Resource ETF is stepping up! (STXRES)

Intellidex Satrix Resi ETF Analysis

The Satrix Resi ETF is the focus of today’s Intellidex analysis as commodities push higher, resource companies have become a hot topic and a possible “SuperCycle” could be inbound. Definitely worth the look if you more diversification into the resources sector.

Intellidex insight: Bloomberg forecasts that commodity prices will continue rising well into 2023. The strong commodities rally has led to speculation on whether this could be the start of a commodity supercycle. A supercycle is defined as “decades-long, above-trend movements in a wide range of base material prices deriving from a structural change in demand”. The previous supercyle of the 2000s was driven by urbanisation and industrialisation from China in particular but also other emerging markets.

A supercycle of a similar nature would again depend on China, which was the only economy to report GDP growth in 2020. It is also expected to spearhead the recovery in global growth, with 8.1% GDP growth estimated for 2021. However, unlike the supercycle in the 2000s, China is not focusing its effort on industrial investments. Even though a supercycle might not be on the cards the idea is not farfetched, especially for PGMs –platinum, palladium, and rhodium. Their value has been driven by demand for renewable energy and electric vehicles, as well as constrained supply. As SA is the world’s largest producer of PGMs, lack of investment in the mining sector as well as electricity disruptions will continue straining supply.

Continued demand for PGMs will benefit companies such as Anglo American Platinum, Impala Platinum, Sibanye Stillwater and Northam platinum – which are the primary global miners of PGMs. These four also constitute a combined 49.8% of the ETF. A global economic recovery is expected to be driven by Covid-19 vaccine rollouts, easing lockdown restrictions and policy stimulus packages. Central banks including SA have also been accommodative with their monetary policies, keeping interest rates at historically low levels. The large monetary and fiscal stimulus packages and China driving domestic demand also should push inflation up from its current lows, which would make commodities an even more attractive addition to a portfolio.

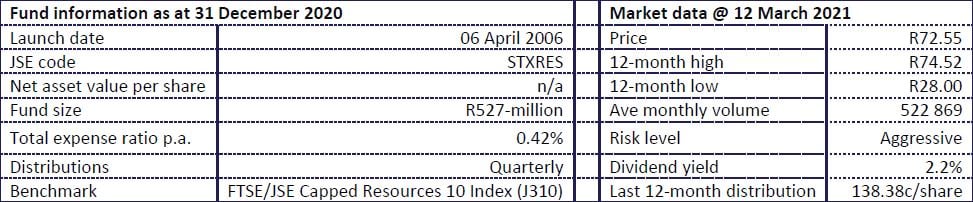

Fund description: Satrix Resi is a specialist fund that invests in companies in the oil & gas and basic materials industries. Its constituents are exposed to commodity prices.

Top holdings: The fund’s constituents are mining companies with Anglo American Platinum and BHP accounting for 29.8% and 29.6% of the fund, respectively.

Suitability: The fund suits investors with a meaningful risk appetite and a long-term investment horizon. This allows for the short-term losses that may occur with equity investing.

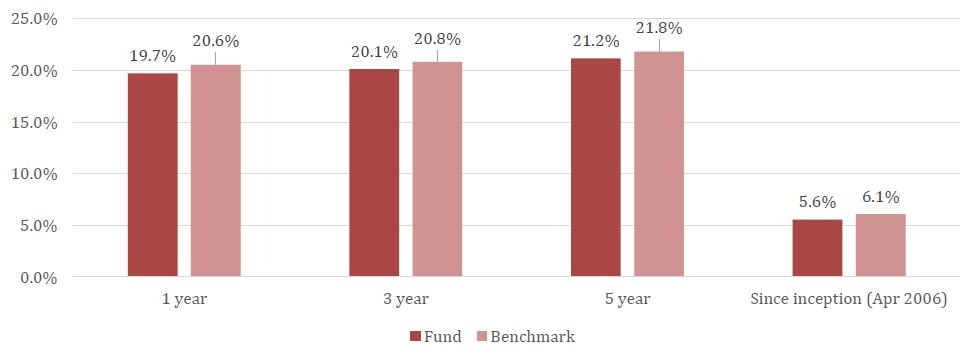

Historical performance: Net asset value performance to end-December 2020 (annualized for periods greater than one year).

Source: December fund fact sheet

Fundamentals: Satrix Resi is a specialist fund that invests in companies in the oil & gas and basic materials industries. Its constituents, which are exposed to commodity prices, are likely to move in the same direction. While this is a plus during a commodity boom it often result in larger capital losses during cycle downturn.

There are two important risks to consider. First, the fund is concentrated in one broad sector and all companies respond to similar risk factors. It is important therefore that this ETF forms part of a wider portfolio that includes other sectors. Second, it is an all-equity investment which is more volatile than other asset classes such as bonds and cash.

A concern for South African resources investors is uncertainty over property rights as well as unresolved disagreements between government and the private sector on the mining charter.

Fund statistics

Alternatives: The fund has no alternatives.

EasyResearch Informed Decisions

The Satrix Resi ETF (STXRES) is an excellent and cost-effective way to get exposure and diversify into the resources sector. Fundamentals should be taken note of especially all the risks associated and mentioned by Intellidex in the sector.

If we do see a commodity super cycle come to fruition, then this could also be a small addition to your broader investment portfolio. Good news is this ETF is allowed in your TFSA account and like Satrix says “Gluten-free, Dairy-free, sugar-free, Nothing’s as good as Tax-Free”.

Click logos to view ETFs

New to investing

and want to learn more about other Intellidex ETF picks?

Read: Intellidex Favorite ETF Picks

Background: Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets. They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to numerous companies in a single transaction. ETFs can be traded through your broker in the same way as shares, say, on the EasyEquities platform. In addition, they qualify for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares or bonds in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

Subscribe To Our Research Portal

Search all research

Let Us Help You, Help Yourself

From how-to’s to whos-whos you’ll find a bunch of interesting and helpful stuff in our collection of videos. Our knowledge base is jam packed with answers to all the questions you can think of.