Despite the Coronavirus death toll and infection increasing; and this despite oil demand from China dropping by approximately 3 million barrels a day (20% of total consumption), I was pleasantly surprised to see markets rally this week, as the Chinese Central Bank boosted confidence by injecting 1.7 trillion Yuan into the economy using reverse repos. The Nasdaq hit a record high and the S&P 500 had its biggest one day gain in six months on Tuesday.

View #INVEST

Growth & Income Bundle

The Mining Indaba, held in Cape Town last week seemed to focus predominantly on the electricity shortage and the negative impact it would have on production. It seems a shame to be constraining output and the ability for local mines to take advantage of historically high metals prices.

Business Confidence index declined to 92.2 in January from 93.1 in December, the weakest January number since 1993.

And the Purchasing Managers’ Index, which gauges manufacturing activity, fell to 45.2 points in January from 47.1 in December, remaining below the 50-point mark separating contraction from expansion for a sixth straight month.

We saw a couple of local companies releasing results and trading updates this week:

Vodacom said on Tuesday that revenue in SA and their service sector saw an improved growth rate to 5.9% and 4.6% respectively, supported by increased demand for data. International operations delivered service revenue growth of 9% (7.1% normalised), with strong growth in data and M-Pesa mobile money revenues. The company also said that it had revised roaming agreements with Rain for 4G/LTE coverage which will further expand their 4G capacity in an environment where delays in assigning available spectrum will constrain capacity.

Imperial Brands was down 7% after releasing a profit warning saying that first half Earning per Share (EPS) would be down 10% in constant currency and full year revenues are expected to be "significantly lower" than last year (vs. expected positive low single digit growth previously. Imperial traded at a relatively cheap 7.1x ’20e PE ratio, but we’re still happy to remain underweight.

View #INVEST

Conservative Income Bundle

Sappi 1Q20 EPS came in at 6cps, (below consensus of 8cps)

- Sappi's coated paper business performed well, gaining market share during the quarter which helped to reduce market-related downtime.

- Investors are still expecting losses in 2Q and 3Q

Implats has released a trading statement for the six months ended 31 December 2019, saying that they are expecting to see a gross profit increase of more than 90% to approximately R6bn, while 1H20 earnings look very light vs. 1H20 sell-side expectations (disappointing by 15-20%) despite the strong PGM prices.

Until there is a meaningful change in the PGM basket price at spot (or in IMP’s operational performance), we continue to estimate meaningful upside to earnings (and thus the share)

and would view last week’s weakness as a buying opportunity.

View #INVEST

Aggressive Growth Bundle

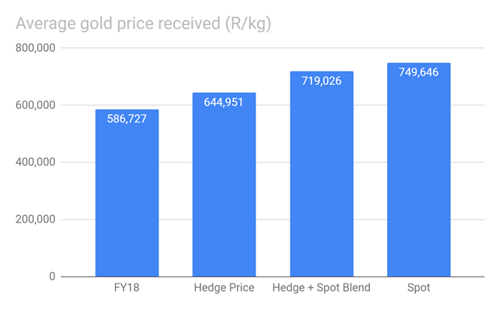

Harmony Gold released a trading statement for the six months ended 31 December 2019.

The company has hedged 29% of its FY20 production at a hedge price of R644,961/kg. The hedge looked good at the time it was announced last year but after gold’s run it’s set to be a drag on FY20 earnings.

Source: company reports

Source: company reports

We would be hesitant to invest in Harmony Gold given its poor track record of free cash flow generation.

View #INVEST

Growth Bundle

Across the pond, the U.S. added 225,000 jobs in January, up from December’s upwardly revised tally of 147,000, and well above with economists’ median forecast for a gain of 160,000. Unemployment ticked up slightly to 3.6% from the 3.5% 50 yr low.

Tesla had a volatile week as the stock surged 20% on Monday, its largest one-day gain since 2013, and then fell 17% on Thursday. Shares of Tesla have rallied by over 30% since the auto maker posted its second consecutive quarterly profit. The stock is up over 300% since early June.

Amazon finally joined the prestigious 13-digit club of Apple, Microsoft and Alphabet, after it closed with a valuation above $1 trillion for the first time, after hitting $1trn during intra-day trading but failing to close above $1trn on two previous occasions.

Catch Anthea's weekly recap on CliffCentral!

Click the image below to listen to the podcast.

Anthea Gardner

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Anthea Gardner, founder of Cartesian Capital (Pty) Ltd as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information (i) contained within this research and (ii) received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.