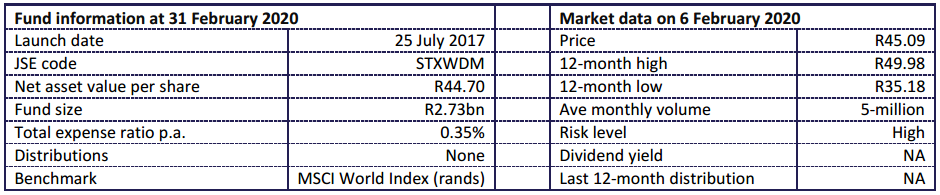

Catch this insight by Intellidex on the South African equity market. This note is on the Satrix MSCI World Equity Feeder ETF. With this fund you will gain exposure to about 85% of total equity capitalisation of the 23 most advanced countries, which acts as a hedge against the South African economy and the rand. This ETF is ideal for long-term investors with tolerance for high risk.

Intellidex insight:The Satrix MSCI World ETF is the younger of the two funds that track the MSCI world index on the JSE. While the MSCI World index’s underlying assets are denominated in dollars, South African investors gain easy exposure by paying in rands. What’s more, purchasing the fund does not decrease your hard currency allowance by the central bank. It is Satrix’s responsibility to convert the rand into dollars and acquire the index’s underlying assets. Similarly, when you redeem your investment the fund manager converts your underlying dollar assets into rands. This gives rise to an additional source of return, foreign exchange return. In the past decade, foreign exchange return has been a major source of overall fund return, as the rand

has maintained a losing streak against the greenback. A caution though as it works both ways: if the rand appreciates, it eats into your overall return.

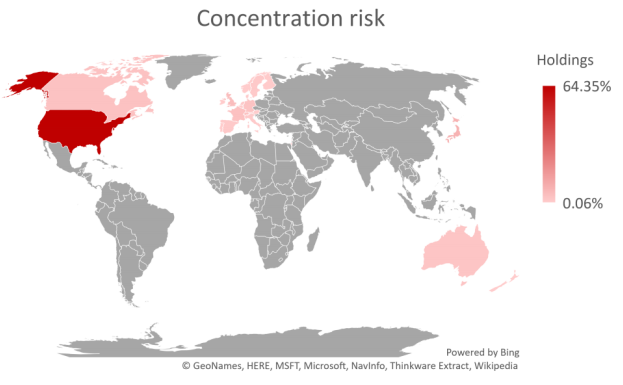

With this fund you will gain exposure to about 85% of total equity capitalisation of the 23 most advanced countries, which acts as a hedge against the South African economy and the rand. This makes the fund attractive as a core long-term holding as it enhances diversification and growth potential. However, there is a concentration in US equities, which constitute 64% of the fund’s investments.

Satrix MSCI World is a feeder fund which means it gains exposure to the MSCI World index indirectly through the iShares Core MSCI World UCITS ETF. Nonetheless, it is cheaper than its Sygnia counterpart. Even if we add another layer of fees incurred by Satrix through this indirect exposure its fees are lower at 0.55%, compared with 0.69% for Sygnia. Furthermore, while Satrix automatically reinvests all dividends, Sygnia distributes biannually.

The fund is also exposed to counterparty risk which entails potential loss due to insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments. This risk, however, is low as the institutions involved are well capitalised.

Fund description:The fund tracks the value of the MSCI World Index in rands by investing in the iShares Core MSCI World UCITS ETF (the underlying fund). The MSCI World Index measures the performance of the large- and mid-cap stocks across developed market countries

Click logo to view

Satrix MSCI World ETF

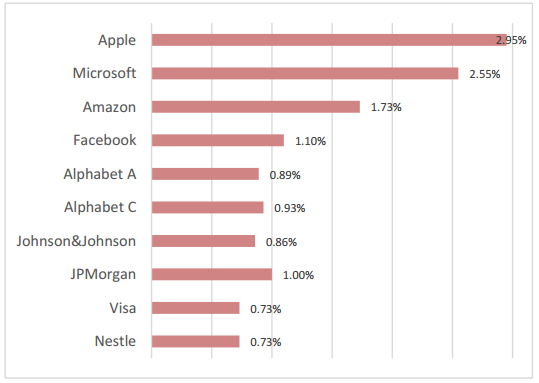

Top holdings:The fund’s top 10 investments account for 13.5% of its total investments. The fund is well

Top holdings:The fund’s top 10 investments account for 13.5% of its total investments. The fund is well

diversified with over 1,600 constituents from different industries and geographies.

Source: Intellidex, Satrix

Suitability:Equity prices are volatile, especially in the short term, which may lead to sizeable capital losses due

to the workings of various market variables: political developments, economic news, company earnings and

significant corporate events. This short-term noise means the fund is ideal for long-term investors with

tolerance for high risk.

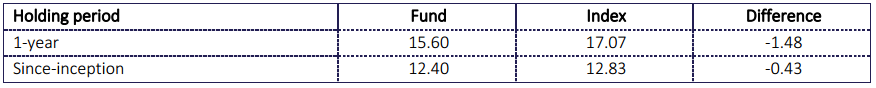

Historical performance:

Fundamentals:Equities are driven by level of economic activity. Unfortunately, the spread of Covid-19 has caught most people unaware and its damage to both the global economy and human life has been extensive. The short-term outlook is dire, but equity investments are long term in nature. We also draw comfort from the incredible response by global fiscal and monetary authorities in their stimulus measures to offset the economic impact of the virus. Furthermore, the rand has blown out and its weakness looks set to persist. As such South African investors would be served better by offshore exposure.

Click logo to view

Satrix MSCI World ETF

Fund statistics:

Alternatives:Sygnia Itrix MSCI World Index ETF

Click below to view

Satrix MSCI World ETF Fact Sheet

Compare ETFs on EasyETFs

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

If you thought this blog was interesting, you should also read:

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.