Performance review

The NewFunds Swix 40 ETF was our pick among the top 40 funds last year when we identified our favourite ETFs in each category. It’s had a tough year, but we still prefer this fund because of its structure, in that it excludes many basic materials and resources companies.

Ever since Satrix introduced the first ETF on the JSE about 16 years ago, funds which invest in the JSE Top 40 index have proven to be popular among South African investors. These funds now hold assets worth close to R12bn, accounting for about 38% of all equity ETFs. The obvious attraction of the top 40 index is the diversification and its ability to provide stable returns over the long term.

NewFunds Swix 40 tracks the Swix top 40, not the traditional JSE Top 40 index. The Swix weights constituent companies based on the share capital that is held in electronic records and registered in the SA share register. This weighting has traditionally resulted in reduced exposure to resources/basic materials, most of which have primary listings on international exchanges. This has an effect of improving diversification, considering that the top 40 companies based on straight market capitalisation (or the size of the company) are dominated by resources/basic materials companies.

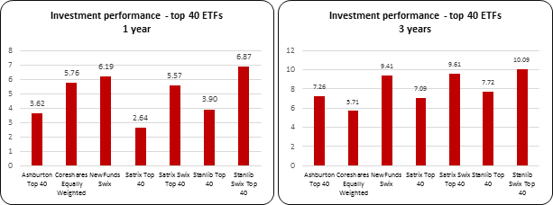

The past 12 months to end-September have been tough for the NewFunds Swix 40. It returned 6.19%, which is close to zero real growth if you factor in inflation of about 6% over that period. That is worse than returns from some fixed deposits on the market. Most funds that are focused on the Top 40 delivered about the same return. The best performer in the segment, Stanlib Swix Top 40, returned 6.87%.

The returns follow from a largely subdued equities performance generally. After reaching a record high of 55,335 points in April 2015, the JSE all share index has been bouncing between 50,000 and 54,0000 points as political squabbles within government and concerns over a ratings downgrade have kept a lid on the upside.

Outlook

We expect markets to remain challenging and complex. SA’s near-term growth is being curbed by soft commodity prices for SA’s exports, regulatory and policy uncertainty and continuing labour market volatility. Finance minister Pravin Gordhan last week lowered GDP growth estimates for South Africa to 0.5% for this year and expects it to improve to 2.2% by 2019. Those projections, which may yet prove to be optimistic, are way below what SA needs to raise the prospects for equity markets.

While the medium-term budget policy statement might suffice to stave off any immediate negative action from the credit rating agencies, it remains to be seen whether a downgrade to junk status can be entirely avoided in the long run. The risk is that the Treasury’ s restrictive policies – curbing government expenditure and increasing taxes – might actually stall economic growth further and plunge the country into a self-perpetuating downward spiral. That said, the bulk of the top 40 companies have operations outside SA where growth prospects are better. Factors such as the exchange rate and global consumer spending are more important factors, so the Top 40 can provide a hedge against domestic economic developments.

Risk

The fund is disproportionately overweight in Naspers (22%), which reduces diversification benefits. Furthermore, this is a 100% investment in equities, which is a riskier asset class than bonds or cash. However, the returns over time should compensate for volatility.

Top holdings

The top-10 holdings constitute about 60% of the overall portfolio and are dominated by financials and consumer services stocks. This in contrast to the traditional top 40 index ETFs which have a bias towards basic materials and resource companies.

Fees

The fund has an effective annual cost of about 0.36% which is quite competitive on the local market.

Alternatives

Alternative funds are the Satrix Swix 40 and Stanlib Swix 40.

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

|

|