Intellidex top ETF picks for Dec 2016

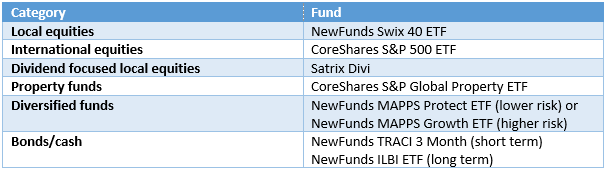

Each month Intellidex picks its preferred funds from each of six broad classes of investment strategies. Beginning last month, we expanded the selection to six from five. Our picks are based on the medium- to long-term outlook so changes only arise if there are fundamental shifts in our outlook, say, due political, economic, social, technological, environmental and legal factors. Not all categories are appropriate for all investors – it depends on your personal circumstances – but the funds we pick are what we think are the best available in each category.

This month we make a few changes due to the launch of two new funds offered by Grindrod, CoreShares S&P 500 ETF and CoreShares S&P Global Property ETF. These funds fit nicely in the existing broad classes of investment strategies that we consider.

In a positive light, SA has avoided a credit downgrade from the three global rating agencies. However, several challenges remain: meagre economic growth, budget deficit, trade deficit and an uncertain political environment.

On a global scale the geopolitical uncertainty we alluded to last month continues to take shape. In the US, president-elect Donald Trump’s proposed policies of massive fiscal expansion are likely to raise the inflation rate and economic growth which should be bullish for equities in the short- to medium-term. Subsequently, this is move is likely to see the economy overheating which should provoke interest rate hikes as government debt grows and to curb a higher inflation rate. Already the Fed has motivated for a possible rate hike before the end of this year.

Across the Atlantic, Europe has fallen deeper into uncertainty. Brexit set a precedent and now nationalism appears to be sweeping through Europe. More recently, Italians voted ‘no’ to proposed constitutional reforms, which is seen by some quarters as an anti-establishment vote and rejection by the electorate of further integration with Europe. The euro fell to a 19-year low against the dollar following the announcement of the results on 5 December. More uncertainty lies ahead as Germany, France and Netherlands all have important elections next year and it is clear that the outcomes might be antagonistic to the European Union project.

Our view on appropriate ETFs incorporates the highly volatile local and global environment we are operating in.

We explain why we like these funds below, but here are our top funds for December:

Local equities

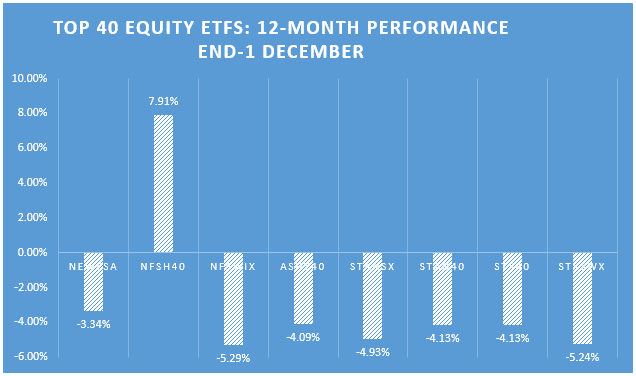

For local equities, we prefer funds that track the performance of the top 40 index, which accounts for at least 80% of the JSE’s total market capitalisation. We consider these to offer good diversification and still provide stable and superior returns over the long term.

Within this class, we prefer the Swix-weighted funds because they have a relatively lower exposure to commodities. Commodity prices recovered significantly during the year, in some cases climbing more than threefold. However, we don’t see a repeat of this performance in the short term because the commodities market remains weak.

We like any of the three Swix-weighted top 40 funds (Satrix Swix, NewFunds Swix 40 or Stanlib Swix) but our favourite is the NewFunds Swix 40 ETF because it has maintained the lowest expense ratio relative to peers. However, it has underperformed both its closest peers for the past year, registering a return of -5.29% (November: -5.19%), while the Stanlib Swix returned -4.93% (November: -4.39%) and the Satrix Swix -5.24% (November: -5.13%). All Swix-weighted funds performed better than non-Swix weighted top 40 funds. This performance is poor relative to other asset classes such as bonds and cash, but investors should note that equity investments are volatile and tend to outperform in the long run. Also, note that Sharia 40 fund’s performance anomaly is due to its overweight in basic materials and underweight in consumer services relative to other funds.

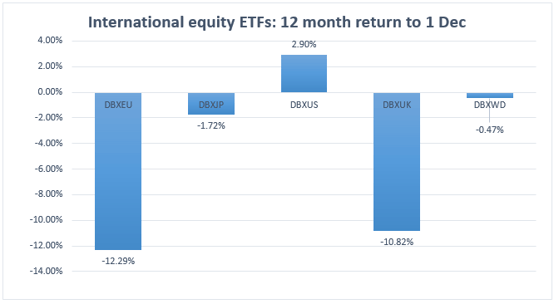

International equites

Geopolitical factors in the US and Europe remain. On one hand, there is rise of nationalism in Europe which was reflected in Britain’s vote to leave the European Union. On the other hand, the unexpected election of Donald Trump as the next US president has raised uncertainty in the global markets, but has been positive for the US market. Proposed policies by Donald Trump are likely to be bullish for the US market in the short- to medium-term. Developments in Europe have heighten uncertainty in that region and may evolve into an existential threat to the European Union. This is likely to see an increase in risk-off investment strategies which favour the strengthening of the US dollar. Given the difficult global environment and risks of seismic political shifts in the US, we think US assets will benefit disproportionately. The Japanese economy relies heavily on exports for growth so the DBx Japan ETF is likely to be hurt by weak global demand as well as the geopolitical issues mentioned above.

As such we maintain our positive view on taking a US exposure, but we change our preferred fund to the recently listed CoreShares S&P 500 ETF in place of the DBx USA fund. They both are 100% exposed to US equities – with different weighting methodologies – but the former has a lower expense ratio.

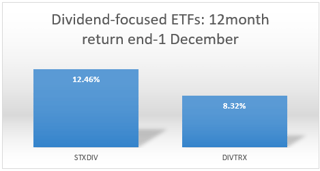

Dividend-focused ETFs

We believe returns should be considered on a total return basis rather than just looking at the income (dividend) return component. Whereas the Satrix Divi pools its assets from the top 40 index, the Coreshares Dividend Aristocrat ETF extends its pool to mid-caps.

We believe returns should be considered on a total return basis rather than just looking at the income (dividend) return component. Whereas the Satrix Divi pools its assets from the top 40 index, the Coreshares Dividend Aristocrat ETF extends its pool to mid-caps.

We prefer the Satrix Divi because it is forward-looking, based on projected dividends. Coincidentally, it has outperformed its peers over the past 12 months, returning 12.5% (November: 2.8%) compared with 8.32% (November: 4.4%) for the Coreshares ETF. A weakness with the CoreShares fund is that it is based on historical dividends that may not be repeated in future.

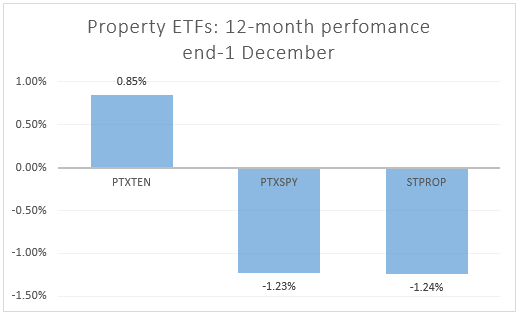

Property ETFs

Property has evolved as a distinct asset class with attractive diversification benefit when added to a diversified portfolio.

Grindrod recently launched a global property fund, CoreShares S&P Global Property ETF, to add on to the already three listed property funds. Previously we chose CoreShares PropTrax 10 because of its equally weighting index which reduces the idiosyncratic risk of individual companies. But the introduction CoreShares S&P Global Property ETF presents even more diversification benefits, including geography and currency, which makes it our pick this month in this category. It also de-emphasises the European exposure, embedded in PropTrax10, which had increased fund’s risk profile as the rise of nationalism in threatens the Eurozone establishment.

Grindrod recently launched a global property fund, CoreShares S&P Global Property ETF, to add on to the already three listed property funds. Previously we chose CoreShares PropTrax 10 because of its equally weighting index which reduces the idiosyncratic risk of individual companies. But the introduction CoreShares S&P Global Property ETF presents even more diversification benefits, including geography and currency, which makes it our pick this month in this category. It also de-emphasises the European exposure, embedded in PropTrax10, which had increased fund’s risk profile as the rise of nationalism in threatens the Eurozone establishment.

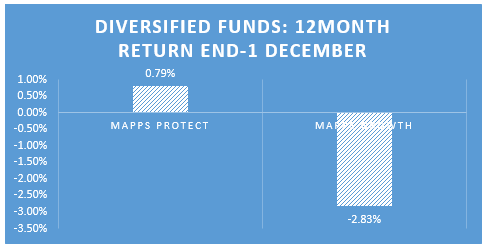

Diversified funds

Equities are regarded as the financial asset class that carries the most risk. They generally provide the best returns over time, which compensates for the high short-term risk, so they are more suited to longer-term investors.

One way to lessen that risk is to invest in funds that include other asset classes such as bonds and cash. Two good funds for this are the NewFunds MAPPS Protect ETF and the NewFunds MAPPS Growth ETF. The funds are designed to meet two different risk appetites: Protect is suitable for older savers nearing retirement and Growth is for younger savers with a longer time horizon. MAPPS Growth returned -2.83% (October: -2.51%) while MAPPs Protect had a return of 0.79% (October: 1.44%) over the past 12 months.

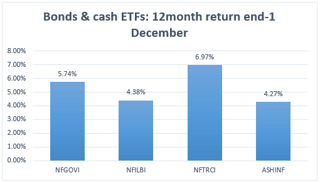

Bond and cash funds

Bonds and cash have distinct risk-return properties which, when combined with equity investments, produce better risk-adjusted returns.

There are four listed funds in this category:

(i) NewFunds GOVI ETF;

(ii) NewFunds ILBI ETF;

(iii) NewFunds TRACI 3 Month ETF;

(iv) Ashburton Government Inflation ETF.

They each track different things: (i) tracks government bonds; (ii) & (iv) tracks inflation-linked government bonds; and (iii) tracks short-term money market instruments.

If you are investing for a very short period, usually less than a year, then we prefer the NewFunds TRACI 3 Month as it is the least sensitive to sudden adverse interest rate movements. This is as close to a bank-like deposit as you can get.

For a longer investment horizon, particularly in emerging markets, various external and internal variables can drive the inflation level up. As such we choose an inflation-linked bond to cushion investors for unseen inflation pressures. Because the NewFunds ILBI ETF has a lower expense ratio, it is our choice here. It has also marginally outperformed its alternative, returning 4.38% (November: 6.01%) compared with 4.27% (November: 5.93%.)

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.