Performance review

It is a year since we last reviewed this ETF. And it has been a bad year for investors in it thanks to its exposure to the generally weak South African market. Markets are being weighed heavily by the volatile domestic political situation, concerns over the direction of governance and economic policy in general and the risk of a downgrade in South Africa’ credit rating.

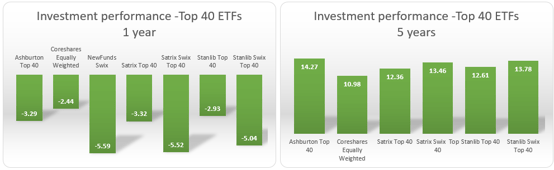

Ashburton Top 40 ETF lost 3.29%, while inflation averaged 6.6% over the period. This means if you had invested R1000 on 24 November last year, your investment would have been now worth R967. If you had, however, chosen to invest through equal monthly instalments, which is another available option for investing in ETFs, the loss would have been a bit worse at 4.26%. This is largely because of the lower dividends received had you made instalment investments.

This poor performance is, however, not peculiar to Ashburton Top 40, but all the ETFs which tracks the Top 40 Index. NewFunds Swix Top 40 lost 5.59% over that period followed by Satrix Swix Top 40 which shed 5.52%. But it is critical to see these returns in the long-term context. Over five years the returns from these ETFs look good. Ashburton Top 40 returned an average of 14.27% per year, which is highly competitive. This strengthens the view that ETFs should always be considered as long-term investments in which short term volatility is covered by long-run returns.

Outlook

While SA recently escaped a downgrade to junk by Fitch and Moody’s, the downgrade risk remains. Moody’s, the only one of the three main international rating agencies to rate SA two notches above junk‚ warned on Friday that political infighting‚ low growth and unemployment still pose the greatest risks to the South African economy.

While the tight fiscal policy adopted by National Treasury has sufficed to stave off any immediate negative action from the credit rating agencies, it remains to be seen whether a downgrade to junk can be entirely avoided in the long run. We fear that the Treasury’ s restrictive policies – curbing government expenditure and increasing taxes – in a bid to maintain fiscal discipline might actually stall growth and plunge the country into a recession. GDP growth is expected to come at 0.5% this year and rise to 2.2% by 2019. Those projections seem overly optimistic given the conditions on the ground – soft commodity prices, regulatory and policy uncertainty and continuing labour market volatility – are likely to see equity markets remain under pressure.

That said, the bulk of the top 40 companies have operations outside SA where growth prospects are looking better than SA. Macroeconomic issues such as the exchange rate and global consumer spending are more important. SA’s volatile political situation could also lead to rapid changes in sentiment should issues around president Jacob Zuma’s presidency be resolved.

Suitability

The Ashburton Top 40 ETF is ideal for investors with a medium- to long-term investment horizon. Equity investments tend to exhibit higher short-term volatility than other asset classes, so a longer investment horizon gives a portfolio time for returns to accumulate ahead of volatility.

Top holdings

The top-10 holdings constitute about 66% of the overall portfolio with a disproportionate overweight in Naspers (16.98%) and AB INBEV (13.67%).

Alternatives

Alternative funds are the Satrix Top 40 and Stanlib Top 40. But investors can also use CoreShares equally weighted, NewFunds Swix 40, Stanlib Swix 40 and Satrix Swix Top 40 to get exposure to SA’s largest stocks though this set of ETFs apply methodologies different from Ashburton Top 40.

About Exchange traded funds (ETFs)

Exchange Traded Funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, US-listed companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the EasyEquities platform. In addition, it qualifies for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

|

|