Know your ETF - 1nvest SA Bond ETF

1nvest SA Bond ETF

The turmoil in stock markets makes a strong case for government bonds to be considered in a portfolio. While Covid appears to be a thing of the past, the world now faces a new challenge – soaring prices.

Factors that spurred the inflationary pressures include global supply disruptions brought on by Covid, prolonged accommodative monetary policy and intensified fiscal stimulus during the pandemic. In addition, the war between Russia and Ukraine restricted energy and food supply, thus adding to fuel and food inflation.

Most central bank policy makers were caught off-guard by the magnitude of the spike in inflation. The South African Reserve Bank is an exception as it began its hiking cycle in November 2021. The endeavour to increase interest rates in a bid to bring inflation to a halt comes at a cost of lower valuations for stocks while impeding economic activity.

Low and stable inflation is beneficial for stock markets, governments, financial services providers and households. This is because most financial products are somewhat linked to inflation, thus providing certainty. Governments often borrow at the rate of inflation, which if elevated can open a door for ballooning debt.

Higher interest rates that accompany high inflation increase interest payments for indebted households and businesses, thus squeezing disposable incomes and net profits respectively.

The performance of government bonds is influenced by a multitude of factors such as economic growth, political stability, revenue base, current account balanceand the rating of the country’s debt by S&P Global and Moody’s ratings agencies. The agencies research the sovereign’s ability to repay debt.

SA was welcomed to the Citibank world government bond index in October 2012. The index tracks investment-grade bonds from over 20 countries. The entry criteria are that total outstanding amount of a country’s issues must be above $50bn, domestic long-term credit rating must be at least A- or A3 by S&P or Moody’s and there must be no barriers to entry. Inclusion in the FTSE index enhances the ability to raise funds at a lower costs.

Unfortunately for SA, we were removed from the index in April 2020. This was bad news because there are funds that are mandated to invest only on investment- grade debt securities.

Investors therefore need to be compensated by earning a higher risk premium for holding risky bonds. Essentially, SA’s removal from the index has elevated borrowing costs for the government.

The current account balance, which has a considerable weighting on a country’s credit rating, came in at a deficit of R87bn in Q2 - the first shortfall since 2020 - from a surplus of R157bn in Q1. Financial outflows in the form of dividends paid to offshore investors contributed significantly to the Q2 deficit.

Like many other countries, SA is grappling with a growth problem. GDP slid an annualised rate of 0.7% in Q2 owing to historic blackouts and floods in KwaZulu- Natal, among other things. Manufacturing accounted for the biggest share (-0.7%) in the GDP decline. The finance, real estate and businesses sectors added +0.6% in Q2. These figures are likely to hamper SA return to the world government bond index. Ratings agencies usually review ratings at least twice a year.

S&P Global has the country’s rating on sub-investment grade (BB-), which is three notches below investment grade and just one notch above speculative investment grade. The agency downgraded SA credit rating to sub- investment grade in end-November 2017. However, the agency changed its outlook on the country’s rating to positive from stable in July, citing that the favourable terms of trade in 2021 have improved the external and fiscal trajectory. Power outages will continue to hamper SA’s trajectory towards sustainable growth and productivity. The debt burden from most SOEs will weigh on the fiscus, thus rendering it harder for SA to make its way bank to the world government bond index.

This ETF will suit investors who have a low risk appetite and want to diversify their portfolio. It has a total expense ratio of 0.29% and a suggested minimum investment period of about 3 years.

Fund suitability

-

ETF suits investors with a low risk appetite and a long-term investment horizon. This allows for the short-term losses that may occur with bond investing.

Fees

- The fund has a total expense ratio of 0.29%.

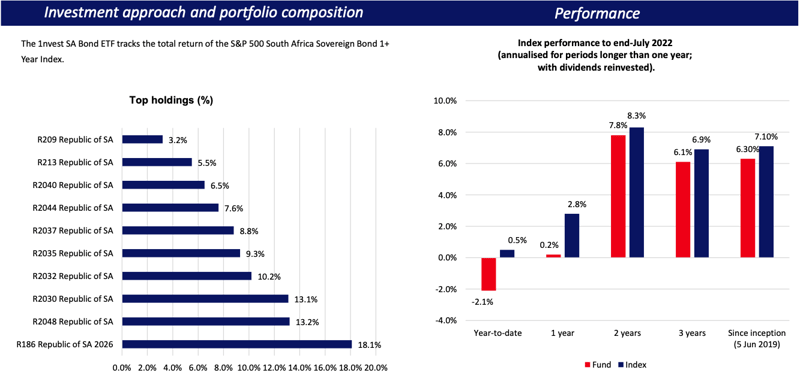

Top 3 Allocation - top 3

- Over 12 years - 51%

- 7-12 years 28.8%

- 3-7 years 18.1%

New to investing and want to learn more about other ETFs?

Read: Top Fund Picks for December

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.