Catch this insight by Intellidex on the Sygnia-Itrix global property ETF. The Sygnia-Itrix global property ETF tracks the S&P Global Property 40 Index which contains 40 leading global REITs This ETF suits investors seeking exposure to global property companies. It can also be used as a building block for an income strategy or simply as a rand hedge.

Intellidex Insight: We consider property to be a must-have element of a balanced portfolio. While property investments share similarities with general equities, they add a nice income and diversification flavour to a portfolio. Because of the more resilient cash flow, real estate investment trusts (Reits) tend to be less volatile than general equities. They also tend to pay higher and more reliable dividends because they generate high and consistent cash flows and are obligated to pay out a certain percentage of their taxable income to retain the Reit status.

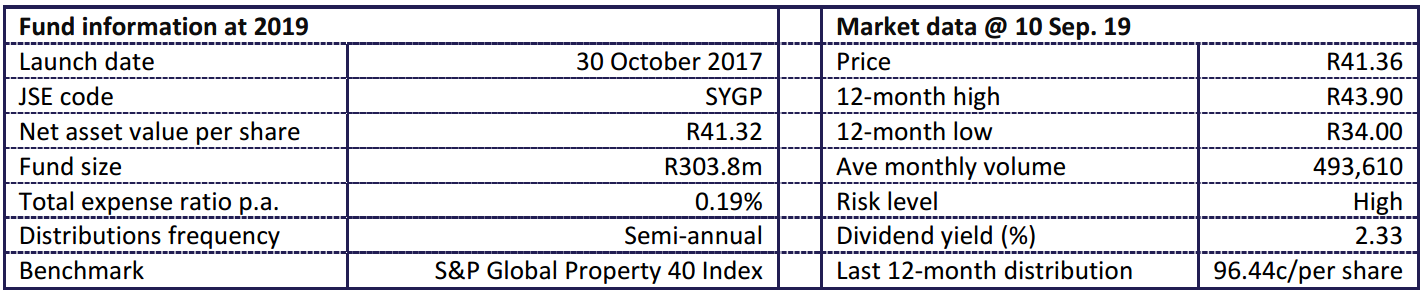

The Sygnia-Itrix Global Property ETF’s value proposition is that it has an aggressively low total expense ratio (TER) of 0.19% that significantly undercuts its competitors, whose charges range from 0.29% to 0.69%. The fund is also efficient at replicating the risk and return characteristics of its specified benchmark.

While it is a global property fund, it is largely US-centric with more than 60% of its holdings in the US. However, it compensates for this lack of geographical diversification by spreading its funds across property sectors. While most local Reits concentrate on the office, industrial and retail sectors, Sygnia-Itrix Global Property ETF has its hand in about eight sectors, including health care and residential

Fund description: The Sygnia-Itrix global property ETF tracks the S&P Global Property 40 Index which contains 40 leading global REITs. Constituents are weighted based on their market capitalisations and capped at a weight of 10% each.

Click logo to view

Sygnia-Itrix Global Property ETF

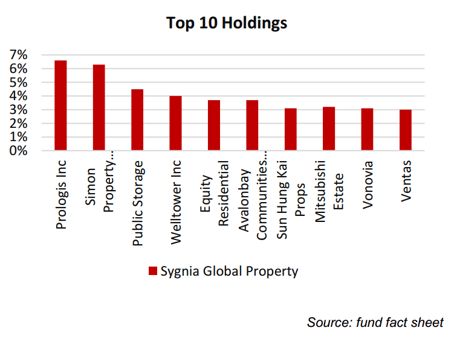

Top Holdings: The top 10 holdings constitute 41.2% of the fund. Due to the 10% weight cap the fund is relatively well diversified across individual counters. The largest stock accounts for less than 7% of the fund.

Suitability: This ETF suits investors seeking exposure to global property companies. It can also be used as a building block for an income strategy or simply as a rand hedge.

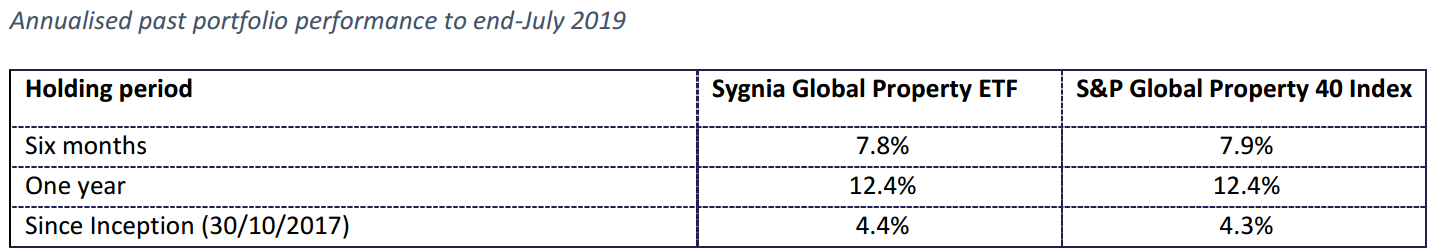

Historical performance: While still a young fund, its performance has been impressive: it’s one-year return of 12.4% is streets ahead of the JSE all share index’s 7.81%. Most of the growth, however, was due to currency effects.

Source: July 2019 fact sheets

Fundamentals: Property values respond to interest rate levels and economic activity. As interest rates rise, interest payments on property owners’ loans follow suit, which means they have less cash flow available for dividends. Also, the rising cost of borrowing suppresses property prices, diminishing their appeal as income providers.

Global interest rates are trending downwards which is a boon for this fund. However, the global economy is expected to slow down on the back of geopolitical tensions and protectionist measures. The trade disputes between the US and China have left markets in a rather chilling condition, forcing analysts to forecast a further economic slide.

Click logo to view

Sygnia-Itrix Global Property ETF

For JSE-listed global ETFs, the rand-dollar dynamics play a major role. The rand has been on the back foot over the past few months amid a beleaguered South African economy and rising political tensions. If the currency continues on that trajectory, this fund will benefit.

Fund statistics:

Alternatives: There are two other global property ETFs listed on the JSE. One is the CoreShares Global Property ETF (total expense ratio: 0.69%) which has a similar investment approach to the Sygnia fund. The other is the Stanlib Global REIT Index Feeder ETF (now 1nvest) (TER: 0.34%) which is not limited to the top 40 global REITs but tracks global real estate companies and REITs generally.

Click below to view the

Sygnia-Itrix Global Property ETF

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report

|

|