Telkom SA SOC Limited (TKG)

Once upon a time in a South African town not that far away, the darling of telecommunications (when it was the single operator) is spending in a bid to try and keep its head above water.

Click logo to view Telkom SA SOC Limited Shares.

on EasyEquities

Fundamentals

With the recent news that Telkom was in takeover talks with the struggling mobile provider Cell C, Telkom’s cash flow, expenditure and high debt levels became a focal point once again.

The company’s recent interim results or the six months ended 30 September 2019 saw headline earnings fall by 44% but saw an almost 70% jump in EBITA. Telkom’s mobile division once doomed to fail, now the darling has posted revenue growth close to 57% in the six months to September 30th.

Telkom's spending in rolling out high-speed 4G networks depleted its free cash flow, pushed its net debt to EBITDA ratio beyond the previous estimates, and pulled profits down. The share price has been under immense pressure since the JSE SENS announcement on the 12th of November.

Telkom SA SOC Limited (TKG) share overview:

- Sector: Communications Services.

- Market Cap of R25.99 Billion

- Dividend Yield: 5.74%

- Shares outstanding: 496 million

- 52 Week Range low of 5210c and 5625c per share high.

Telkom did declare an interim dividend of 71.5 cents per share which is scheduled to go ex-dividend on the 27th of November 2019. Sipho Maseko, the Telkom CEO, did warn its investors that it's capital requirements were likely to impact its dividend policy.

Outlook

Things are not looking up for Telkom as its acquisition of Cell C fell through the mat as Cell C agreed to an extended its roaming deal with MTN. The roaming deal might be a game-changer for Cell C which can now manage its network requirements more cost-effectively. MTN will also benefit from the extended deal by earning more revenue from Cell C. Telkom share price might be under pressure for the foreseeable future until it can get its house in order.

Click logo to view Telkom SA SOC Limited Shares.

on EasyEquities

Chart Life

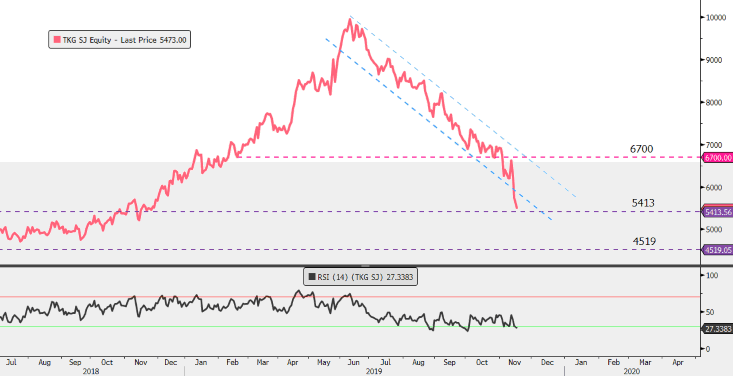

We can see that Telkom’s share price has been in free fall since the latter part of the year and might continue in a downtrend for some time If the 5413-support level does not hold. The price action needs to close above the 6700 resistance to negate the negative outlook at this time.

Source - Bloomberg

Portfolio particulars

- Portfolio Neutral (Current)*

- Portfolio Buy opportunity: close above 6700c per share**

- WhatsTheBeef long term target price: Neutral.

Know your company: Telkom SA SOC Limited (TKG)

- Telkom SA SOC Limited is a South African wireline and wireless telecommunications provider, operating in more than 38 countries across the African continent.

- The company was founded in 1991 in Johannesburg, South Africa.

- Telkom is a semi-privatised and 39% state-owned enterprise.

Source - Wikipedia, Telkom, BusinessDay, MoneyWeb, BusinessReport

*Portfolio Hold (Current) refers to investors who already hold the stock within their portfolio.

**Portfolio Buy opportunity refers to Technical level crossed which might imply that the markets behavior would support the outlook and Close above refers to a share price close above a Technical Resistance level.

Telkom SA SOC Limited Shares.

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247.com, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.