Pharmaceuticals

Take a listen to Mark's thoughts here.

Ascendis

Share price: R28,66

Net shares in issue: 432,2 million

Market cap: R12,4 billion

Exit PE ratio 23,7x; forward PE 21,5x

Dividend yield 0,8%

Fair value: R26

Target price: R30

Trading Buy and Portfolio Buy

Key takeaway:

Ascendis reports annual results on Wednesday. This is a company I know quite well as I was engaged in late 2013 to undertake the pre-listing assessment and valuation. Much has changed since listing on 22 November 2013.

There’s been a flurry of corporate activity and capital raising, including a recent rights offer to raise R1,2 billion and issue of shares to vendors. The result is shares in issue are now 432 million compared to 229 million at listing. Weighted shares in issue will be about 280 million for 2016 compared with 261 million in 2015, which in turn compared with 212 million in 2014.

EPS of 118 cents is expected, up over 20%, whilst earnings in rand should be up by 35% to R330 million. Normalised earnings were R153 million in F2014 so the business has more than doubled through a mix of organic and acquired growth.

Take note that the geographic mix is changing and thus a better forex match when it comes to hard currency denominated pharmaceutical ingredients relative to soft currency sales in rand. It is feasible for Ascendis to have 30% of sales external to South Africa in the foreseeable future.

The mix of business includes health and personal care products sold to via retail channels, prescription and OTC pharmaceuticals sold through dispensaries, doctors, wholesalers, pharmaceutical retailers, medical devices sold to private and government hospitals, and health and care products to the plant and animal markets.

Even allowing for the additional shares to service, my three-year forecast CAGR on EPS is 18%. The likelihood is that planned acquisitions and potential acquisitions, together with scope to improve trading margin, will boost this number.

Recommendation:

Pre-listing I priced Ascendis as a growth stock. At that time, in November 2013, the stock was listed at R11 but my fair value was R14 and the target price R16.

Of late, the stock has shot above my fair value of R26 and closed at just below R29 on Friday the 9th of September. Nevertheless, there will be some more rabbits to pull out the hat in future so a premium rating is likely to be maintained.

The dividend is small but the company is committed to paying regular dividends and with a cash conversion ratio of almost 100% Ascendis is very cash generative with ample scope to investment for growth.

Given the premium rating the dividend yield of 0,8% is minimal and similar to stablemate Aspen.

Stock isn’t easy to come by in size. The founders, Coast To Coast, retain 44% and there is a mix of other institutional holders.

Trading Buy and Portfolio Buy maintained. Fair value maintained at R26 with the target price R30.

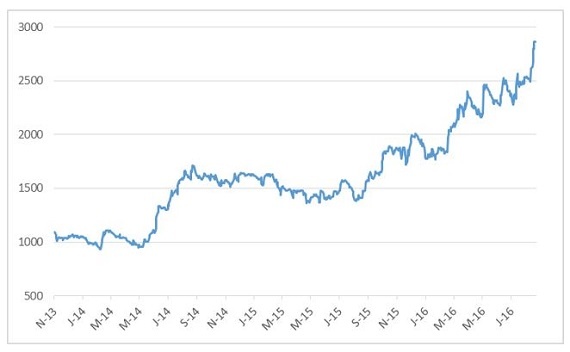

Share price of Ascendis since listing on 22 November 2013 in ZA cents