Intellidex Reviews: db X-tracker MSCI World Index ETF (Now Sygnia)

Research bought to you by intellidex

Researching Capital Markets &Financial Services

Website

db X-tracker MSCI World Index EFT

Suitability: The db X-tracker MSCI World Index ETF (db X World) is an ideal choice for investors with a long-term (more than five years) investment horizon who can tolerate short-term volatility. It provides exposure to the performance of 23 developed markets (including the US, Europe, Japan, Australia and Canada). It therefore provides a hedge against rand weakness and a mechanism to diversify your portfolio exposure globally. It is the broadest international ETF available in SA and has lower costs than equivalent actively managed funds. Investing in this ETF does not affect any exchange control limits as it is rand settled. Allocating some of a portfolio to offshore exposures using an instrument like this is a good idea to achieve portfolio diversity.

What it does: The ETF tracks the price and yield performance of the MSCI world index by holding a portfolio of securities in the same proportion as the basket of securities that make up the index. Essentially, an investment in this ETF tracks the developed world’s equity markets. The index is a free float-adjusted market capitalisation index that is designed to mimic the equity performance of 23 developed markets, representing large- and mid-capitalisation companies with a total market capitalisation of $30-trillion. A free-float adjusted market capitalisation format is based on the market capitalisation of each company excluding locked-in shares such as those held by promoters, founders and governments. The weightings of each investment of the ETF are in proportion to the value of available shares for that company. The index is reviewed quarterly (in February, May, August and November) with the objective of reflecting change in the underlying equity markets in a timely manner, while limiting the costs incurred by index turnover. During the May and November reviews, the index is rebalanced.

Advantages: The ETF offers easy access to companies on various developed world stock exchanges through one investment at a low cost. Most companies are multinationals with business interests spanning various continents, generating earnings in multiple currencies. The rand’s severe depreciation means the foreign currency return component of this instrument has been substantial. Over the past five years, more than two thirds of total fund returns have been due to foreign exchange gains.

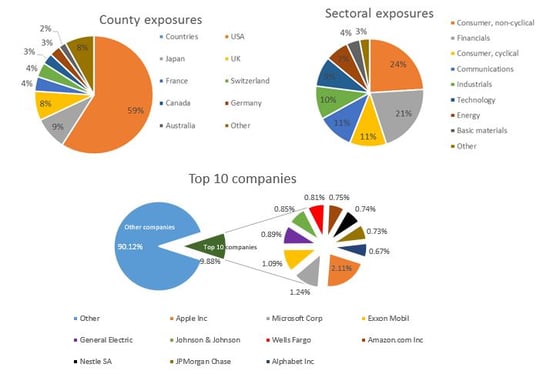

Disadvantages: The ETF has a disproportionate exposure to the US market, with 59% invested in US-domiciled companies. Therefore, US macroeconomic developments have a pronounced effect on the fund’s performance. However, it is well diversified at individual asset holdings level, with its biggest investment in Apple constituting only 2.1% of the fund, which mitigates the risk.

Top holdings: The top-10 holdings constitute just less than 10% of the overall portfolio, reflecting the high level of diversification. Apart from Apple, notable holdings are Microsoft, Exxon Mobil, General Electric, Johnson & Johnson, Wells Fargo, Amazon, Nestle, JPMorgan Chase and Alphabet (Google’s holding company). All these companies are global leaders in their respective industries with long track records. They have significant monopoly power and are highly profitable cash generators.

Risk: This is a 100% investment in equities, which is a riskier asset class than bonds or cash. It is likely to be volatile, but the returns over time should compensate for volatility. We think the sectoral, geographical and currency diversity of the constituent companies diminishes the risks to a degree.

If you are an investor seeking rand-hedge developed market exposure through a well-diversified equity portfolio at low cost, then the db X World ETF is highly suitable.

|

Fund information at 16 Nov 2015 |

|

Alternative ETFs |

||||||||||||||||||||||||||

|

Launch date |

01-Apr-08 |

|

Annualised 3- year return |

|||||||||||||||||||||||||

|

JSE code |

DBXWD |

|

DBX Euro |

22.69% |

||||||||||||||||||||||||

|

Net asset value per share |

R23.87 |

|

DBX Japan |

30.55% |

||||||||||||||||||||||||

|

Fund size |

R3.29bn |

|

DBX USA |

32.94% |

||||||||||||||||||||||||

|

Last distribution |

17.07c |

|

DBX UK |

18.50% |

||||||||||||||||||||||||

|

Management fees p.a. |

0.68% |

|

|

|

||||||||||||||||||||||||

|

Total expense ratio p.a. |

0.68% |

|

Divergence*** |

|||||||||||||||||||||||||

|

Liquidity |

Daily and intraday trading |

|

DBX Euro |

0.00% |

||||||||||||||||||||||||

|

Distributions |

Bi-annual |

|

DBX Japan |

-0.01% |

||||||||||||||||||||||||

|

Benchmark |

MSCI world index |

|

DBX USA |

-0.12% |

||||||||||||||||||||||||

|

|

DBX UK |

-0.10% |

||||||||||||||||||||||||||

|

Market data |

|

|

|

|

||||||||||||||||||||||||

|

Price |

R 23.89 |

|

|

|

||||||||||||||||||||||||

|

12-month high |

R 24.80 |

|

|

|

||||||||||||||||||||||||

|

12-month low |

R 18.80 |

|

|

|

||||||||||||||||||||||||

|

Ave monthly volume |

7.85-million |

|

|

|

||||||||||||||||||||||||

|

Risk level |

Medium |

|

|

|

||||||||||||||||||||||||

|

Dividend yield |

1.06% |

|

|

|

||||||||||||||||||||||||

|

***Divergence or tracking error is calculated as the difference in the fund’s total return performance and the total performance of the index. Calculations are based on annualised 3-year returns to end-October. Fees Historical performance

Fundamental view Currently developed market equities are showing an average price:earnings ratio of between 17 and 21, depending on the jurisdiction. This is higher than the long-term average, suggesting that either prices will have to decline (and therefore so will the value of this ETF) or earnings will have to increase, in order for this key metric to revert to its long-term average. Earnings have been constrained by the weak global economy, but in the long run global growth will return providing a kicker to corporate earnings. This instrument provides an efficient mechanism to track this growth.

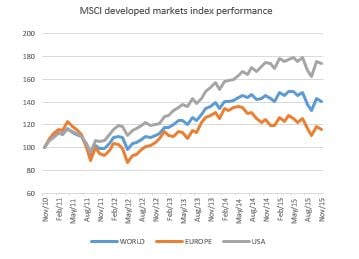

Alternatives Because there are no other ETFs which track the MSCI world index listed on the JSE, the next logical alternatives would be ETFs that track stocks listed on various developed markets. There are a number of developed market index trackers. Db X tracker USA tracks the US MSCI index of around 600 major US listed securities. We found that returns between db X World and db X USA were highly correlated over the past five years. Although db X World’s performance was slightly inferior, it has the lowest fee structure. The high correlation can be explained by the fact that db X World holds 59% of US stocks. Db X tracker Euro tracks the EuroStoxx 50 index, one of the most widely known European blue chip indices. The index contains the 50 most liquid blue chip stocks from countries within the eurozone. This ETF has interesting prospects now that the European Central Bank has rolled out its own quantitative easing programme. Other trackers are db X Japan and db X UK. The former tracks the MSCI Japan index of 400 major Japanese companies, while the latter tracks the FTSE 100 index of the 100 largest UK securities. However, these two are not highly correlated with db X World because they are more limited geographically and in asset holdings. All the alternatives have a similar fee structure of about 0.86%. Disclaimer Remuneration Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza. Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report. |

||||||||||||||||||||||||||||

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.