Suitability: Satrix Fini is one of two ETFs listed on the JSE that invests all its funds only in the financial services sector. We strongly believe sector specific funds such as this one are for experienced investors with a higher risk appetite, who might have a hunch about the direction of certain market sectors, or want to diversify into particular areas. If you are a less experienced investor with lower appetite for risk, it’s advisable to have a broadly diversified portfolio at the heart of your portfolio. In such a case, this ETF can be used as a building block to your core portfolio.

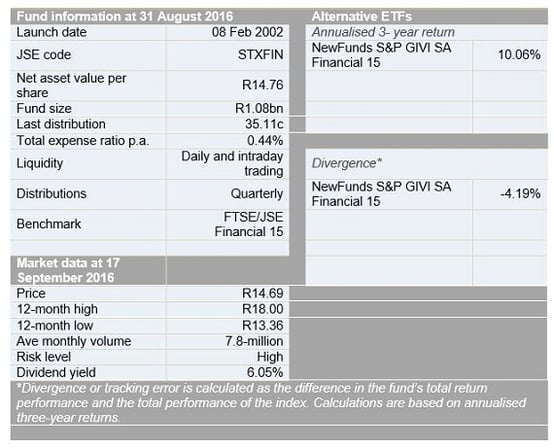

What it does: The mandate of the Satrix Fini ETF is to track the performance of the FTSE/JSE Financial 15 index (J212) fund, which is made up of the 15 largest financial stocks, ranked by market capitalisation.

Advantages: Investing in sector funds gives you an opportunity to profit from trends. If you choose correctly, and that sector subsequently enters a bull run, profits can be handsome.

Disadvantages: The fund is concentrated in one broad sector and all the companies are responsive to largely similar risk factors. It is important therefore that this ETF forms part of a portfolio’s wider equity holdings that also include other sectors such as industrials and resources.

Top holdings: The top 10 holdings constitute 89% of the overall portfolio, with 44% of the funds invested in banks and 30% in life insurance companies. The biggest stock, Old Mutual, accounts for 17% of the fund. It is worth noting that the top holdings are blue chips, which have performed relatively better in the past and have brighter prospects.

Risk: Satrix Fini is an aggressively managed, high-risk portfolio, which is designed to track a pure equity fund. It may therefore have some above average share price volatility in the short term, although higher returns may be expected in the long term.

Fees: The fund has a total expense ratio of 0.44%. This excludes brokerage and transactional costs.

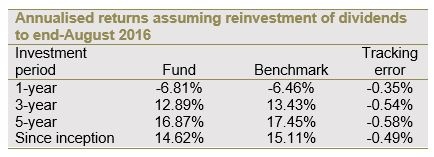

Historical performance: The fund’s performance depends on the method used to invest. A lump-sum investment closely mimics the fund’s performance. However, investing through regular instalments may lag the performance of the fund, according to historical evidence. This supports the need to invest for longer periods when it comes to equities. The performance described in the table below is for a lump-sum investment. The fund has generated an annualised return of 12.9% over the past three years.

Fundamental view

The fund stands to benefit in the short term from SA’s rising interest rates which boost the profitability of banks. However, prospects may be hurt in the medium term as consumers tend to borrow less in the higher interest rate environment and experience greater stress servicing existing debt. Also, financial companies tend to generate a large portion of their earnings in SA, and the local economy is in some distress with various institutions forecasting growth rates below 1%. Investors can take some comfort from the knowledge that SA’s financial sector is regarded as one of the soundest globally.

Alternatives:

Its closest peer is the NewFunds S&P GIVI SA Financial. The NewFunds S&P GIVI constructs its portfolio based on fundamental analysis. With a TER of 0.38% the fund is slightly cheaper than the Satrix Fini.

BACKGROUND: Exchange traded funds (ETFs)

Exchange Traded Funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, financial companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.