ETF Tuesday BGreen ETF

Suitability: The BGreen ETF is ideal for environmentally conscious investors with a long-term investment horizon – which gives the portfolio enough time to weather short-term volatility that can be expected in the case of equity investments. This is one of few funds listed on the JSE with a moral/ethical dimension to its investment strategy. It focuses on the environment, informed by the Carbon Disclosure Project (CDP) and the UN register of clean development mechanism (CDM) databases. The fund invests in environmentally friendly companies among the 100 largest companies on the JSE across sectors, thus ensuring diversification. This means it can serve as a good core equity investment for the long term. With much focus on the environment and other non-financial aspects of companies being lobbied by various pressure groups, it is possible that in the long run businesses that abide by these standards will outperform. However, the performance of the fund has been disappointing compared with to the general top 100 JSE-listed companies’ performance.

What it does: The BGreen ETF tracks the Nedbank Green index (NGRN), calculated independently by financial consultants Riscura, in both price and income performance. It is important for investors to note that although the fund tracks this customised NGRN index, it actually benchmarks its performance against the all share index (Alsi). The NGRN index has been developed by Nedbank corporate and investment banking in line with its green principles and commitment to preserving the environment, and in response to increased demand from environmentally conscious investors. The index consists of a selection of stocks from the top 100 largest South African companies listed on the JSE. Constituents are selected and weighted based on both environmental and liquidity criteria. Environmental credentials are assessed with reference to the CDP and CDM project databases, as supported by the UN. The index is rebalanced in line with the quarterly review of the FTSE/JSE Africa index series. Constituent selection of the ETF is reviewed regularly as the CDM and CDP update their databases.

Nedbank relies primarily on the CDP ratings for both disclosure and performance to assess credentials of constituents. The fund uses an even-weighting methodology, such that the companies with the highest weightings seldom make up more than 5% of the fund. This mitigates concentration risk when compared with the fund’s benchmark indices.

Advantages

Easy access to some of the largest environmentally conscious companies on the JSE through one investment at a lower cost than acquiring them individually.

Even weighting of individual constituents reduces concentration risk.

In the long run it will theoretically outperform other major asset classes such as bonds and cash, albeit at elevated volatility.

Disadvantages

Its benchmark, the all share index, is constructed quite differently from the fund, which inherently increases the tracking error.

ETFs are passive instruments and do not make active bets, which is a concern in periods of poor economic activity, given that broadly, equity returns are linked to economic activity.

Top holdings: The top 10 holdings constitute 34.2% of the overall portfolio.

Risk: This is a 100% investment in equities, which is a riskier asset class than bonds or cash. It is volatile, but the returns over time should compensate for the volatility.

Fees

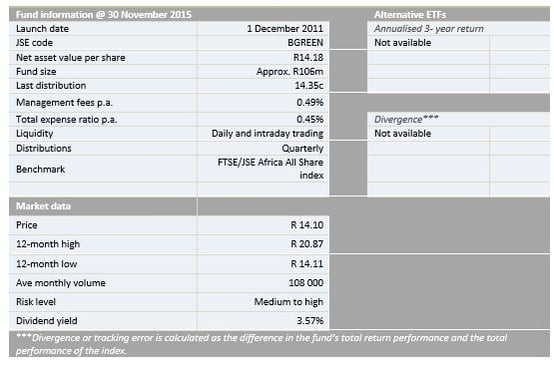

The total expense ratio is 0.45%. Additional costs associated with trading the ETF include bid-ask spreads and brokerage fees.

Historical performance

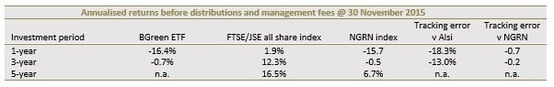

The performance depends on the method used to invest. A lump-sum investment mimics the ETF performance. However, investing through regular instalments usually lags the performance of the ETF, according to historical evidence, and the pattern is apparent in other ETFs too. This phenomenon conforms with the notion of investing for the long term when it comes to equities. The performance described in the table below is for a lump-sum investment.

The fund has generated an annualised return of -0.7% over the past three years. The tracking error against the NGRN index is negligible whereas it has fared poorly against its official Alsi benchmark. The NGRN index is a more representative measure of fund performance as it has similar constituents to the fund. The fund has only 49 constituents compared with more than 300 companies for the Alsi.

Fundamental view

Although equities are mainly driven by general economic performance there are emerging trends that are becoming important in driving value. The world is placing more and more importance on global warming and its perceived effects, and this is likely to make adherence to green guidelines mandatory rather than optional. In December last year at the COP21 global climate conference, all countries for the first time entered into a binding agreement in principle to curb carbon emissions. And earlier last year the world’s largest sovereign fund, Norway’s $900bn Government Pension Fund, passed legislation to reduce its investment in coal, worth about $9bn of its portfolio.

SA’s economy is expected to perform poorly this year with the IMF projecting GDP growth 0.7%. The ETF under-represents constituents of the JSE top 100 companies that derive the bulk of their income from outside SA. This makes SA’s macro outlook important in driving fund value.

The fund is heavily exposed to financials, basic materials, consumer goods, consumer services and industrials, which take up more than 85% of the fund.

Muted growth prospects, rising interest rates and a potential ratings downgrade pose a big threat to financials. Consumer stocks are under pressure because of rising interest rates and administrative costs as well as the low-growth economy, while commodity prices are severely depressed due to a supply glut and waning demand. Any recovery of basic materials and commodity prices is dependent on the correction of supply and demand forces.

Alternatives

There are no other ETFs which follow the criteria of the BGreen ETF. However, the bulk of listed ETFs use the JSE’s top 100 companies as a universe for fund construction purposes. There are other funds constructed on moral/ethical lines such as the NewFunds Shari’ah Top 40 offered by Absa.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.