Sygnia Itrix MSCI World Index ETF

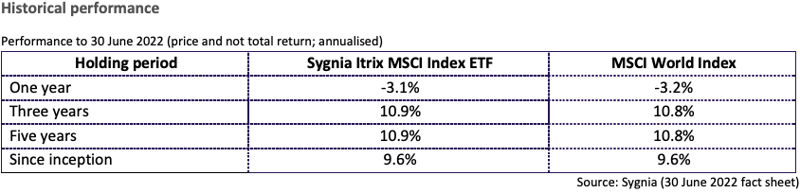

On a one-year basis, the ETF performed in line with the benchmark, both delivering approx.-3%. Exposure to the likes of Apple, Amazon and Microsoft resulted in this performance as these top holdings have trended downwards.

Within the telecoms space, European providers are set to win their decade-long fight to make Big Tech pay for network costs, following favourable outcomes from EU regulators and the bloc’s efforts to rein in US tech giants. This has been noted as the EU’s strongest move yet to set an international standard. Players such as Deutsche Telekom, Orange, Telefonica and Telecom Italia noted that this was all about a fair share contribution, given that the six largest content providers account for just over half of data internet traffic.

However, this notion has been rejected by the likes of Alphabet, Netflix, Meta, Amazon and other tech giants with some others dismissing it as an internet traffic tax while one company even called it a bid to appropriate money from one industry to support the old guard. According to Barclays, this EU legislation meant to recover costs could result in €3bn (about $2.93bn) annually for the telecoms industry.

The battle to get Big Tech to shoulder network costs is spreading from South Korea to the US. This follows the successful passing of landmark rules on privacy and other curbing of the power of US tech major companies and possibly resulting in the setting of global standards on network costs. Unsurprisingly, there’s been some pushback from the tech giants given the likely negative impact of such restrictions.

The investment objective of Sygnia Itrix MSCI World Index ETF is to track the MSCI World Index as closely as reasonably possible. This is a high risk, passively managed index tracking fund, with an objective to replicate the price and yield performance of the MSCI World Index as closely as possible by physically holding a portfolio of securities equivalent to the basket of securities comprising the index and in the same weightings of the index. With a calculated tracking error of 0.1%, the ETF is virtually in line with the benchmark, the MSCI World index.

Fund suitability

- The high-risk nature of the ETF inherently implies expected high returns over the long term. This is understandable given that the technology sector is a high growth area. Therefore, the ETF is suitable for investors with an affinity for the sector. However, it must be noted that in addition to competitive forces, legislation may restrict growth of the tech sector, which maybe considered an element of risk. Hence investors are urged to be cognisant of that.

Fees

- The fund has a total expense ratio of 0.69%.

Top Holdings

- Apple Inc and Microsoft are the top two holdings in the fund – and have been consistently for several years. A closer look at the fund reveals a significant sector weighting towards the IT sector with holdings of major global players such as Amazon, Tesla, Alphabet, Meta etc. Unsurprisingly, about 65% of the geographic weighting lies in the US.

Sygnia Itrix MSCI World Index ETF (JSE:SYGWD)

New to investing and want to learn more about other ETFs?

Read: Top Fund Picks for December

Compare ETFs on EasyETFs

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.