FAANG stocks

Probably the most popular and important investing acronym to be aware of this century, the “FAANG” index has gripped the imagination of a generation. The FAANG stocks – Facebook, Amazon, Apple, Netflix and Google (holding company now being Alphabet Inc.).

These giants of the tech world have dominated money manager portfolios for some time now and as of March 2019 the total market capitalization of these 5 tech companies equalled $3.1 Trillion.

Whether you invest into each stock separately or as a group through an ETF the “five” as they are commonly known should be part of any value investor investors portfolio who is not risk averse without a doubt.

The term “FANG” was created and popularized by the one and only Jim Cramer from CNBC’s Mad Money in 2013. The original group did not include Apple Inc from the start and was only added later to the original group.

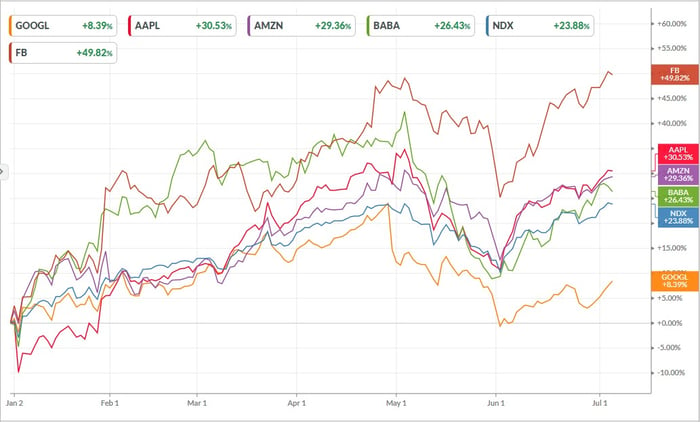

Since the original “FANG” we have seen Apple added as well as other notable tech companies like Alibaba (BABA), Baidu (BIDU), Nvidia (NVDA), Tesla (TSLA) and Twitter (TWTR) known as the NYSE FANG+ index.

Chart Life:

All these tech stocks trade on the NASDAQ, which measures over 3000 tech and growth stocks. The Nasdaq 100 (NDX) (Blue line) below has been outperformed by some of the individual “FAANG” tech stocks YTD.

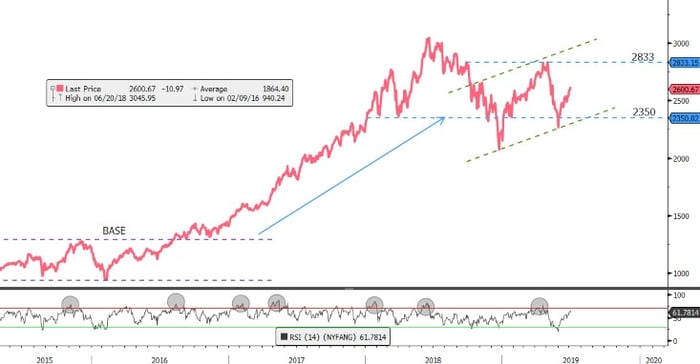

Looking closer at the NYSE FANG+ index below we might expect the price action to rise to the upper band of the channel (green dotted) until the Relative Strength Index (RSI) reaches overbought levels. Notable technical levels to watch on the FANG + would be the 2833 resistance and the 2350 technical support level.

These Technical levels coupled with Fundamentals will be watched closely as the earnings season approaches which is a huge contributing factor to each tech stocks outlook.

Click to invest:

Sources - PCR, Bloomberg, KOYFIN, Investopedia, and Wikipedia

Keen to add more US stocks on the EasyEquities platform?

Submit your share suggestion on this form.

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247.com, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.