Intellidex 2020 reviews: US Dollar Custodial Certificates ETF

Catch this insight by Intellidex on the US Dollar Custodial Certificates. The fund offer investors direct exposure to US treasury bonds and is suitable for investors wanting to hedge their investment against rand weakness.

Intellidex insight: US Dollar Custodial Certificates (DCC) offer investors direct exposure to US treasury bonds (USTBs). RMB, the fund sponsor, acquires USTBs and holds them in a ring-fenced account. DCC does not track any index but RMB uses its discretion on which maturities to acquire. It then creates US dollar custodial certificates which are listed and sold on the JSE.

During the investment period RMB pays holders of the DCCs the coupon interest it receives on the USTBs, less 30 basis points. To ensure investors can sell their certificates speedily, RMB ensures there is a liquid secondary market for these certificates. The returns from this ETF come from changes in the rand-dollar exchange rate, movements in the price of the USTBs as well as the periodic interest paid.

The total expense ratio (TER) is close to 0%, because the 0.3% levied on the coupon interest paid – given that the yield is about 1% – translates to an even lower expense ratio when juxtaposed on a bigger denominator, the value of underlying assets. All transactions with investors are rand-settled.

Note that unfortunately the fund does not qualify as a tax-free investment.

Fund description: The fund does not track a index and has an opaque structure where constituents are selected by RMB. The fund’s listing document states that it contains US treasury bonds with varying maturities. Dividends are paid regularly whenever coupons are received by the fund from the issuer, the US government.

Click logo to view

US Dollar Custodial Certificates ETF

Top holdings:US treasury bonds with varying maturities.

Suitability: Suitable for investors wanting to hedge their investment against rand weakness. Given the influence of the exchange rate on the performance of this fund, it will best suit investors who have a negative view on the rand and believe that investing in dollars may preserve their assets. Therefore, this ETF enables companies and individuals to hold unlimited quantities of cash in US dollars without flouting exchange control limits.

Historical performance:

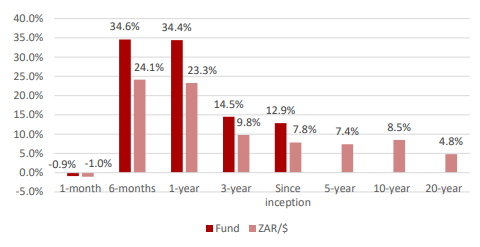

Price performance to end-June 2020 (annualised for periods greater than one year)

The returns graph shows that the fund has a high correlation with the rand’s depreciation – the difference is

The returns graph shows that the fund has a high correlation with the rand’s depreciation – the difference is

attributed to the dollar price movement of the underlying assets/bonds. This means that as the rand depreciates against the dollar, the fund’s total return increases – and vice versa. Over the past 20 years the rand has depreciated by an average of 4.8% a year against the greenback. This means the rand has lost almost 61% of its value against the dollar in the past 20 years. Incidentally, 61% of the fund’s return since its inception in 2012 is directly attributed to the weakening of the rand, with the balance coming from price movements of the fund’s underlying assets. While in the short term, periods of sustained rand weakness are sometimes followed by periods of strength, over the long term the rand has consistently weakened against the dollar, which supports investing in the fund.

Fundamentals: Equity markets exhibit low correlation with the bond markets, as such bonds can effectively diversify a portfolio of risky assets by improving its risk-adjusted returns. At the height of the Covid-19 market turmoil, funds that had bond holdings experienced less volatility and less drawdown than pure equity portfolios. While gold remains one of the best portfolio diversifiers, we like the allure of bonds given that they are cash-generating assets through the semi-annual coupon payments.

The price of USTBs fluctuates, tracking macroeconomic developments and monetary policy, which affects the overall supply and demand on the market. The monetary policy set by the US Federal Reserve has a strong impact on USTB prices. A rising federal funds rate tends to draw money away from bonds, causing the price to drop. A decline in the fed funds rate will have the opposite effect. Bonds also tend to drop when other investments (like equities) seem less risky and the economy is in expansion. During economic downturns, investors often decide that bonds are the safest place for their money and demand could spike, pushing prices up, as is the case now due to Covid-19.With this ETF we think the rand-dollar exchange rate will be the dominant return driver. Also, note that as bonds approach maturity they tend to converge towards their face value, which limits the upward price movement of underlying bonds.

Click logo to view

US Dollar Custodial Certificates ETF

The ETF will be exposed to risks arising from movements in financial markets. Movements in the rand-dollar

exchange rate will affect the value of the USTBs. US macroeconomic factors, particularly the interest rate, will also have an impact on returns. The actual price will be determined by market conditions.

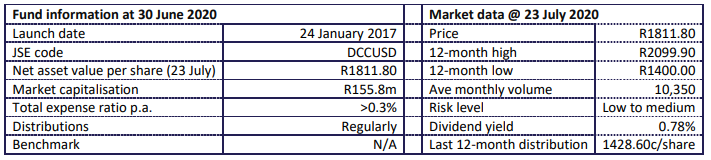

Fund statistics:

Alternatives: Ashburton World Government Bond (TER of 0.43%) and 1nvest Global Govt Bond Index Feeder (TER of 0.4%).

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.