Barrick Gold Corporation (GOLD)

Barrick is one of the Top 10 biggest gold producers in the world and its CEO, Mark Bristow is a South African, and a geologist if I may add.

The company merged with RandGold in 2018 and its share price has gone from around $10 in 2018 to $30 per share in 2020 and is currently trading at $22 per share. Most analyst recon a fair value is $30, with some even suggesting $40 per share.

Log in to view Barrick Gold Corporation (GOLD) shares

on EasyEquities

The following three factors make me feel bullish about the company.

1) Net debt down from $11.85 billion in 2012 to $0.42 billion in 2020. 2) Their all-in sustaining cost (AISC) is in the lowest quartile of the industry cost curve, at less than a $1000 per ounce (oz). 3) What really sweetens the deal is the current gold price above $1,788/oz.

Taking the above 3 points into account you realize the company is now printing money. But wait, let’s do the math, a $788 profit per ounce multiplied by 5 million ounces (Moz) per annum adds up to a “tonne” of money ($3.94 billion). Full year results are expected to be released on 18 February 2020 and I will certainly keep an eye on this stock. The share price is not expected to stay this low for long, but some volatility can be expected depending on the gold price.

Fundamentals

- Market Cap: USD$ 39.94 billion

- 52 Week Range: Low of $12.65 and high of $31.22 per share

- Gold production: Estimated between 4.8 Moz and 5.2 Moz in 2020 compared to 5 Moz in in 2019

- Price/Earnings: 13.12x

- Cash on Hand: $4.7 billion in Q3 2020, compared to $2.2 billion in 2019

- Listing: NYSE & TSX

The great

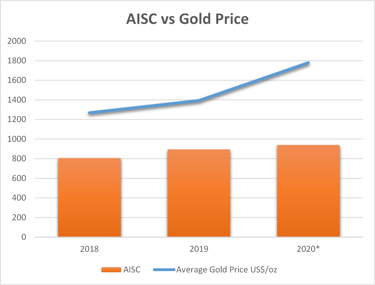

- AISC estimated to be at $940 for 2020*, compared to $894 in 2019 and $807 for 2018 (see Figure 1).

- Average gold price per ounce at $1779 in 2020*, $1393 in 2019, and $1268 in 2018.

Figure 1: All in sustaining cost vs Average gold price in US$/oz.

- The company is essentially printing money at a gold price above $1,500/oz and dizzying amounts of it at an average gold price of $1778/oz. The AISC margin in Q3 of 2020 was sitting at $839/oz.

- Net debt decreased to decade lows of $0.42 billion in Q3 of 2020, compared to $2.2 billion in 2019, and $4.17 billion in 2018. With no significant maturities until 2033.

- Free Cash Flow hit record highs in Q3 of 2020 with a total of $2.26 billion at the end of Q3, compared to the $1.132 billion in 2019 and the $0.365 billion in 2018.

The opportunity

- World gold supply is suggested to have peaked in 2019 with the total gold production declining by 1%.

- A gold price above $1,500/oz is expected for the foreseeable future as it is supported by the potential peak in production and no new major supply coming in.

- Barrick has 6 of the top 10 Tier One gold producing assets and two new Tier One potentials on the horizon (Barrick defines a Tier One gold asset with a life of mine of more than 10 years, at least 500,000 oz of gold, and cash costs per ounce over the life of mine in the lower half of the industry cost curve).

Log in to view Barrick Gold Corporation (GOLD) shares

on EasyEquities

Outlook

I am a shareholder of Barrick Gold. Volatility in the share price is linked to the gold price and it is currently trading at $22 dollars. It may even drop to $20 or $18 per share, but if the gold price stays above $1,500 per ounce, I will be looking at opportunities to increase my shareholding.

The good thing is that the gap between the AISC and gold price is very big and the company debt levels are at decade lows. A very useful comparison would be to compare Barrick Gold with the other Top 10 gold producers in the world. I think I will untangle this a bit further in another article next week. Other opportunities also exist for multi commodity mining companies, such as Sibanye-Stillwater.

New to investing

and want to learn more about Small Cap Stock?

Read: Renergen's Helium (He) is no laughing matter says EasyVestor

Sources:

1 https://www.barrick.com/English/investors/quarterly-reports/default.aspx 2https://seekingalpha.com/article/4401162-barrick-gold-shares-wont-stay-down-for-long 3https://www.forbes.com/sites/greatspeculations/2018/09/27/barrick-gold-randgold-merger-a-new-gold-mammoth-in-the-making/?sh=302b36e8211e

4 Estimated realized gold price for 2020, full results expected on 18 February 2021.

Take note that all stock data was taken on 8 February 2021.

Innes Buurman

EasyVestor, Project Geologist

The contents of this blog post are for information purposes only. This is the genuine opinion and actual experience of the user sharing their story and is not financial advice. The user doesn’t have any financial interest or relationship to us other than being a client. Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Innes Buurman a Project Geologist with experience in hard rock geology, over a range of commodities including Ni-Cu-PGE, Au, Zn-Pb, Coal, and CBM as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.

.