Intellidex 2019 reviews: Stanlib SA Property ETF (Now 1nvest SA Property ETF)

Catch this insight by Intellidex on the Stanlib SA Property ETF. The Stanlib SA Property ETF tracks the SA Listed Property Index (Sapy), which tracks the performance of more than 20 liquid property companies by market capitalisation that have a primary listing on the JSE. Sector-focused ETFs best suit long-term investors since they are considered riskier than diversified funds.

Intellidex Insight: The Stanlib SA Property ETF will soon be the only fund that tracks the SA Listed Property Index (Sapy) as the other two funds that were doing so are being merged and will migrate to a different index. While the Sapy is a widely recognised benchmark for SA’s property sector, we find it lacking in diversification. It is usually top-heavy with a handful of stocks driving its risk and returns.

The other downside is that it excludes companies that do not have a primary listing on the JSE. This denies the index access to foreign property companies such as Capital Counties, Intu Properties and Hammerson. The ETF does offer international exposure, however, through its holdings in Nepi Rockcastle, Growthpoint, Vukile and Redefine. These companies hold sizeable investments in Hungary, Spain, Australia and Poland.

However, we think investors concerned about diversification are better off with the Satrix Property ETF or the upcoming CoreShares property fund. These funds have mechanisms to avoid over-concentration and do not discriminate based onprimary/secondary listing.

The Stanlib SA Property ETF will likely appeal to investors who want specific exposure to SA-based REITs, which can provide higher income yields than property development companies and foreign REITs

Fund description: The Stanlib SA Property ETF tracks the SA Listed Property Index (Sapy), which tracks the performance of more than 20 liquid property companies by market capitalisation that have a primary listing on the JSE.

Click logo to view

1nvest SA Property ETF

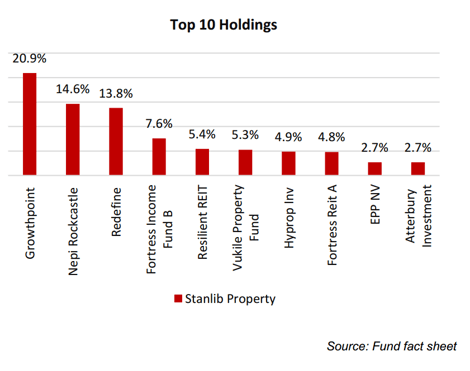

Fund Holdings: The top 10 stocks constitute 82.7% of the fund. The company weightings depict the dynamics of an uncapped fund, with distribution ranging from 16.8% to 3%. Growthpoint is the biggest constituent

followed by other heavyweights in the local industry. This give the portfolio strong exposure to domestic property companies that have some offshore market interests.

Suitability: This sector-based ETF likely appeals to investors seeking exposure to SAbased REITs with high-income yields rather than property development companies and foreign REITs. Sector-focused ETFs best suit

long-term investors since they are considered riskier than diversified funds

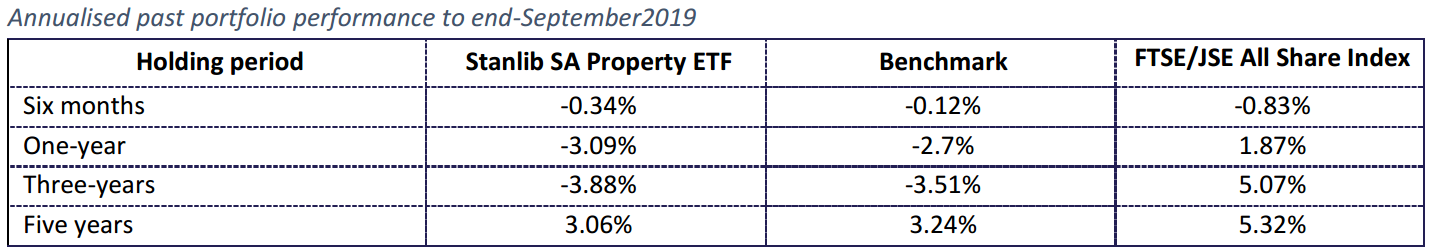

Historical performance: The Stanlib Property ETF’s performance has been quiet disappointing, returning 3.06% a year over the past five years

Source: http://www.etfsa.co.za/docs/perfsurvey/perform%20survey%20-%20Sept2019.pdf; and September 2019 fact sheets

Fundamentals: The ETF has 99.58% of its funds invested in the domestic property companies which in turn have offshore interests. Like other investments this asset class is very sensitive to macroeconomic risks, settlement risks and interest rate and bond-yield movements. Despite the challenging economic conditions, the local listed property sector has been relatively resilient.

Data from the South African Property Owners Association (Sapoa) as well as MSCI Retail Trading Density Index show that occupancy levels in the SA property sector are still decent. Sapoa reported that the national vacancy rate for offices improved to 11% during 2019Q3 from 11.3% in 2019Q2. In the retail segment, the vacancy rate of the more than 100 shopping centres forming part of the MSCI index printed at 4.3% at the end of 2019Q2. The vacancy rate in the industrial sector was 3.6% as at the end of 2018, which is solid. However, all sectors reported high rental reversions which means that lease renewals and new tenant uptakes are coming at lower rental rates, which is constraining the ability of REITs to grow distributions to shareholders.

Click logo to view

1nvest SA Property ETF

Several companies have since reported declines in dividends. Hyprop, which was a market darling not too long ago, warned that its dividend will drop by between 10% and 13% for FY20. SA Corporate Real Estate, which has been embroiled in a prolonged boardroom battle, also reported below-guidance dividend numbers for the six months to June: down 6%, versus its earlier forecast of flat growth.

We expect this to be the new normal for the sector. SA needs GDP growth of 3.5% or higher to drive employment growth and subsequently demand for space. With the economy not expected to grow anywhere near that level in the short to medium term, it is very difficult to see the sector performing robustly and improving its occupancy levels.

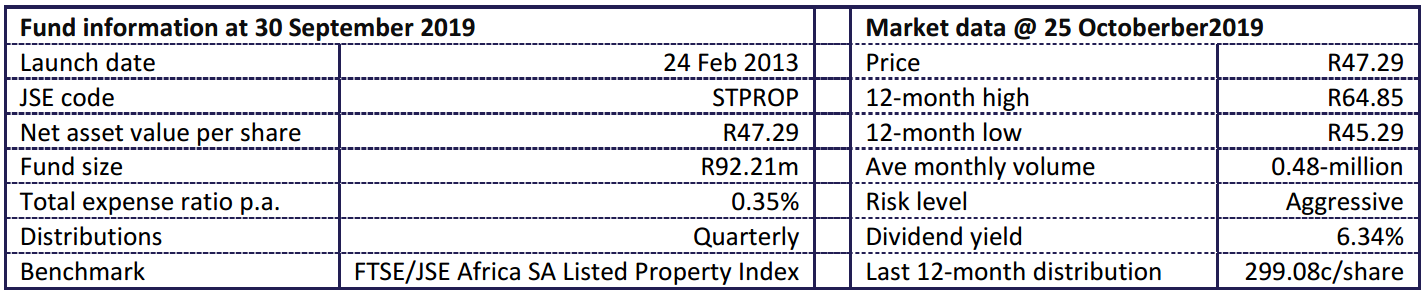

Fund statistics:

Click below to view the

1nvest SA Property ETF

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.