Intellidex Reviews: CoreShares PrefTrax ETF

Research bought to you by intellidex

Researching Capital Markets &Financial Services

Website

Suitability: The CoreShares PrefTrax is the only ETF on the JSE which offers investors exposure to the pool of publicly traded preference shares. A preference share is a class of ownership in a company that has a higher claim on assets and earnings than ordinary shares, but less of a claim than debt. They generally have a dividend that must be paid out before dividends to ordinary shareholders. Preference shares are regarded as hybrid instruments as they share similar characteristics with both debt and equity. In SA, a dividend withholding tax of 15% is paid on dividends earned from preference shares, giving them a tax advantage over bonds and money market instruments which are taxed at the marginal income tax rate of the taxpayer once the interest exemption of R23 800/year is used up. This tax advantage makes CoreShares PrefTrax shares appeal mainly to high net worth, income-focused investors. Share capital appreciation is limited, so when investing in this ETF your main aim should be to generate income over a long period.

What it does: CoreShares PrefTrax tracks the FTSE/JSE preference share index in the same weightings in which they are included in the index. The JSE preference share index measures performance of non-convertible, floating rate perpetual preference shares (these are the most standard form of preference share which cannot be converted to ordinary equity, or recalled by the company).

Advantages: The main attraction of preference shares as an asset class is their attractive after-tax yield. Historically SA preference shares have outperformed bonds and money market instruments on an after-tax yield basis. Another benefit of this ETF is that if there is no willing buyer when you want to dispose your units, Grindrod, the ETF issuer, will step in as the counterparty.

Disadvantages: One of the main criticisms that has been levelled against preference shares following the collapse of African Bank is that holders have all the downside risk of equity but limited upside benefits. Preference shares are ranked below debt on the risk hierarchy of a company’s balance sheet. In the event that a company is wound up, first in line are holders of senior debt, followed by senior unsecured debt and subordinated debt. However, pref shareholders do rank above ordinary shareholders. Following protracted negotiations, holders of African Bank’s preference shares will be getting around a third of their money back. African Bank, however, formed a very small component of the overall pref share index.

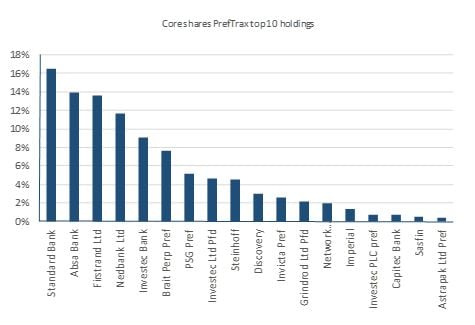

Top holdings: Close to two thirds of the fund’s assets are invested in preference shares issued by banks. Standard Bank tops the list with 17%, followed by Absa, FirstRand and Nedbank which all contribute at least 10% each. Investments in preference shares issued by non-financial counters account for less than 5% of the portfolio.

Risk: As with all investments, there are certain risks to investing in CoreShares PrefTrax. First is the index tracking risk – the ETF’s returns may not match the index returns. Second, while Grindrod stands ready to provide liquidity for investors willing to sell their units of this ETF, investors are still exposed to capital risk.

|

Fund information at 31 October 2015 |

|

Alternative ETFs |

||

|

Launch date |

26 March 2012 |

|

Annualised 3-year return to 30 Sept |

|

|

JSE code |

PREFTX |

|

NewFunds GOVI ETF |

4.87% |

|

Current net asset value per share |

R8.62c |

|

RMB Inflation-X ETF |

6.20% |

|

Fund size |

R271m |

|

NewFunds ILBI ETF |

6.40% |

|

Last 12-month distributions |

75.93c/unit |

|

|

|

|

Management fees p.a. |

Included in TER |

|

Tracking error |

|

|

Total expense ratio p.a. |

0.57% |

|

NewFunds GOVI ETF |

-0.21% |

|

Liquidity |

Daily and intraday trading |

|

RMB Inflation-X ETF |

-0.49% |

|

Distributions |

Quarterly |

|

NewFunds ILBI ETF |

-0.30% |

|

Benchmark |

Preference Shares Index |

|

|

|

|

Market data (14 January 2016) |

|

|

|

|

|

Price |

R 8.62 |

|

|

|

|

12-month high |

R 9.50 |

|

|

|

|

12-month low |

R 8.33 |

|

|

|

|

Ave monthly volume |

1.2-million |

|

|

|

|

Risk level |

Moderate |

|

|

|

|

***Tracking error is calculated as the difference in the fund’s total return performance and the total performance of the index. |

||||

Fees: NewFunds’ total expense ratio is 0.57%, which is within the range of other ETFs.

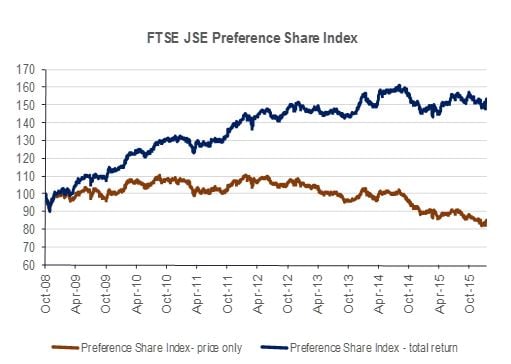

Historical performance: While the fund has been good at tracking its benchmark with a tracking error of 0.44%, poor performance by preference shares as an asset class over the past few years has weighed on the overall returns of this ETF. The fund recorded a loss of 0.6% since inception in March 2012. Historically, preference shares have appealed to tax-sensitive investors as dividends received were tax exempt until the introduction of the 15% withholding tax in 2013. That has dented their attractiveness but they still hold tax advantages.

Fundamental view: The past few years have been bumpy for most listed preference shares. The Preference Share Index took a harsh beating and is now sitting at a 15% discount to its 2008 levels. That said, throughout its history the index’s total return has largely been driven by dividends as opposed to capital appreciation. Which is why we think CoreShares PrefTrax ETF will appeal to long-term, income-focused investors.

The prospects of preference shares hinge to a great extent on how banks respond to the amendments to the Basel 3 regulatory framework. Under the new regulations, which SA started implementing in 2013, banks’ preference shares will not be regarded as core capital as was previously the case. Banks are therefore required to phase out preference shares as core capital at the rate of 10% per year. While banks have an option not to redeem their preference shares, the fact that these shares won’t count as core capital will make them more expensive for most banks to hold at current yields. We expect most players to eventually redeem them.

Capitec has so far taken the lead, redeeming more than 20% of its issued preference shares while Standard Bank, the largest issuer is seeking authority from shareholders. If other banks follow suit, we expect the preference share sector to be negatively affected, considering that more than half of all the preference shares on the market are issued by banks. Depending on the prices at which holders initially bought their shares, chances are that some might be redeemed at losses to holders. Redemptions will also affect the composition of the index tracked by this ETF. It should be noted however that due to the high discounts on preference share current prices, this ETF is offering an attractively high yield.

Alternatives: Investors do not have much options when it comes to ETFs which track preference shares. Some of the attributes of preference shares, however, can be found through bond ETFs. We list available bond ETFs below. The main weakness with the bond ETFs except the RMB Inflation-X ETF is that they are total return ETFs. This means as much as these funds receive periodic interest payments from their underlying investments, they do not distribute it to unit holders but issue more units.

The NewFunds Govi ETF tracks the performance of the SA government bond total return index (Govi). This index consists of bonds issued by the South African government, including only those issues in which National Treasury obliges the primary dealers to make a market. With a total expense ratio of 0.24%, this is the cheapest bond ETF on the market. The fund has done quite a good job of tracking its benchmark. Since inception it has trailed its benchmark by 0.25%.

NewFunds ILBI ETF, also issued by Absa Capital, tracks the Barclays Capital/Absa Capital south african government inflation-linked bond total return index of eight RSA inflation-linked bonds. All coupons received are automatically reinvested to provide a total return product. Inflation-linked bonds show an appreciation in capital value equal to the rise in the local inflation rate (CPI), and the interest rate (coupon) is also calculated on the inflation-linked value of the bond. Therefore, both capital and income are protected against inflation erosion. The product has an expected TER of 0,28% a year.

As the two Absa ETFs do not offer distributions, income-seeking investors might find RMB Inflation-X ETF attractive. It also provides investors with access to eight RSA inflation-linked bonds but makes quarterly distributions of interest payments to shareholders. The RMB Inflation-X ETFs offer a real yield of the current inflation rate plus 1,82%. The TER is 0,45% a year.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.