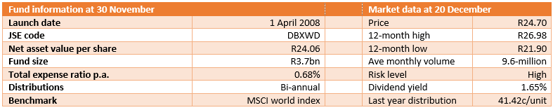

The db x-tracker ETFs have traditionally derived the bulk of their returns from foreign exchange rate gains. The db x-tracker MSCI World (dbx-World) ETF has maintained this theme, incurring losses because of rand strength against the dollar in the year to end-November. In fact, the underlying index, which represents companies listed on various developed world stock exchanges, gained 1.04% in the past year in dollar terms – but forex losses (dollar gains over rand) were so significant that the SA investors (rand-denominated db x-World ETF) lost 3.35%. On the longer view, the fund is a strong performer, returning 18.6% per year on a five year view.

*Period ending 15 December 2016

Outlook

Equities fundamentally derive value from economic performance. However, this family of funds has an additional return component attributed to foreign exchange movements. Since inception, rand weakness has accounted for more than 78% of the db x-World fund’s total return.

Geopolitical risks in the US and Europe have increased since our last review. In Europe, there is the rise of nationalism which was reflected by Britons’ and Italians’ anti-establishment votes which have led to substantial uncertainty for the future of those countries and Europe as a whole. In the US, the unexpected election of Donald Trump as the next US president has also raised uncertainty in the global markets, but has been positive for the US market. Proposed policies by Donald Trump are likely to be bullish for the US market in the short- to medium-term. Additionally, the resumption of interest rate tightening by the US Federal Reserve will strengthen the dollar against most currencies, particularly emerging currencies. This is likely to see an increase in risk-off investment strategies which favour the further strengthening of the US dollar. Given the tricky global environment and risks of seismic political shifts, we think US assets will benefit disproportionately, and these constitute 60% of the fund. Against that, the fund may be weighed by uncertainty in Europe which accounts for 24% of the fund. Japan which takes up 9% of the fund may benefit from the recent weakness of the yen (against the dollar) although its deep-seated structural challenges will remain antagonistic to its growth in the medium to long term.

Suitability

This fund is ideal for long-term investors who want to hedge against rand weakness and are concerned about the performance of the South African economy. The portfolio offers exposure to blue-chip companies listed in world’s most developed economies, most with cross-border business and multi-currency income streams. Investing in this ETF does not affect any exchange control limits as it is rand-settled.

What it does

The fund mimics the price and yield performance of the MSCI World index. The index is a free float-adjusted market capitalisation index that is designed to mimic the equity performance of 23 developed markets, representing large- and mid-capitalisation companies with a total market capitalisation of $30-trillion. Free float adjustment means the fund excludes from its weightings tightly held shares held by strategic investors such as governments, corporations, controlling shareholders and management, as well as shares subject to foreign ownership restrictions. This ensures that the fund invests in the most liquid stocks.

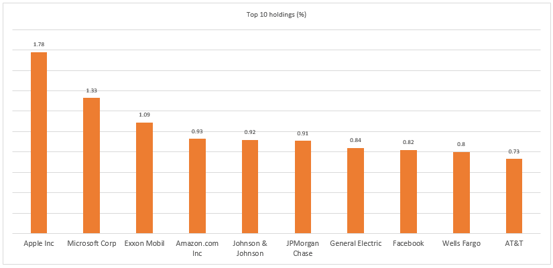

Top holdings

The top 10 holdings of this ETF occupy only 10% of the fund. The biggest one, Apple, constitutes just 1.78%, which presents great diversification compared with most JSE-listed ETFs weighted by market capitalisation.

Risk

This is a pure equities investment, so the performance is likely to be volatile. Investment in this fund exposes you to a number of risks including general market risks, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

Alternatives

As an alternative to this ETF, you may consider db x-Euro, db x-FTSE 100, db x-USA, db x-Japan, Coreshares S&P Global property and Coreshares S&P 500 ETFs.

About Exchange traded funds (ETFs)

Exchange Traded Funds (ETFs) are passively managed investment funds that track the performance of a basket of pre-determined assets (in this case, US-listed companies). They are traded the same way as shares and the main difference is that whereas one share gives exposure to one company, an ETF gives exposure to more than one company in a single transaction. ETFs can be traded through your broker the same way as shares, say, on the EasyEquities platform. In addition, it qualifies for the tax-free savings account, where both capital and income gains accumulate tax free.

Benefits of ETFs

- Gain instant exposure to various underlying shares in one transaction

- They diversify risk because a single ETF holds various shares

- They are cost-effective

- They are liquid – it is usually easy to find a buyer or seller and they trade just like shares

- High transparency through daily published index constituents

|

Disclaimer

This research report was issued by Intellidex (Pty) Ltd. Intellidex aims to deliver impartial and objective assessments of securities, companies or other subjects. This document is issued for information purposes only and is not an offer to purchase or sell investments or related financial instruments. Individuals should undertake their own analysis and/or seek professional advice based on their specific needs before purchasing or selling investments. The information contained in this report is based on sources that Intellidex believes to be reliable, but Intellidex makes no representations or warranties regarding the completeness, accuracy or reliability of any information, facts, estimates, forecasts or opinions contained in this document. The information, opinions, estimates, assumptions, target prices and forecasts could change at any time without prior notice. Intellidex is under no obligation to inform any recipient of this document of any such changes. Intellidex, its directors, officers, staff, agents or associates shall have no liability for any loss or damage of any nature arising from the use of this document.

Remuneration

The opinions or recommendations contained in this report represent the true views of the analyst(s) responsible for preparing the report. The analyst’s remuneration is not affected by the opinions or recommendations contained in this report, although his/her remuneration may be affected by the overall quality of their research, feedback from clients and the financial performance of Intellidex (Pty) Ltd.

Intellidex staff may hold positions in financial instruments or derivatives thereof which are discussed in this document. Trades by staff are subject to Intellidex’s code of conduct which can be obtained by emailing mail@intellidex.coza.

Intellidex may also have, or be seeking to have, a consulting or other professional relationship with the companies mentioned in this report.

|

|