Dropbox Inc. (DBX)

Hosting has taken on a whole new meaning since this cloud-based storage company arrived on the scene, and the famous Dropbox needs no introduction.

Click logo to view Dropbox Inc (DBX) Shares.

on EasyEquities

Fundamentals

Dropbox Inc is set to release earnings this week after the U.S market close on Thursday the 20th of February 2020. Revenue is widely expected to increase year-over-year when the earnings for the quarter ended in December 2019 are released.

Some analysts expect the quarterly earnings from the year-ago quarter to increase by $0.14 per share and revenue to come in at $443.17 million.

Dropbox Inc (DBX) share overview:

- Sector: Information Technology

- Market Cap of $ 7.7 Billion

- Dividend Yield: 0%

- Price/Book: 10.09

- PEG: 1.47

- Shares outstanding: 415 million

- 52 Week Range low of $16.75 and $26.13 per share high.

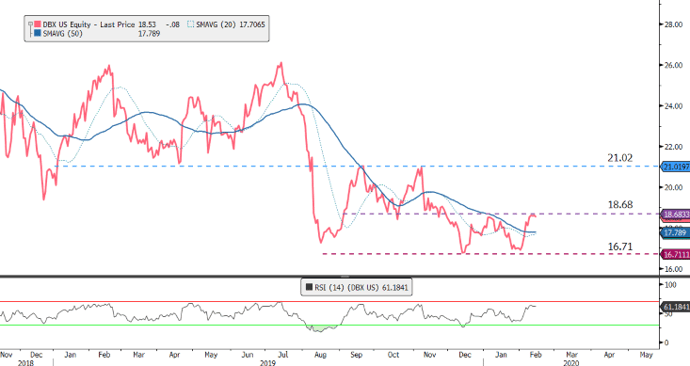

The stock has been in a downtrend since Q2 earnings in August missed expectations. Although the Q3 year over year revenue increased, the share price continued lower, and the share is now trading below its March 2018 IPO price of $21 per share.

Dropbox might also not be without some headwinds soon with talent leaving the organization, and competitor offerings poised to increase this earrings report will be closely watched.

Click logo to view Dropbox Inc (DBX) Shares.

on EasyEquities

Chart Life

The price action on Dropbox has been in a steady downtrend and seems to be entering a side-ways consolidation phase. We need to see a breakout of this side-ways price action above the $21.00 per share level to negate the downtrend.

Source - Bloomberg

Informed decisions

For market participants not already invested in Dropbox, it might be an opportune moment to wait and see how the upcoming earnings report turns out before jumping on board.

Portfolio particulars

- Portfolio Neutral (Current)*

- Portfolio Buy opportunity: Neutral**

- WhatsTheBeef long term target price: Neutral.

Know your company: Dropbox Inc (DBX)

- Dropbox was founded in 2007 by MIT students Drew Houston and Arash Ferdowsi as a startup company.

- It has a five-star privacy rating from the Electronic Frontier Foundation and has been blocked in China since 2014.

- The total number Dropbox of users in 2018 was 600 million, with over 1.2 billion files uploaded daily.

Dropbox Inc (DBX) Shares.

Sources - ZacksResearch, Bloomberg, Investing.com, SeekingAlpha, Wikipedia, EasyResearch

*Portfolio Hold (Current) refers to investors who already hold the stock within their portfolio.

**Portfolio Buy opportunity refers to Technical level crossed which might imply that the markets behavior would support the outlook and Close above refers to a share price close above a Technical Resistance level.

Stock prices, data and chart was taken on 18/02/2020 before the U.S market open.

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247.com, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.The value of a financial product can go down, as well as up, due to changes in the value of the underlying investments. An investor may not recoup the full amount invested. Past performance is not necessarily an indication of future performance. These products are not guaranteed. Examples and/or graphs are for illustrative purposes only.