Cloud Atlas AMI Big50 ex-SA ETF

Stock markets have been subdued throughout 2022, with most global indices breaching -20%, which is a bear market level. Inflationary pressures, fuelled by the Russia-Ukraine war, have been, among others, a cause for concern for central bank policymakers.

The inflationary pressures are external and supply-driven, and not within the control of central bank policymakers. For example, the war in Europe has restricted oil and gas supplies, leading to a sharp increase in petrol prices. Policymakers are aware of this, however they are raising interest rates in order to prevent secondary inflationary effects, a case where households borrow to catch up with price increases.

High interest rates are a challenge for indebted companies and households while impeding economic activity. This is because interest payments increase, squeezing disposable incomes and profit margins. Equity markets discount the future, and currently the future does not look bright. However, the current valuations may be attractive to risk- seeking investors.

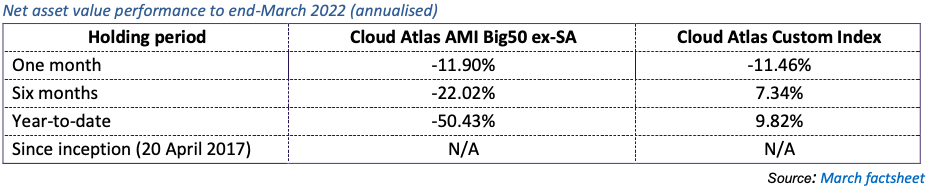

This is an extremely risky fund. It has returned -50.43% year-to-date, while the underlying index gained 9.82%. The fund’s losses are way more than what traditional stocks and other funds have lost in the year. It has a high total investment cost of 1.2%. It invests in other African countries that are very risky.

The ETF is structured to follow Cloud Atlas’s own custom index; however, the fund has not been successful in tracking the index, leading to a huge tracking error of 15.44%.

Fund suitability

- This ETF is ideal for investors seeking exposure to equities in other African markets.

Fees

- The fund has a total expense ratio of 1.2%.

Top holdings

- Cloud Atlas has created its own custom index, which invests in some of Africa’s prominent companies in the construction, industrials, real estate, food & beverage and energy sectors.

Cloud Atlas AMI Big50 ex-SA ETF (JSE:AMIB50)

New to investing and want to learn more about other ETFs?

Read: Top Fund Picks for December

Compare ETFs on EasyETFs

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.