakers are increasingly trying to substitute some of the palladium used in diesel and petrol catalytic convertors with platinum. Should that happen, platinum will regain its shine.

Intellidex Reviews

April 2020: in the news

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.