Intellidex Reviews: RMB Top40 (Now Ashburton)

Research bought to you by intellidex

Researching Capital Markets &Financial Services

Website

Suitability: RMB Top40 is a solid ETF choice for investors seeking steady returns and decent income but who can tolerate the risk associated with equity investments. It has been one of the best-performing funds in its category and offers among the lowest fees. It tracks a diversified index and can be considered as a core investment for the long term.

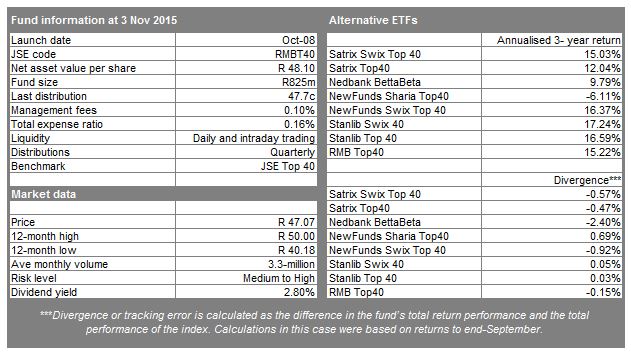

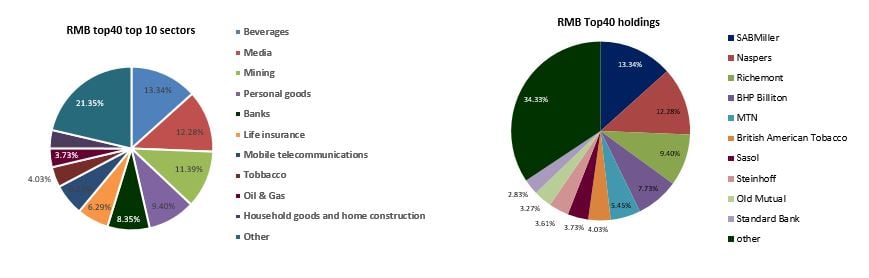

What it does: The fund tracks the JSE top 40 index, investing in the 40 largest listed companies. It weights its holdings by market capitalisation, so the bigger the company, the bigger percentage is invested in it. This means if Naspers accounts for 12% of the total market cap of the top 40 companies, then RMB Top40 will have 12% of the portfolio invested in Naspers. The Top 40 Index is weighted on quarterly basis which helps minimise trading expenses for the fund.

Advantages: The ETF offers easy access to the largest companies on the JSE through one investment. Many of the biggest companies on the JSE earn a significant portion of their earnings outside SA. The rand’s severe devaluation over the past few years, accelerating over the past few months, means foreign earnings are increased substantially when exchanged into rands.

Disadvantages: Market capitalisation weightings skew the portfolio towards the largest stocks, which might not necessarily be cheap ones. However, tracking the market-cap weighted top 40 index and rebalancing four times a year helps to ensure low turnover and reduce risk.

Top holdings: RMB Top40’s largest investments are in SABMiller, Naspers, Richemont and BHP Billiton. These are companies which have long track records and well-established businesses. They have highly cash-generative operations that support stable dividend policies that are linked to earnings performance.

Risk: This is a 100% investment in equities, which is a riskier asset class than bonds or cash. It is likely to be volatile, but the returns should compensate for volatility in the long run. We think the sectoral and geographical diversity of the constituent companies as well as the fact that they are blue chip counters with good track records does diminish the risks to a degree.

So if you are an investor seeking general market performance through a well-diversified equity portfolio at low cost with decent dividend payments, then the RMB Top40 ETF is likely to be suitable.

Fees: Fees take a total of 0.16% out of RMB Top40’s returns each year, a comparatively low cost. For every R1 000 invested in the fund, 160c goes to fees. This ETF offers the lowest fees in its category and also engages in securities lending. Securities lending is the practice of lending out of the fund’s underlying holdings in exchange for a fee. A large portion of the proceeds are passed on to investors, which partially offsets the fund’s expenses.

Historical performance

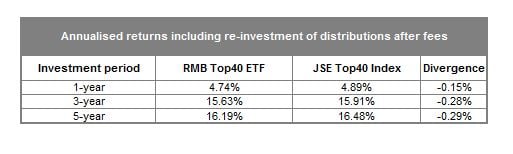

The RMB top40’s performance holds up well against its peers. Over the past five years the fund has an annualised return of 13.64% which ranks second after Stanlib Top 40, which returned 13.8% and is also a low-cost ETF. Based on results for a year to end- September, the fund’s returns trailed that of the JSE Top40 by 0.15%.

Fundamental View

Fundamental View

Generally there is a strong relationship between the performance of the economy and that of broad portfolios of equities. Presenting the mid-term budget recently, National Treasury forecast GDP growth of 1.5% this year and 1.7% next year. While those numbers are certainly worrying, constituents of the RMB Top40 generate more than half of their earnings from markets outside of SA. That makes the global outlook and the rand exchange rate important factors.

The fund is heavily invested in consumer goods, financials, basic materials and consumer services. These four sectors account for almost 90% of the fund. Two major macroeconomic issues now affecting the consumer goods and services sector are the exchange rate and global consumer spending. The companies in these sectors generate the bulk of their earnings from foreign markets.

Almost a quarter of the fund is invested in financial companies evenly spread between banks and non-banks. A large portion of earnings for these companies is generated within SA, which makes domestic factors more important. Uncertain and muted growth prospects pose a big threat to financials.

After a steep fall in commodity prices, the contribution of resource stocks to the fund has almost halved to about 15% since 2013. Unless there is significant movement in the fundamentals, particularly related to oversupply, this sector is likely to remain under pressure. This means the fund’s dividend yield might be affected as most of mining stocks were contributing considerably to the fund’s dividend.

The top 40 index offers a price:earnings multiple of 21 which is higher than its historical average. Given such valuations coupled with uncertain growth prospects, growth in the top 40 index is likely to be constrained in the short to medium term.

Alternatives

Stanlib Top 40 offers a good alternative to the RMB Top40. The ETF has been one of the best performing from a return point of view and with total fees of just 24 basis points it’s also the second-cheapest in its category. Over the past 12 months the fund outperformed its benchmark by 0.03%. It is slightly smaller than Satrix 40 and RMB Top40.

Satrix Swix Top 40 is another option. It is the oldest in this category and has assets under management of more than R7bn. However its fees are the highest in this category.

Other options are ETFs which track also track top 40 companies but apply different weighting methodologies. This obviously results in different weightings to those of RMB Top40.

The Nedbank BettaBeta Equally Weighted Top40 ETF tracks the JSE BettaBeta Equally Weighted Top40 Index. This ETF simply applies an equal weighting of 2.5% to each investment. The ETF is listed on the JSE and the Botswana Stock Exchange.

Other ETFs track the FTSE/JSE Shareholder Weighted Top 40 Total Return Index. In this category we have NewFunds Swix 40 and Stanlib Swix 40. These ETFs track the FTSE/JSE Swix Top 40 which adjusts the top 40 index to eliminate foreign holdings and cross-holdings of the constituent companies. This shareholder-adjusted ETF reduces volatility. What’s important to note though is that these two ETFs have performed relatively better than RMB Top40 and its peers. Stanlib Swix 40 outperformed its benchmark by 0.05% over the past 12 months. The Satrix Swix 40 has a five-year annualised return of 15.39% and the NewFunds Swix40 has a return of 16.37%. Fees for the two are also reasonably low.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.