Capital Appreciation Limited (CTA)

Its small cap Wednesday and Fintech companies are all the rage and Capital Appreciation or simply known as Capprec is taking Fintech into the cloud(s).

Capprec is a leading financial technology (Fintech) company with a Payments division and a Services division.

The Payments division provides payment infrastructure and business-to-business (B2B) payment solutions to established, blue-chip clients.

Its Services division comprises Synthesis, a highly specialized software and systems developer, offering consulting, integration and technology-based product solutions. Synthesis is a leader in digital, crypto, RegTech and providing Amazon Web Services’ (AWS) cloud platforms and infrastructure.

Log in to view Capital Appreciation Limited (CTA) shares

on EasyEquities

Fundamentals

Capprec reported results for the six months ended 30 September 2020 on 2 December with revenue growth evident across all of the Group’s operating segments. During the interim period, Capprec increased its blue-chip client base across several lines of business, achieved robust growth in its payment terminal estate, and made strong progress in extending its payments segment into the Android space.

- Share code: CTA

- Market Cap: R1.4 billion.

- Dividend Yield: 4.95 %

- Price/Earnings: 9.07x

- Return on equity (excluding excess cash): 12.19%

- Return on assets: 23%

- Debt: None

- Cash: c.R500 million

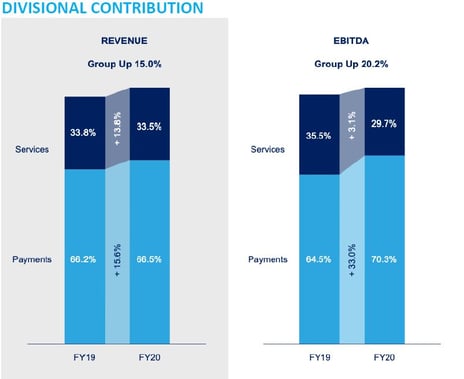

The escalating demand for Synthesis’ digital and cloud-based services generated rapid growth in consulting income and a strong pipeline of opportunities. Against the backdrop of a very challenging economy, Group revenue increased by 15% to R324 million and trading profit increased by 23% to R84 million. Headline earnings per share was up almost 30%.

Payments division

The Payments division provides end-to-end terminal estate management and payment services. Its customers include major banks in South Africa including, Absa, FNB, Nedbank and Standard Bank, as well as a range of other financial institutions, retailers and large corporate customers both in South Africa and elsewhere in Africa. The division grew revenue by 16% to R215 million and increased EBITDA by 33% to R67 million while profit after tax was up 54% to R47 million. Cash generation remained strong with almost all revenues being generated from blue-chip, well-capitalised clients.

Services division

Synthesis is a specialist Cloud provider, delivering high impact, AWS enabled solutions. The market for Cloud-based solutions is expected to deliver compound annual growth of more than 30% through 2023. Its other areas of expertise include artificial intelligence, machine learning which are delivered through an “intelligent data” offering as well as crypto and payment technology. Like the Payments division, clients are established banks and financial institutions, prominent insurers and retailers, and other enterprises in the telecommunications and healthcare sectors. Synthesis increased revenue by 14% to R108 million, with services and consultancy fees increasing by more than 20%, due to the increased demand for Cloud and digital projects. EBITDA increased to R28.0 million and profit after tax to R18 million. The Company continued to make good progress in diversifying its revenue base geographically, with projects in Mauritius, the East African islands and the Asia Pacific region.

Here are some excerpts from a Business Day article: Capital Appreciation gets boost from Covid-19 demand for digital services

“Fintech group Capital Appreciation (Capprec) said that while the Covid-19 pandemic has not left its clients unscathed, growing demand for digital and electronic services helped underpin a double-digit growth in revenue during its half year to end-September. The escalating demand for digital, cloud-based and data services benefited the group, Capprec said on Wednesday, adding it is also at an advantage that much of its revenue is generated from blue-chip, well-capitalised clients. Capprec’s business includes providing technology that banks and other financial services companies use to add more features to their digital platforms, such as integrating loyalty programmes and the sale of prepaid vouchers. Its blue-chip clients include the big four banks as well as Discovery Vitality, TymeBank and some asset managers.”

Want to learn more about Capital Appreciation Limited (CTA):

Watch: The Investment Case for Capital Appreciation

Log in to view Capital Appreciation Limited (CTA) shares

on EasyEquities

Outlook

With a consistent track-record of strong delivery, Capprec is well-positioned to benefit from the digital evolution and increased demand for cloud-based solutions. Moreover, its strong balance sheet allows it to fund organic growth while pursuing complementary acquisition opportunities. In addition, Capprec will consider the repurchase of shares further boosting shareholder returns.

New to investing

and want to learn more about Small-Cap Stocks?

Read: Afrimat, a sustainable investment opportunity

Sources: Decusatio, Capital Appreciation Limited Company reports, Moneyweb, Business Day

The contents of this blog post are for information purposes only and is not financial advice. The research provider doesn’t have any financial interest or relationship to us other than being a content provider. Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Decusatio as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.

.