Catch this insight by Intellidex on the South African equity market. This note is on the Sygnia/Itrix Eurostoxx 50 ETF. This ETF is suitable for investors with long investment horizons and can be used as part of a core strategic allocation in your portfolio.

Intellidex insight: The Sygnia/Itrix Eurostoxx 50 ETF is the only ETF on the JSE that offers easy access to more than 50 blue chip companies on various eurozone stock exchanges in one low-cost transaction. These companies account for 60% of the free-float market capitalisation of the Eurostoxx Total Market Index, which has more than 600 counters.

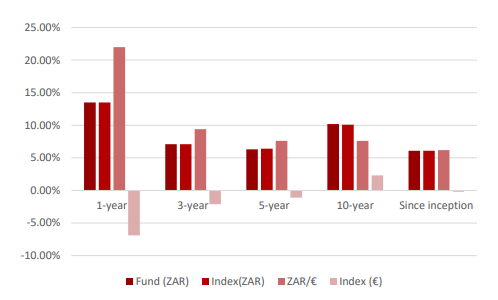

An integral aspect of ETFs holding international assets is two return components: asset price return and foreign exchange movements. The underlying assets of the Euro Stoxx fund are denoted in euros, so any rand weakness adds a layer of foreign exchange return. Specifically, since the Sygnia Itrix Euro Stoxx 50 ETF listed on the JSE in 2005, all of its return has emanated from the depreciation of the rand against the euro. Therefore, the fund is a great way to hedge against rand weakness.

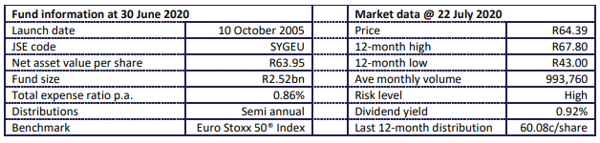

Similarly, the fund enhances geographical diversification. The fund’s total expense ratio (TER) has remained the same as three years ago when Sygnia took it over from Deutsche, despite promises to lower it. Sygnia has introduced a sliding fee structure based on the amount invested, with the best TER of 0.4% for an investment of at least R100m. But this is not helpful to retail investors who invest small amounts and have to hand over

0.86% of their investment in fees.

Investing in this ETF does not affect any exchange control limits as it is rand-settled

Fund description: The ETF tracks the price and yield performance of the Euro Stoxx 50® Index and pays dividends in June and December.

Click logo to view

Sygnia/Itrix Eurostoxx 50 ETF

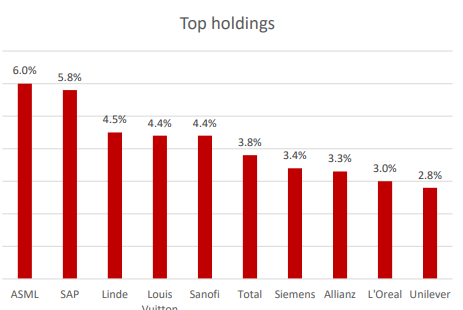

Top holdings:Some of the prominent companies in the fund include Total, Louis Vuitton, Linde and Unilever. The biggest holding, ASML Holdings, occupies 6% of the fund. The fund is spread over 10 sectors and countries, which makes it well-diversified.

Suitability: We believe the fund is suitable for investors with long investment horizons who can stomach higher short-term volatility, compared with other asset classes like bonds and cash. The fund can be used as part of a core strategic allocation in your portfolio.

Historical performance:

Since inception the fund’s rand return has been underwhelming. The underlying euro return of the fund since its listing in 2005 has been flat with the fund’s total return all coming from the weakening of the rand against the euro.

Net asset value performance to end-June 2020 and annualised for periods more than one year

Fundamentals: European stocks have become one of the most unloved asset classes of the last decade for well-documented reasons. The bloc struggled to find legs coming out of the global financial crisis, compounded by debt crises of various member countries, weak consumer demand, Brexit uncertainty and the tariff trade wars.

More recently Covid-19 threatened to deal a final blow to Europe’s economy but an unprecedented monetary response by the European Central Bank should provide a platform for a decent recovery.

Click logo to view

Sygnia/Itrix Eurostoxx 50 ETF

Fund statistics:

Alternatives: None

Click below to view

Sygnia/Itrix Eurostoxx 50 ETF

Compare ETFs on EasyETFs

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.