1nvest TOP 40 ETF

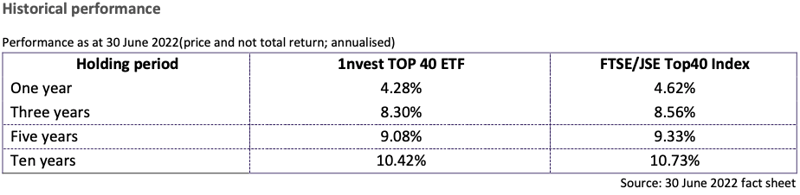

This ETF has delivered approximately 4.3% on a one-year basis, slightly below its benchmark, the FTSE/JSE Top40 Index, which delivered about 4.6%. The fund has seen pressure in companies such as MTN and Anglo American while Naspers, FirstRand and Standard Bank remained relatively flat, with British American Tobacco and Sasol having improved, all on a year-to-date basis.

Anglo American recently announced that it will form a new joint company with Electricite de France SA subsidiary EDF Renewables, Envusa Energy, to develop renewable energy in South Africa. The mining group indicated that as part of the agreement, Envusa will launch a mature pipeline of more than 600 megawatts of wind and solar projects in the country. This would be an initial phase toward developing an ecosystem expected to generate three to five gigawatts of renewable energy by 2030.The phase is expected to be fully funded (including debt financing) and ready for construction to begin in 2023.

Envusa is expected to supply Anglo American with a blend of renewable energy generated on Anglo’s sites and renewable energy transmitted through the national grid. As noted by Anglo American management, the energy transition should offer South Africa and the rest of the region an opportunity to build a clean and inclusive energy ecosystem that should create significant new economic opportunities. Furthermore, this roll-out is expected to produce clean energy for green hydrogen production, which will be utilised for Anglo American’s planned fleet of hydrogen-powered mine haul trucks, with the ultimate objective being to drastically reduce on-site diesel emissions.

The objective of the fund is to track the FTSE/JSE Top40 Index (Top40) as closely as possible. The fund invests in the constituents of the Top40 Index and aims to replicate the index by holding the same weightings of the constituents. The Top40 is an equity index of the 40 largest companies by market capitalisation, listed on the JSE. The fund is rebalanced quarterly and therefore has minimal trading costs. The fund may also hold a small portion in cash instruments and listed derivatives to effect efficient portfolio management.

Fund suitability

- This fund is suited to investors who seek the following: exposure to the South African equity market; a low-cost fund; a simple and transparent investment process that invests in liquid, listed securities; and exposure that blends well with other investment strategies to reduce total costs and diversify risk. However, investors should expect some volatility in the shorter term while taking a longer-term view on growth. Inflationary pressures in key markets such South Africa and the UK will certainly cause some volatility and economic uncertainty over the short to medium term.

Fees

- The fund has a total expense ratio of 0.29%.

Top holdings

- Richemont, Anglo American and Naspers are among the top two holdings in the fund. With regards to sector weighting, the fund has 31.28% in Basic Materials, 25.77% in Financials and 16.86% in Consumer Cyclicals. In terms of investment by country, the highest is South Africa with 58.3% followed by the UK at 17.94%.

1nvest TOP 40 ETF (JSE:ETFT40)

New to investing and want to learn more about other ETFs?

Read: Top Fund Picks for December

Compare ETFs on EasyETFs

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.