Know your ETF - Sygnia Itrix S&P 500 ETF

Sygnia Itrix S&P 500 ETF

Equity markets have had a challenging year so far, shaken by high inflation and the consequences of the Russia-Ukraine war, among other factors.

Towards the end of every year, top analysts from renowned investment banks and asset management firms release their expected annual return for the S&P 500 index for the following year. Very seldomly do they forecast negative returns for the index which tracks the performance of the 500 largest companies listed on stock exchanges in the US.

The current tough economic climate has forced analysts to slash their expected earnings growth for companies and the overall S&P 500 index. Goldman Sachs cut its 2022 estimate for the index to 3,500 points from a previous target of 4,300. The investment bank cited higher inflation as a major risk to its outlook. Inflation in the US reached a 40-year high of 9.1% in June before easing to 8.2% in September, while core inflation, which excludes volatile items such as food and energy, has risen steadily to 6.6% in September from 5.9% in June.

The elevated prices caught many central banks off guard, which necessitated aggressive interest rate hikes. Indeed, the US Federal Reserve increased the Fed funds rate by 75 basis points in September for the third consecutive time this year, bringing the benchmark interest rate to a target range of 3.0%-3.25%. The Fed signalled further interest rate increases until inflation is brought under control. The rate hiking cycle has prompted investors to turn to the dollar for safety, increasing its value. Generally, a stronger dollar means that imports are cheaper for US consumers, which leads to lower inflation. However, this does not seem to be the case.

What's worrying investors is that two of the last three tightening cycles have resulted in a recession. While the Fed is pointing to a strong labour market, most economists are forecasting that the higher rates will trigger a recession.

Other major economic institutions such as the IMF, OECD and World Bank are expecting slower global growth of around 2% due to higher inflation and interest rates.

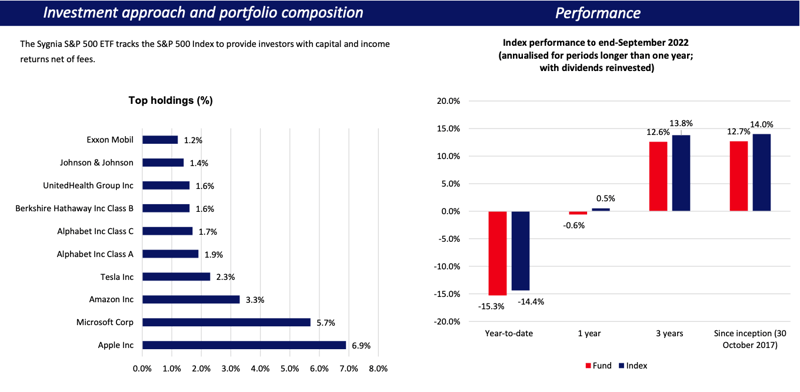

The S&P 500 is widely regarded as a good gauge for the performance of stock markets worldwide and the overall economy. Tesla, one of the largest companies in the index, posted Q3 revenue of $21.5bn, slightly lower than the expected $22.0bn. The company noted that its biggest risk remains the stronger dollar, which affects the affordability of its vehicles for customers outside the US. Other challenges mentioned by the company are higher input costs and supply chain disruptions.

The latter, induced by the pandemic, have exacerbated price pressures. By increasing interest rates, central banks are placing emphasis on the outcome, which is a result of factors outside their control.

Interest rates are expected to remain at elevated levels over the medium term to discourage consumers from borrowing to supplement their incomes. Monetary policy has been accommodative since the global financial crisis in 2007/08 as central banks increased money supply which resulted in a rally in stock markets globally. The sudden increase in rates is a headwind for equity valuations as it raises discount rates while reducing expected cashflows.

The S&P 500 is in bear market category as it is down by more than 20% year-to-date. Some of the largest companies in the index such as Microsoft and Apple have declined by more than 30%.

For the patient investor, the depressed prices might represent a good buying opportunity as inflation and interest rates will eventually moderate.

The ETF seeks to provide investors with low-cost exposure to companies listed on the S&P 500 index. It has a portfolio size of R2.9bn implying that it can withstand a protracted downturn. It has a tracking error of 0.05%, which signals that the fund is rebalanced frequently to match the index. The ETF also provides a rand hedge benefit as its returns are not only driven by the performance of the companies within the index but also the rand-dollar exchange rate.

Fund suitability

- This ETF is suitable for investors with a high risk appetite seeking offshore exposure to companies listed on the S&P 500 index.

Fees

- The fund has a total expense ratio of 0.20%.

Sector allocation– top 3 (%)

- Information Technology - 26.2%

- Healthcare - 15.1%

- Consumer Discretionary - 11.7%

Sygnia Itrix S&P 500 ETF (JSE:SYG500)

New to investing and want to learn more about other ETFs?

Read: Top Fund Picks for December

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.