Not to be confused with a small “head dress” but you might have heard investors talk about investing into Small Caps or Small Cap stocks? The size of a company defined by market cap (capitalization) plays a big role when considering your next investment opportunity. The JSE has three main categories of stock categories namely Small, Medium and Large Cap stocks.

Market cap will define whether you are included in the illustrious JSE Top40, which every “big” company is gunning for or not. Being part of the Top40 stocks does not only mean you get noticed but you are now also included in the tracker funds (ETFs) as well.

But first, you must start somewhere and that is usually on the AltX equity exchange. This is where the smaller companies with values smaller than the top 100 listed companies list. The AltX is for small and medium-sized companies in South Africa and operates in parallel with the JSE and wholly owned by the JSE Securities Exchange.

Investing into small caps, good or bad idea?

When investing into any company you need to do your home work and investing into small caps is no different. Although the small cap universe only comprises around 4,5% of the JSE’s market capitalization it has outperformed the market and gained popularity. The Purple Group (PPE) is a great example of a small cap stock with great potential for growth in the future.

Click logo to view

Purple Group stock

One of the most watched and well-known indices in the world, the Russel 2000 measures the performance of around 2000 small cap companies in the United States. The reason the Index is watched so closely is that growth in the small cap sector is a leading indicator of economic growth.

You can even invest into these stocks with an ETF on EasyEquities called the iShares Core S&P Small-Cap ETF if you don’t want to put in the time going through all 2000 companies.

Click logo to view

iShares Core S&P Small-Cap ETF

Some of the pit falls might be that the companies have excellent growth potential but are less know than their Mid and Large Cap counterparts which attract all the investments. Hence Liquidity constraints on small cap stocks might be an issue which should be considered. Small cap stocks are also well known for their volatility which makes them an attractive prospect for investors over the short term as well as long term.

Noteworthy Small Cap stocks making waves

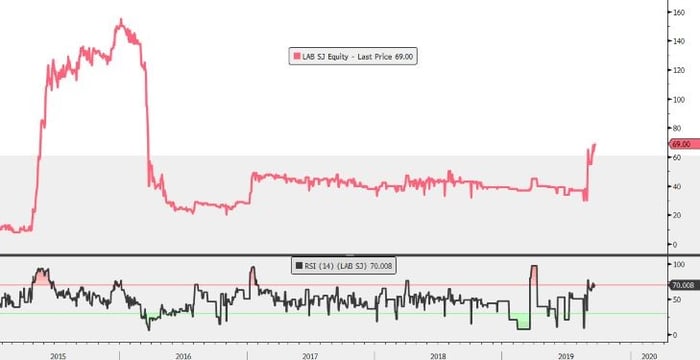

Labat Africa Limited (LAB) if alternatives are your thing then look no further than Labat Africa as the company is venturing into the cannabis market. The investment holding company also acquired a license to trade in Lesotho which was the first African country to decriminalize cannabis. Labat Cannabis is looking to capture the South African market while providing medical and wellness cannabis consumers with the best possible solutions.

The share is currently trading at R0.69 per share.*

source - Bloomberg

Purple Group Limited (PPE) is the ground breaking, record setting financial services group that pioneered the democratized share investing trend we see today. The flagship brand, EasyEquities is setting the pace of what the future of investing should look like in South Africa. EasyEquities was also recently crowned best Tax-Free Savings account for the fifth year running. With exciting future prospects, the company is definitely one to watch in this sector.

The share is currently trading at R0.30 per share.*

source - Bloomberg

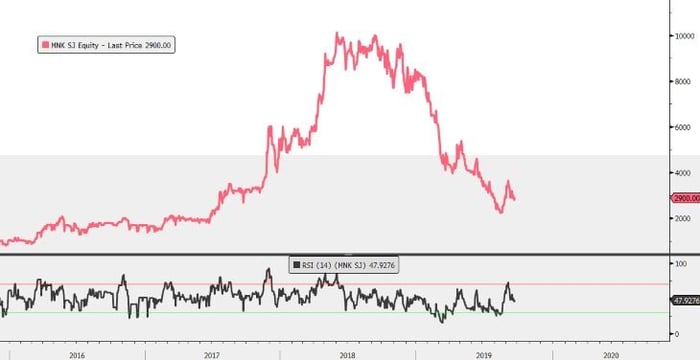

Montauk Holdings Limited (MNK) Renewable energy made waves last year as dwindling natural energy resources made the world “go green”. Montauk who operates large scale renewable energy projects utilising landfill methane in the USA saw its share price shoot the lights out on the JSE in 2018. The share price peaked at R98.99 but lost out significantly throughout 2019 with some saying its trading closer to fair value. Future operations include the building of multiple Renewable Natural Gas (RNG) facilities and the recent acquisition of Pico Energy.

The share is currently trading at R29.00 per share. *

source - Bloomberg

*Share prices were taken pre-market on 26/09/2019

Read more:

Understanding the JSE Top 40

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. First World Trader (Pty) Ltd t/a EasyEquities (“EasyEquities”) and GT247.com do not warrant the correctness, accuracy, timeliness, reliability or completeness of any information received from third party data providers. You must rely solely upon your own judgment in all aspects of your investment and/or trading decisions and all investments and/or trades are made at your own risk. EasyEquities and GT247.com (including any of their employees) will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.