ETF ANALYSIS

The five exchange-traded funds (ETFs) that Intellidex recommended in May as the best in their categories have performed well since then. Having reviewed the macroeconomic environment and developments in ETF offerings, we think they remain the best choice for investors aiming to build a diversified investment portfolio.

The low-growth macroeconomic environment has not changed since May and we believe our choices in each of the main asset classes, local and international equities, property, bonds and cash, will continue to provide solid returns.

The JSE’s all share index as well as the top 40 index of the 40 biggest companies have traded sideways over the past year, reflecting SA’s struggling economy. But there has been good news from the manufacturing sector, with production and export numbers on the bright side, indicating that with the rand ranging between R13.50 and R14.50 to the dollar, our exports are competitive.

That has partly contributed to relatively decent gains by industrial companies, with the industrial index having gained 14% this year. The financial index, however, has remained largely flat, while there has been a strong run by resources stocks off a very low base.

Going forward there isn’t too much to get excited about. As long as US interest rates remain unchanged at record lows there will be much market uncertainty. Globally, investors tend to switch to “risk on” mode when indications are a US rate hike will be delayed – which sends funds to SA and other emerging markets that offer better yields than developed markets – and “risk off” when it seems the US rate hike will happen.

The macroeconomic picture remains pretty bleak with little coming from the government or globally to stimulate growth. One real concern is that the ratings agencies could downgrade SA’s credit rating, a move that will increase the cost of debt raised by the government and large companies on international markets, making it more difficult to improve our economic growth rate.

Given that picture we remain satisfied that our ETF portfolio below will continue to offer solid returns in a low-growth environment.

Local equities

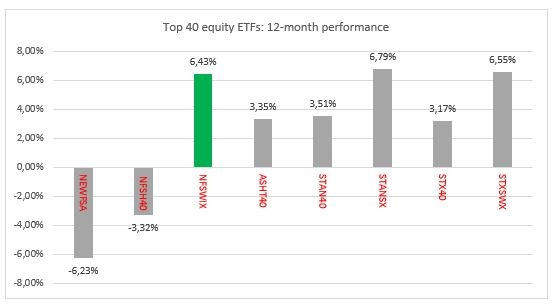

There are a range of funds which invest in local equities but we prefer those which track the performance of the top 40 index, which accounts for at least 80% of the JSE’s total market capitalisation. We have found them to have better diversification and they are also able to provide stable and superior returns in the long term.

Within this class we prefer the Swix-weighted funds because they don’t have much exposure to commodities. Despite their run this year, we’re not convinced global demand for resources is strong enough to pull up commodity prices. Our favourite is the NewFunds Swix 40 ETF which has the lowest expense ratio than its peers. The fund has been one of the best performers in its class of ETFs. Over the past 12 months it 6.4%, an improvement from our last review in May where its returned 4.2%. The returns are in line with inflation over the same period. However, the appeal of equity investments is in their potential for superior long-term, inflation-beating returns.

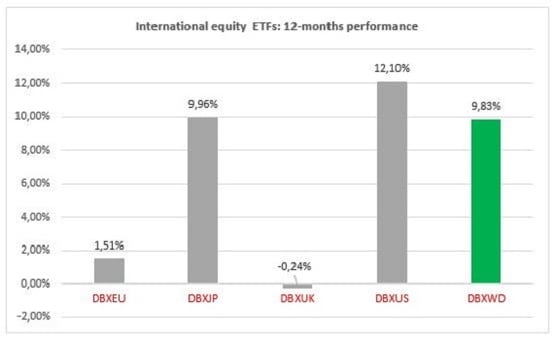

International equites

Dividend-focused ETFs

While we are not strong proponents of dividend-focused ETFs, of the two available we prefer the Satrix Divi. The ETF is forward-looking, based on projected dividends, as opposed to the CoreShares Dividend Aristocrats ETF which is based on historical performance that may not be repeated in future. The Satrix Divi returned 6.25% in the past 12 months, a decent recovery compared to May where its 12-month return was 0.8%.

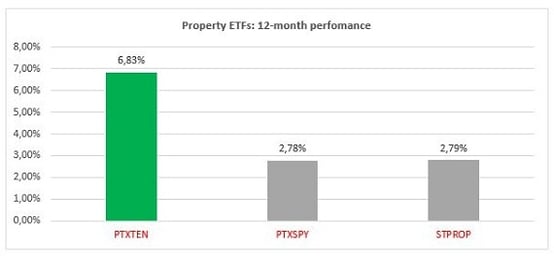

Property ETFs

Diversified funds.

Equities are regarded as the financial asset class that carries the most risk. They generally provide the best returns over time, which compensates for the high short-term risk, so they are more suited to longer-term investors.

One way to lessen that risk is to invest in funds that include other asset classes such as bonds and cash. Two good funds for this are the NewFunds MAPPS Protect ETF and the NewFunds MAPPS Growth ETF. The funds are designed to meet two different risk appetites: Protect is suitable for older savers nearing retirement and Growth is for younger savers with a longer time horizon. MAPPS Growth returned 7.20% (May: 4.05%) while MAPPs Protect had a return of 7.23% (4.38%) over the past 12 months.

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.