The NewFunds Swix 40 ETF is a market capitalisation weighted fund based that considers only the JSE

register, resulting in dual-listed stocks being down-weighted because a significant portion of their shares are held offshore. Also, this weighting format has traditionally resulted in limited exposure to resources/basic materials, most of which have primary listings on international exchanges.

Fund description: The NewFunds SWIX 40 ETF tracks the FTSE/JSE shareholder-weighted (Swix) top 40 total return index, not the traditional JSE top 40 index. The ETF is more representative of the universe of shares available to South African investors.

Click logo to view

NewFunds SWIX 40 ETF

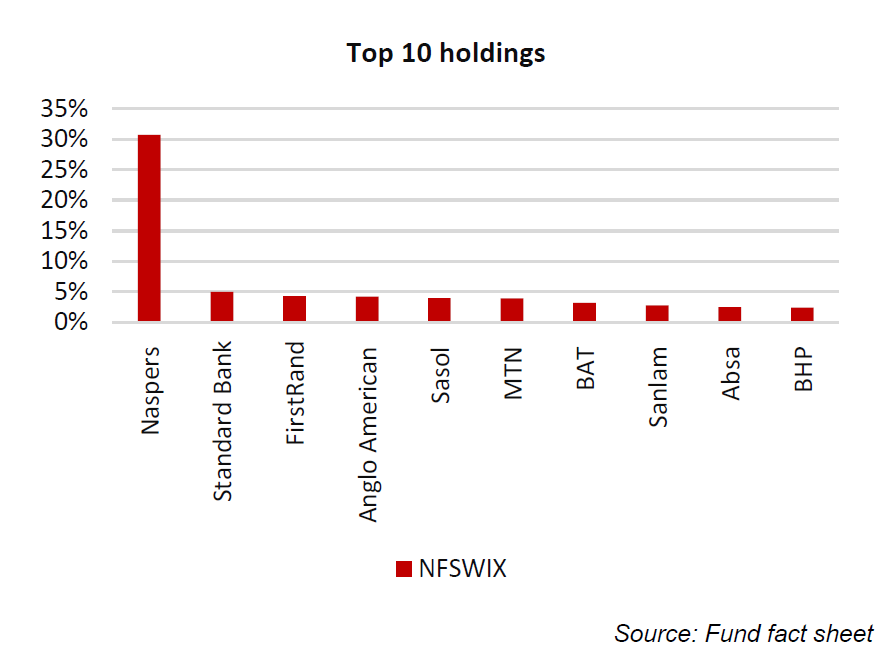

Top holdings: The biggest single holding is Naspers with a weight of 30.7%, which significantly reduces

diversification benefits.

Suitability: The ETF is considered aggressive as it is an equities-only fund, suitable for long-term investors seeking exposure to the largest blue-chip companies on the JSE. Equity investments tend to exhibit high short-term volatility and could result in capital loss. However, a longer investment horizon gives the portfolio time to accumulate higher returns ahead of volatility, making it ideal for risk tolerant long-term investors.

Historical performance: While short-term returns are strong, the NewFunds Swix 40 ETF and other funds that track SA’s major equity indices have been under pressure over the past year to end-June.

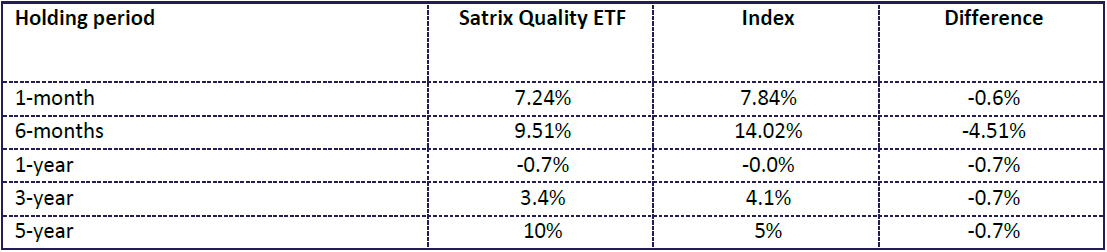

Net asset value performance to end-June 2019

Source: http://www.etfsa.co.za/docs/perfsurvey/perf_survey_June19.pdf and June 2019 fact sheets

The NewFunds Swix 40 ETF posted a -0.7% loss in the 12 months to end-June. However, the fund has turned a corner, posting an impressive 9.51% in the first half of 2019. A similar trend was observed among the top 40 funds with Ashburton Top 40 leading the pack, returning 13.86% in the same period.

Fundamentals: The Swix 40 ETF is driven by both local and global economic conditions as well as the sectoral allocation. A large chunk of the portfolio is dominated by consumer-driven companies. This sector is under strain with consumers facing rising fuel, electricity and other administered costs, against a backdrop of rising unemployment. SA-facing equities are going through a rough patch largely due to waning investor confidence caused by rising economic and political uncertainty.

Click logo to view

NewFunds SWIX 40 ETF

The International Monetary Fund recently slashed SA’s economic (GDP) growth forecast for this year to 0.7% from 1.2% and to 1.1% from 1.5% for next year. This follows the severe 3.2% contraction in the economy in the first quarter. Such a poor outlook will have a negative effect on SA-facing companies. However, top 40 companies have significant operations beyond SA where economic prospects are better. This is likely to offset local economic conditions and give the fund a boost.

Fund statistics:

Alternatives: The NewFunds SWIX 40 ETF’s direct alternatives are the Satrix Swix 40 and Stanlib Swix 40 which both similarly track the Swix index.

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the Easy Equities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report

|

|