In this week's byte size insight into all things investing in cryptocurrencies, we asked Crypto Entrepreneur, Earle Loxton, about 'how much is enough when investing in cryptocurrencies?' If you are familiar with the Lou Bega's Mambo No 5 hit song, then you already know the answer to our question: Earle was quick to respond "just a little bit"

Click logo to view

DCX10 on EasyEquities

Perhaps a surprising response from a self-confessed Crypto Bull, but when you consider the portfolio impact just a little bit of crypto can have on your portfolio then perhaps that’s exactly right.

Earle is not alone in encouraging investors to “get off zero” and start investing in cryptocurrencies through the DCX10 and adds that Michael Jordaan, former FNB CEO and venture capitalist, has also been publicly quoted saying that “It would be wise for investors to allocate a small part of their portfolio (even if less than 1%) to cryptoassets.”

So what is the impact of just a little bit?

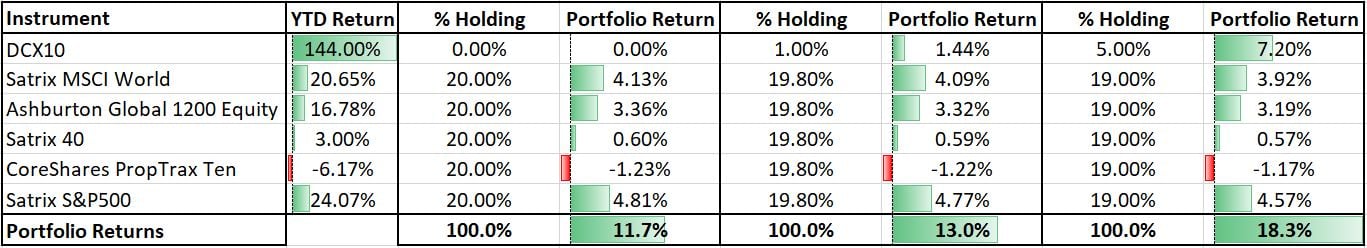

Well let’s look at the performance impact of adding just 1% and 5% of the DCX10 to an equally weighted portfolio of the top 5 ETFs held on the EasyEquities platform since January 2019.

From this illustration it is abundantly clear that a small amount of DCX10 in a portfolio can make an enormous difference in the outcome, with limited downside. We dropped the portfolio into Riskalyze, our multi-award winning partner risk assessment tool to see what the impact would be on this portfolios risk score. To understand more about this tool and what its about click here.

Here are the results of the Riskalyze Risk Score for Portfolio 1 (0% DCX10) vs Portfolio 3 (5% DCX10) highlighting again that the increase in potential returns may just be worth the small additional risk.

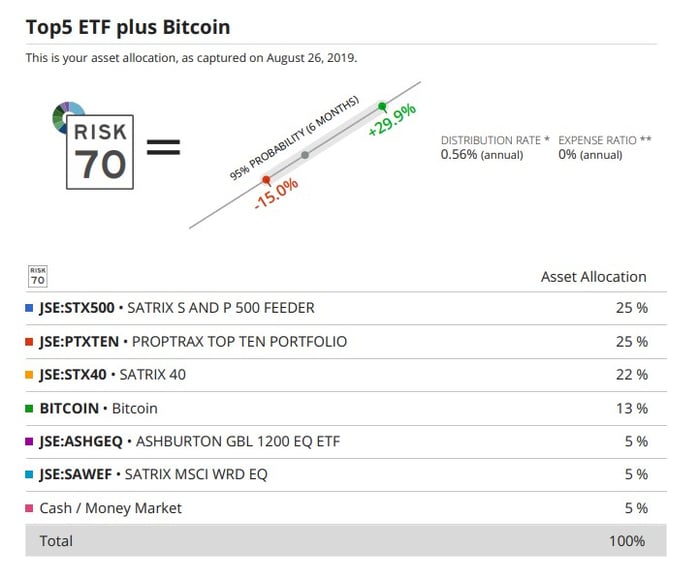

Finally we asked Riskalyze to optimise this Portfolio, on a risk return basis using 10 years of historic return data, in this instance we substituted DCX10 for Bitcoin as we don’t have 10 years of data on DCX10, for a client with a risk score of 70 (this being the average risk score of all EasyEquities clients).

Buy DCX10

on EasyEquities

We placed one constraint on the portfolio optimisation tool, being that none of the included instruments must make up less than 5% of the portfolio in the outcome. You may find the results highlighted below, but click here for a detailed and insightful breakdown.

New to the crypto markets

and want to know more about the DCX 10 index?

Read: 5 reasons to consider adding DCX10 to your portfolio

Digital Token FAQs can be found here for even more information

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Earle Loxton, CEO of DCX Capital (Pty) Ltd as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.