Real Estate Madness

Stock Picks

With April madness heading our way, here at EasyResearch, we are still crazy about property in 2022, and with these three real estate sector offerings, April should be no one’s fool!

3 Real Estate sector offerings on the radar:

EasyAUD

Charter Hall Group (CHC)

This Real Estate Group has stood the test of time, 30 years and counting to be exact, and is none other than the fully integrated property group, Charter Hall Group.

The company operates in four core sectors: office, retail, industrial & logistics, and social infrastructure. Some of the integrated property group's leading ASX real estate investment trusts (REITs) include the Charter Hall Social Infrastructure REIT (ASX: CQE), Charter Hall Long WALE REIT (ASX: CLW), and the Charter Hall Retail REIT (ASX: CQR).

Charter Hall grabbed our attention after releasing its earnings for the first half of the year 2022 (1HFY22), a record period for the company. The property group's profits nearly tripled as Revenue increased 127% from the year before the same period, Statutory profit after tax up 198% from the prior period, and Operating earnings also increased 104%.

“As of the end of the first half, Charter Hall boasted $79.5 billion of funds under management, with $61.3 billion of property funds under management. That represents $27.2 billion – or 52% – funds under management growth for the period”. - Brooke Cooper

- Share Price: AU$ 16.37

- Market Cap: AU$ 7.66 billion.

- P/E Ratio (TTM): 9.3x

- P/B Ratio: 3.3x

- Dividend (Annual Yield %): 2.46%

- Franking: 42%

- 52 Week range low of AU$ 12.01 and AU$ 22.18 share high.

Outlook – With Charter Hall’s 50% growth of its development pipeline over the last six months and its new partnership with Paradice Investment Management, growth and inflows should continue well beyond 2022.

The managing director and CEO, David Harrison, noted: “the current period has seen us experience strong inflows across our strategies, with $2.8 billion of gross equity allotted. We’ve also successfully deployed $5.4 billion in acquisitions across 18 funds and partnerships, a record 6-month period.”

Login to EasyWallets to view shares

on EasyEquities

EasyUSD

Annaly Capital Management Inc (NLY)

The diversified capital manager and mortgaged REIT, Annaly Capital Management, is watchlist ready and has been an ultra-high yield dividend stock pick for US investors for some time now.

The company engages in mortgage finance, corporate middle-market lending. It invests in agency mortgage-backed securities, mortgage servicing rights, Agency commercial mortgage-backed securities, non-Agency residential mortgage assets, residential mortgage loans, credit risk transfer securities, corporate debts, and other commercial real estate investments.

What are mortgaged REITs, you may ask? Let's take a step back; we know that Real Estate Investment Trusts (REITs) invest in properties (apartments, office buildings, complexes, malls, etc.). Mortgage REITs invest in debt (mortgages) of those assets via mortgage-backed securities, which the US Government guarantees.

Annaly Capital Management’s dull fourth quarter 2021 earnings were expected as a mortgage REIT operating model is very interest-rate sensitive, and current economic conditions are not helping. The Q4 earnings report showed a 20% year-over-year decline in net interest income, but its new mortgage servicing rights (MSR) platform grew by 12% in Q4 and over 350% in 2021.

- Share Price: $ 7.43

- Market Cap: $ 10.85 billion.

- P/E Ratio (TTM): 4.6x

- P/B Ratio: 0.9x

- Dividend (Annual Yield %): 12.13%

- 52 Week range low of $ 6.45 and $ 9.64 share high.

Outlook – Despite the interest rate challenges, the mortgaged REIT has placed measures to reduce the impact of higher interest rates. Annaly has been reducing its debt and borrowing as its CEO David Finkelstein said: "We have substantial liquidity with $9.3 billion of unencumbered assets, up to $500 million year over year" Annaly also is decreasing its portfolio of mortgage-backed securities (MBS) and increasing its investments in non-agency MBS, which pays higher interest rates.

Login to EasyWallets to view shares

on EasyEquities

EasyZAR

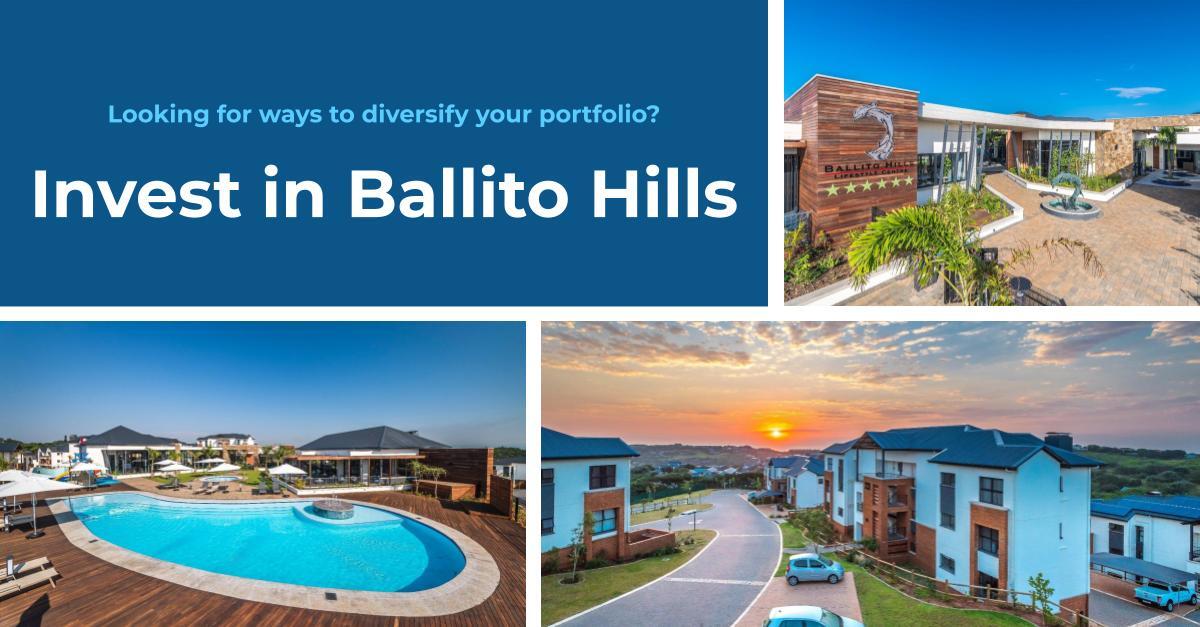

EasyProperties - Ballito Hills

Investing in Coastal living has never been this easy, and with the latest EasyProperties Initial Public Offering at Ballito Hills, it’s even more accessible. But hurry, the IPO is over 80% funded and closing at 22:00 SAST on the 31st of March 2022.

This classic Ballito lifestyle estate situated along the Dolphin Coast offers the best of coastal living- set in the picturesque town of Ballito, close to the beach and only 20 minutes from King Shaka International Airport. Besides having all the modern-day trimmings like a Cinema room, Gym, Swimming pools, Restaurant, Squash Courts, Games, and Kids playground, the investment case is also very intriguing.

Potential for Capital Appreciation

Ballito has been one of the top-performing areas in the country, with residential property prices growing over 5% per annum for 8 of the last 10 years (Propertyt24). Owners of residential real estate in Ballito have seen material increases in the value of their properties during this period.

- Ballito Hills

- Internal Rate of Return (IRR): 10%

- Est Net Rental Yield: 7.37%

- Market Valuation: R 23,662,700

- EasyProperties Discount: 4.71%

- Strong capital appreciation potential

Potential for Rental Income

In KZN, property ownership costs are high relative to some other parts of South Africa, which affects the net rental income earned on investment properties (Moneyweb).

In the case of Ballito Hills, EasyProperties has received an 18-month rental guarantee from the seller that guarantees investors a net rental yield of 7.37%. This is a solid rental yield for this location and provides steady income for the first two years of ownership.

EasyProperties places a high value on the certainty of this rental income, and it allows us to wait for the value of our property to increase comfortably. Ballito Hills is well-positioned in the hub of Ballito, close to most amenities but still enjoys a peaceful setting which results in the development being in high demand from a rental point of view.

Bonus Round: Property Guru insights

Here are six critical points on property trends from the EasyProperties man himself, Rupert Finnemore:

- Local trends seem to be that commercial vacancy rates are improving in the commercial office space as more people come back to the office. FNB 4th Quarter commercial property broker survey suggests that the rising vacancy rates have stalled.

- The latest Increase in the interest rate shouldn't affect the housing market too dramatically as this has been expected and mostly factored into the housing market.

- Number of role players in the commercial and industrial industry reporting on increasing interest in developing transport and distribution nodes supporting online retailers and the last-mile logistic requirements

- An interesting trend to watch is what's going to happen to all the vacant commercial space, particularly in major centers like Sandton (whose market has been particularly hard hit.) Not viable that all are converted to residential opportunities going to be some creative solutions being applied.

- The trend of the zoom boom continues as people continue to prefer finding a better work-life balance for themselves and their families. They are driving both the Cape and the KZN markets.

- Recent pay prop rental index describes how the Rental market is improving – increase in average rent increasing, vacancies down, and arrears improving. Arrears are now better than pre-pandemic levels.

Login to EasyWallets to view shares

on EasyEquities

Informed decisions

The global Real Estate sector has many investment opportunities for EasyVSTR to consider. A long-term view should be essential for buying assets, rental income, investing in Real Estate Investment Trusts (REITs), mortgaged REIT investments, or even our EasyProperties (EP) offering.

New to investing

and want to know more about our recent stock picks?

Read: The red-hot revival stock pick

Sources – EasyResearch, EasyProperties, Australian Securities Exchange (ASX), Australian Securities & Investments Commission (ASIC), Koyfin, Michael Yardney’s Property Update, Annaly Capital Management Inc, Sean Williams, Reuters, Dave Kovaleski, SeekingAlpha, Bloomberg, Rupert Finnemore

Follow Barry Dumas

@BEEF_FINMARKETS

Barry is a market analyst with GT247, with a wealth of experience in the investment markets. Now in his tenth year in the markets, Barry "The Beef" Dumas brings a combination of technical analysis and fundamental insights to the table.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.